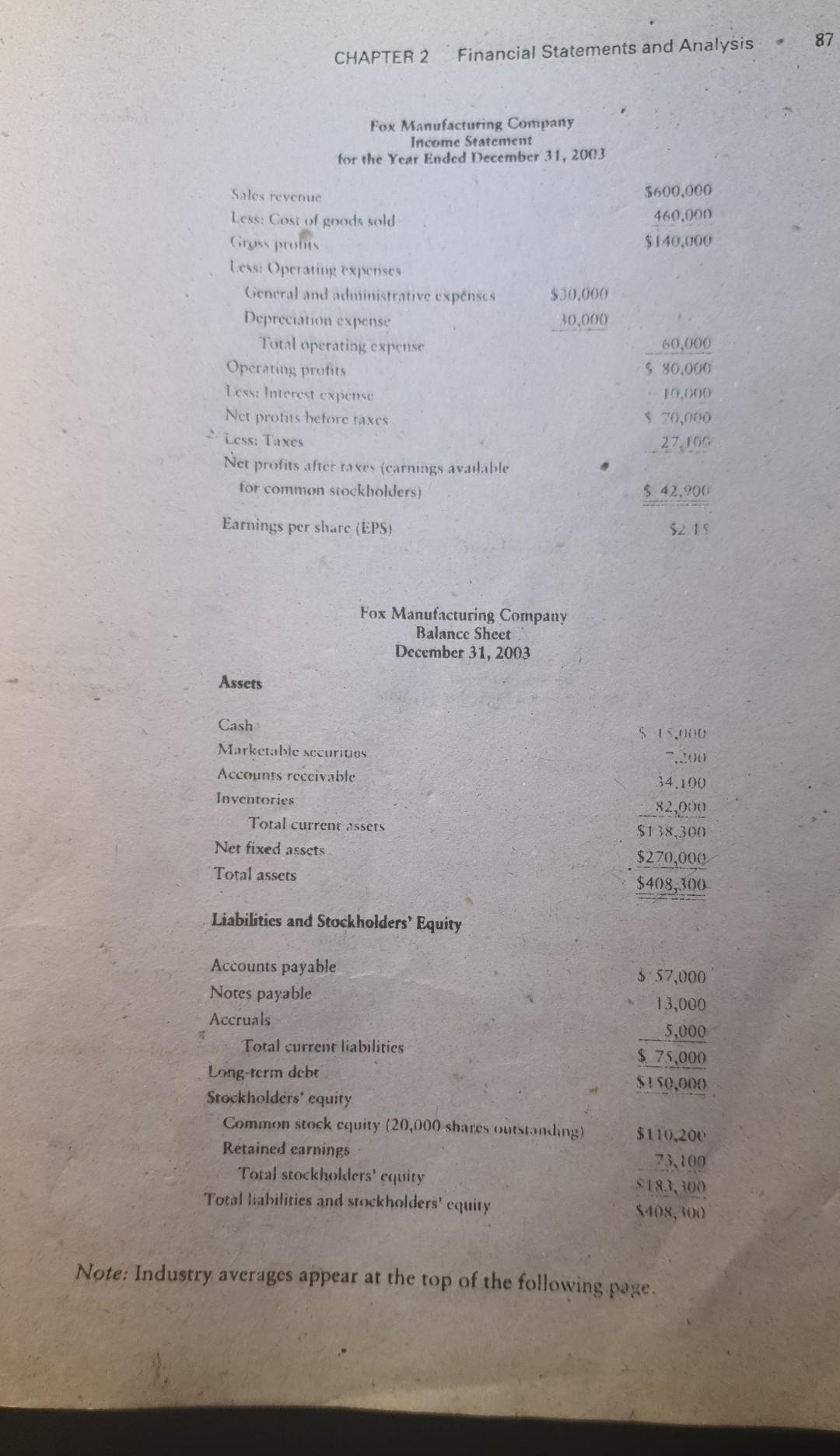

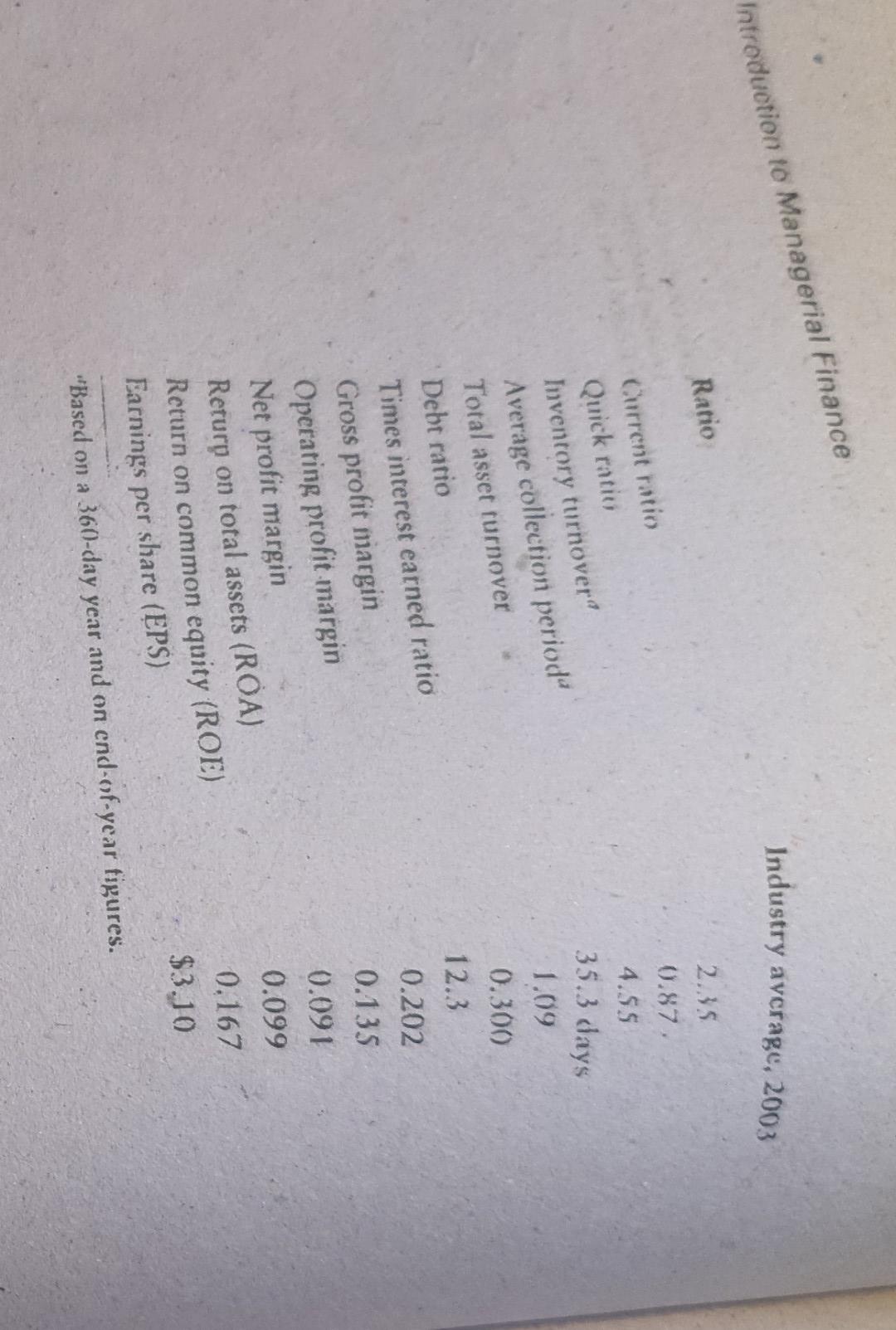

Question: c. Operating profits d. Operating expenses c. Total assets 8. Total common stock equity h. Accounts receivable 2-19 Cross-seciional ratio analysis Use the following financial

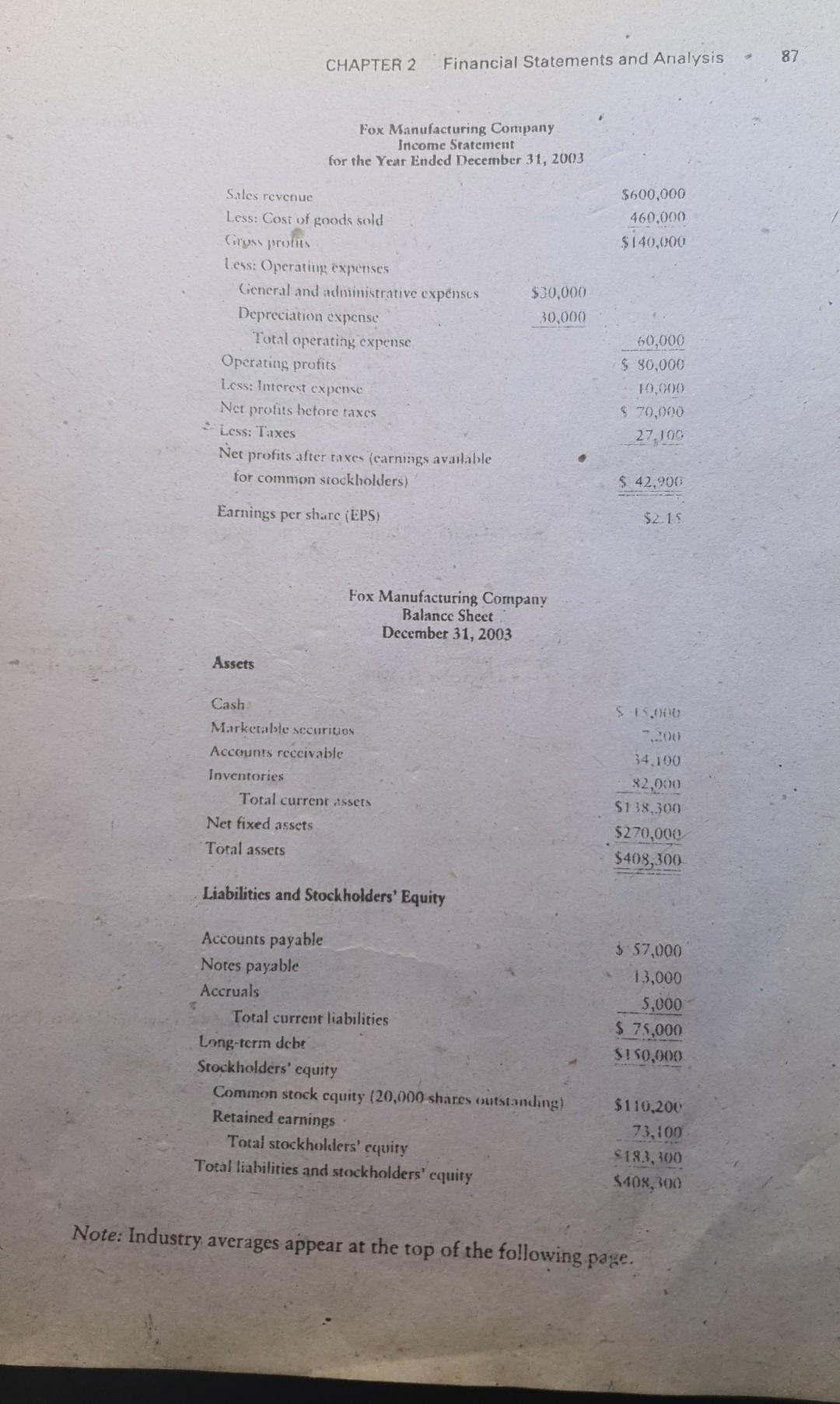

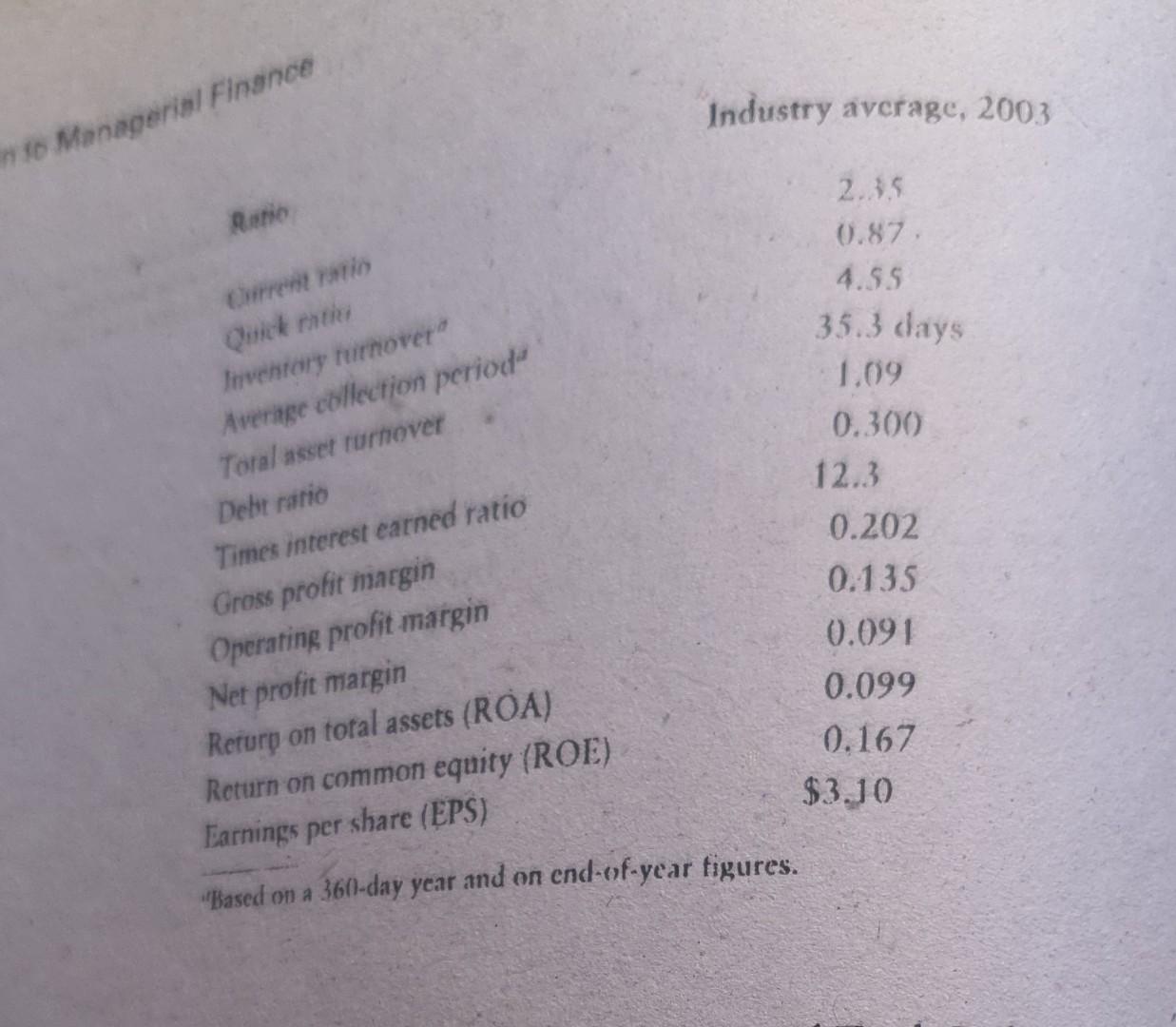

c. Operating profits d. Operating expenses c. Total assets 8. Total common stock equity h. Accounts receivable 2-19 Cross-seciional ratio analysis Use the following financial statements for Fox Manufacturing Company for the year ended December 31,2003 , along in the industry average ratios also given in what follows, to: b. Summarize your findings and make firm's 2003 operations b. Summarize your findings and make recommendations. CHAPTER 2 Financial Statements and Analysis 87 Fox Manufacturing Company Income Statement for the Year Ended December 31, 2003 Fox Manufacturing Company Balance Sheet n 10 Manerial Fingnce Industryavcrage,20030.8735.3days1.09ROE)2.3.54.550.300)12.30.2020.1350.0910.0990.167$3.10 Earnings per share (EPS) "based on a 360-day year and on end-of-year figures. 19 Cross-sectional ratio analysis Use the following financial statements for Fox Manufacturing Company for the year ended December 31, 2003, along .n the industry average ratios also given in what follows, to: a. Prepare and interpret a complete ratio analysis of the firm's 2003 operations. b. Summarize your findings and make recommendations. CHAPTER 2 Financial Statements and Analysis Fox Manufacturing Company Income Statement for the Year Ended December 31,2003 Note: Industry averages appear at the top of the following pase. "rBased on a 360 - cialy yeim

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts