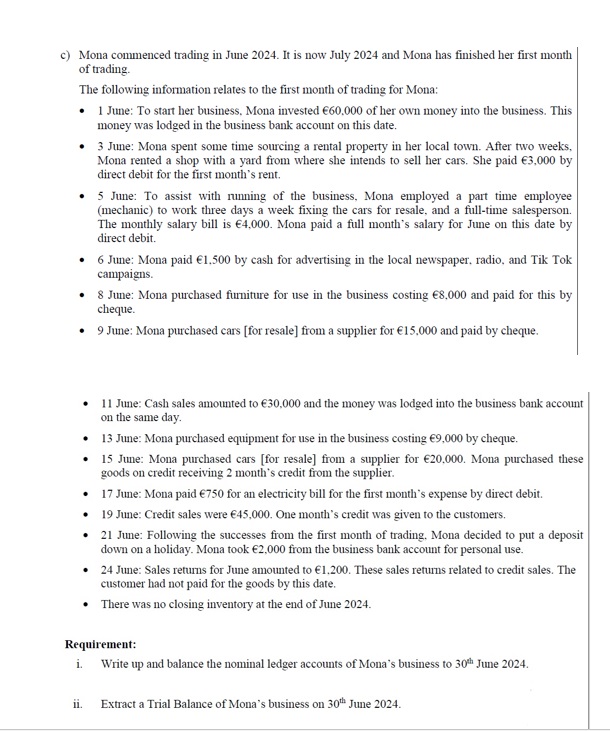

Question: c ) Mona commenced trading in June 2 0 2 4 . It is now July 2 0 2 4 and Mona has finished her

c Mona commenced trading in June It is now July and Mona has finished her first month

of trading.

The following information relates to the first month of trading for Mona:

June: To start her business. Mona invested of her own money into the business. This

money was lodged in the business bank account on this date.

June: Mona spent some time sourcing a rental property in her local town. After two weeks,

Mona rented a shop with a yard from where she intends to sell her cars. She paid by

direct debit for the first month's rent.

June: To assist with running of the business, Mona employed a part time employee

mechanic to work three days a week fixing the cars for resale, and a fulltime salesperson.

The monthly salary bill is Mona paid a full month's salary for June on this date by

direct debit.

June: Mona paid by cash for advertising in the local newspaper, radio, and Tik Tok

campaigns.

June: Mona purchased fumiture for use in the business costing and paid for this by

cheque.

June: Mona purchased cars for resale from a supplier for and paid by cheque.

June: Cash sales amounted to and the money was lodged into the business bank account

on the same day.

June: Mona purchased equipment for use in the business costing by cheque.

June: Mona purchased cars for resale from a supplier for Mona purchased these

goods on credit receiving month's credit from the supplier.

June: Mona paid for an electricity bill for the first month's expense by direct debit.

June: Credit sales were One month's credit was given to the customers.

June: Following the successes from the first month of trading. Mona decided to put a deposit

down on a holiday. Mona took from the business bank account for personal use.

June: Sales returns for June amounted to These sales returns related to credit sales. The

customer had not paid for the goods by this date.

There was no closing inventory at the end of June

Requirement:

i Write up and balance the nominal ledger accounts of Mona's business to June

ii Extract a Trial Balance of Mona's business on June

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock