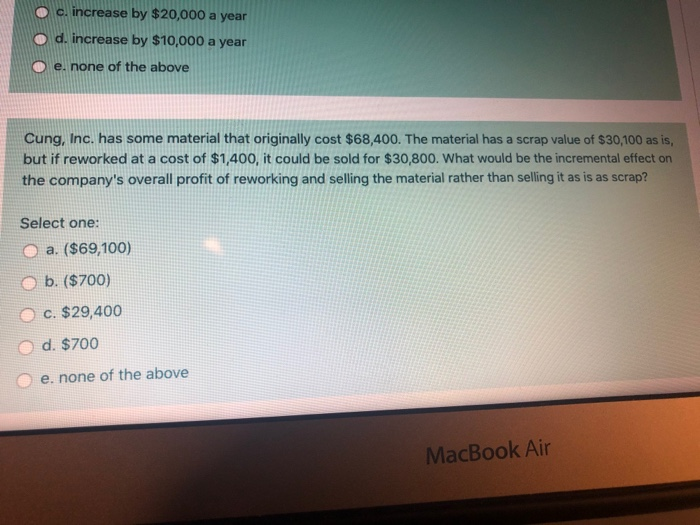

Question: c. increase by $20,000 a year d. increase by $10,000 a year e, none of the above Cung, Inc. has some material that originally cost

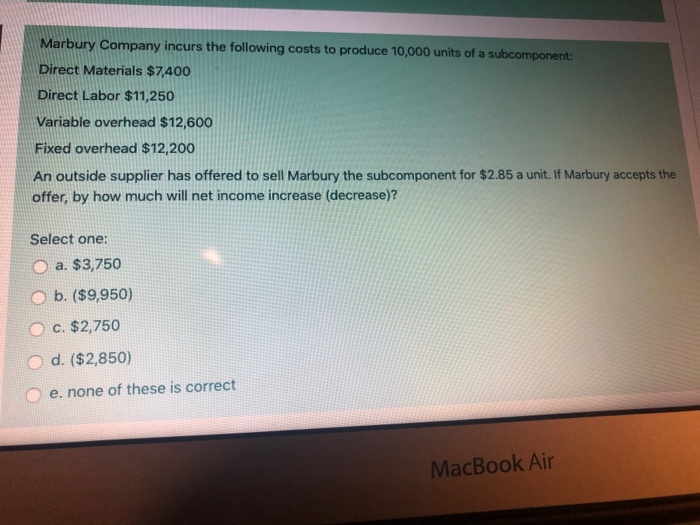

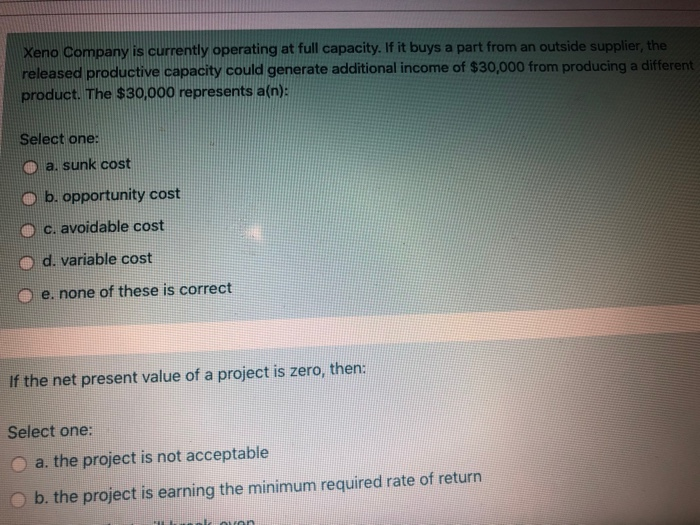

c. increase by $20,000 a year d. increase by $10,000 a year e, none of the above Cung, Inc. has some material that originally cost $68,400. The material has a scrap value of $30,100 as is, but if reworked at a cost of $1,400, it could be sold for $30,800. What would be the incremental effect on the company's overall profit of reworking and selling the material rather than selling it as is as scrap? Select one: O a. ($69,100) b. ($700) c. $29,400 d. $700 e. none of the above MacBook Air Marbury Company incurs the following costs to produce 10,000 units of a subcomponent: Direct Materials $7,400 Direct Labor $11,250 Variable overhead $12,600 Fixed overhead $12,200 An outside supplier has offered to sell Marbury the subcomponent for $2.85 a unit. If Marbury accepts the offer, by how much will net income increase (decrease)? Select one: O a. $3,750 b. ($9,950) O c. $2,750 d. ($2,850) e. none of these is correct MacBook Air Xeno Company is currently operating at full capacity. If it buys a part from an outside supplier, the released productive capacity could generate additional income of $30,000 from producing a different product. The $30,000 represents a(n): Select one: a. sunk cost o b. opportunity cost c. avoidable cost d. variable cost e. none of these is correct If the net present value of a project is zero, then: Select one: a. the project is not acceptable b. the project is earning the minimum required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts