Question: (c) please answer clearly 2. 3. all the select is either A or B answer eBook H Problem Walk Through Karsted Air Services is now

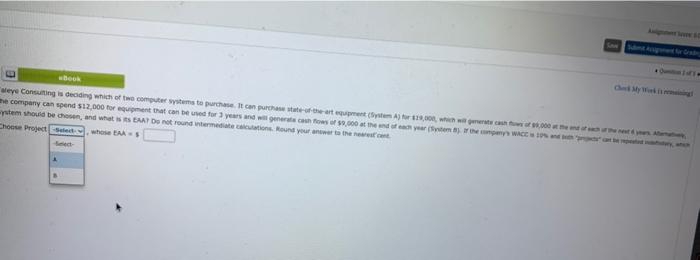

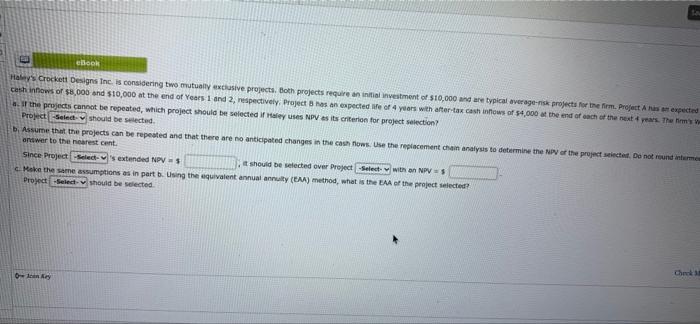

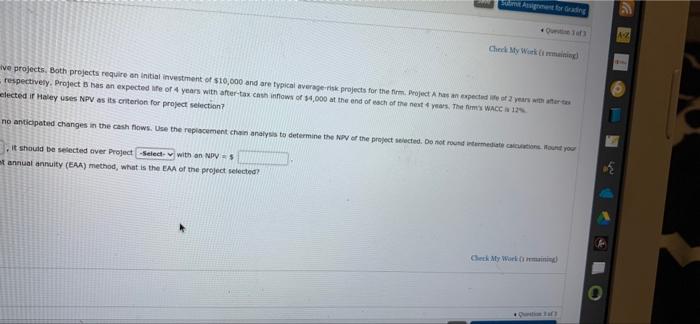

eBook H Problem Walk Through Karsted Air Services is now in the final year of a project. The equipment originally cost $25 million, of which o nas been depreciated. Karsten equipment's after-tax salvage value? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your own menu $ om Walk-Through The equipment originally cost $25 million, of which 80% has been depreciated. Karste can set the used equipment today for 55.25mm, and the wer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar, "wee Consulting is in which of the computer wyses to purchase. It can purchase-of-the-art equipment Systems for which company can spend 512.000 torment that can be for 3 years and wil genere can ows of 90,000 at the end of a year termes ystem should become and what EAAT De not round whermediate actions. Round your answer to the rest Choose Project Sweets Check We ase. It can purchase state-of-the-art equipment (System A) for $19,000, which will generate cash flow of 59,000 at the end of each of the news years and will generate cash flows of 59,000 at the end of each year (System B). If the company's WACC is 10% and both projects can be Hate calculations. Round your answer to the nearest cent. eBook Haley's Crockett Designs Inc. is considering two mutually exclusive projects. Both projects require an investment of $10,000 and are typical average-risk projects for the firm. Project As expected cash innows of $8,000 and $10,000 at the end of years 1 and 2, respectively, Project has an expected of 4 years with after-tax cash infows of $4,000 at the end of each of the next years. The If the projects cannot be repeated, which project should be selected are uses NPV as its criterion for project selection Project Select should be selected b. Assume that the projects can be repeated and that there are no anticipated changes in the cash flows. Use the replacement chan analysis to determine the NPV of the project selected. Do not round informe answer to the nearest cent. Since Project Seeds extended NPV it should be selected over Project Select with an NPV = 5 c. Make the same assumptions as in part using the valent annual annuity (LA) method, what is the EA of the project selected? Project -Select- should be selected Oly Ches Chery Women Ive projects. Both projects require an initial investment of $10,000 and are typical average risk projects for the firm Project As an expected to start respectively. Project has an expected of 4 years with after-tax cu inflows of $4,000 at the end of each of the next years. The WACC IN clected i Haley uses NPV as its criterion for project selection? no anticipated changes in the cash flows. Use the replacement channel to determine the NPV of the project selected. Do not round warmediate Count you It should be selected over Project Seled with an NPV = 5 stannual annuity (EAA) method, what is the EA of the project selected? Cek My World

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts