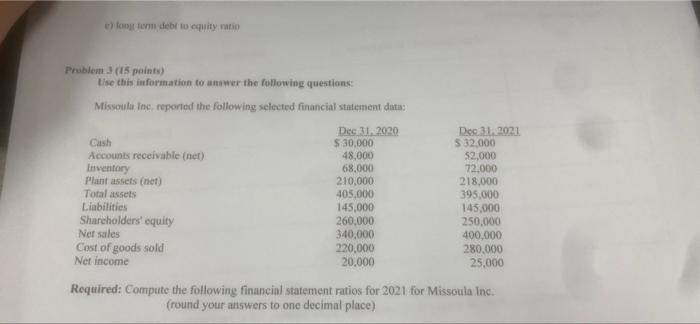

Question: c) long term debt to equity to Problem 3 (15 points) Use this information to answer the following questions: Missoula Inc reported the following selected

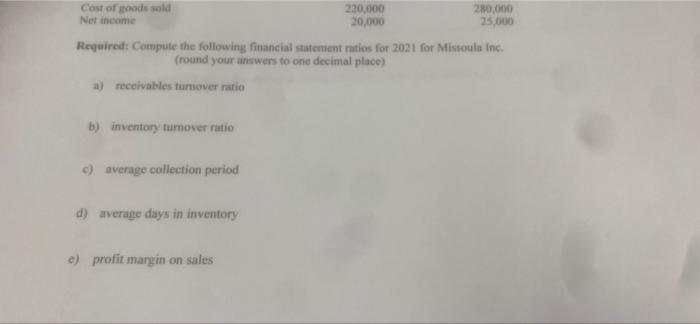

c) long term debt to equity to Problem 3 (15 points) Use this information to answer the following questions: Missoula Inc reported the following selected financial statement data: Dec 31, 2020 Cash $ 30,000 Accounts receivable (net) 48,000 Inventory 68,000 Plant assets (net) 210,000 Total assets 405,000 Liabilities 145,000 Shareholders' equity 260,000 Net sales 340,000 Cost of goods sold 220,000 Net income 20,000 Dec 31, 2021 5 32.000 $2,000 72.000 218,000 395,000 145,000 250,000 400,000 280,000 25,000 Required: Compute the following financial statement ratios for 2021 for Missoula Inc. (round your answers to one decimal place) Cast of goods sold Not income 220,000 20,000 280.000 25.000 Required: Compute the following financial statement ratios for 2021 for Missoula Inc. (round your answers to one decimal place) a) receivables tumover ratio b) inventory tumover ratio c) average collection period d) average days in inventory e) profit margin on sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts