Question: (c) in the scenario below indicate (with reason) whether a long or short hedge is more appropriate and indicate the number of contracts that will

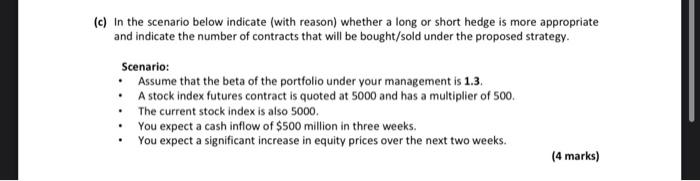

(c) in the scenario below indicate (with reason) whether a long or short hedge is more appropriate and indicate the number of contracts that will be bought/sold under the proposed strategy. Scenario: Assume that the beta of the portfolio under your management is 1.3. A stock index futures contract is quoted at 5000 and has a multiplier of 500. The current stock index is also 5000 You expect a cash inflow of $500 million in three weeks. You expect a significant increase in equity prices over the next two weeks. . (4 marks) (c) in the scenario below indicate (with reason) whether a long or short hedge is more appropriate and indicate the number of contracts that will be bought/sold under the proposed strategy. Scenario: Assume that the beta of the portfolio under your management is 1.3. A stock index futures contract is quoted at 5000 and has a multiplier of 500. The current stock index is also 5000 You expect a cash inflow of $500 million in three weeks. You expect a significant increase in equity prices over the next two weeks. . (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts