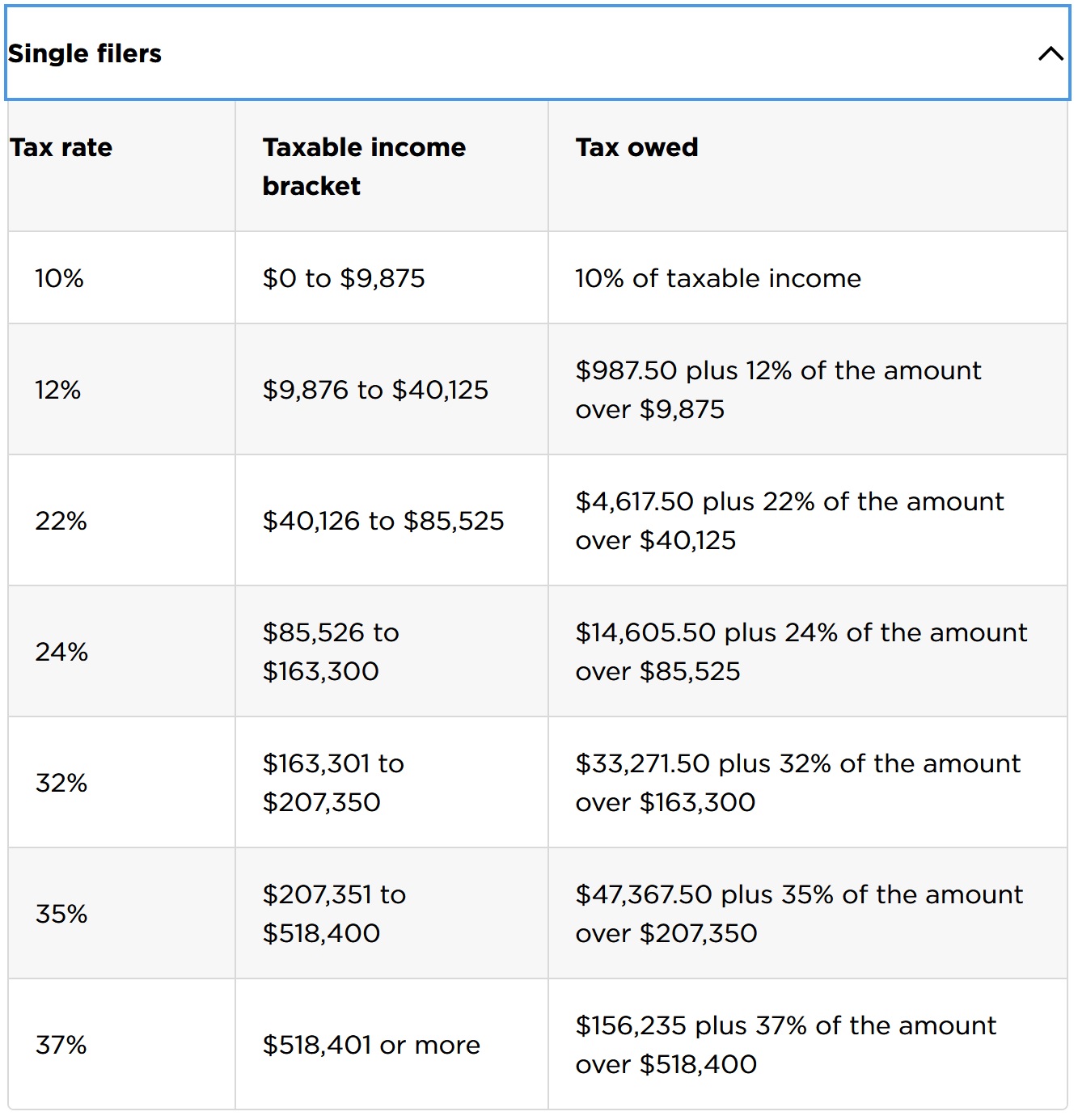

Question: C++ please don't paste code from other website Make a program that will compute the taxes owed from thetable above.This assignment assumes Single filers. Prompt

C++ please don't paste code from other website

Make a program that will compute the taxes owed from thetable above.This assignment assumes Single filers.

- Prompt for the taxable income for a float value, a double value, and an integer value.

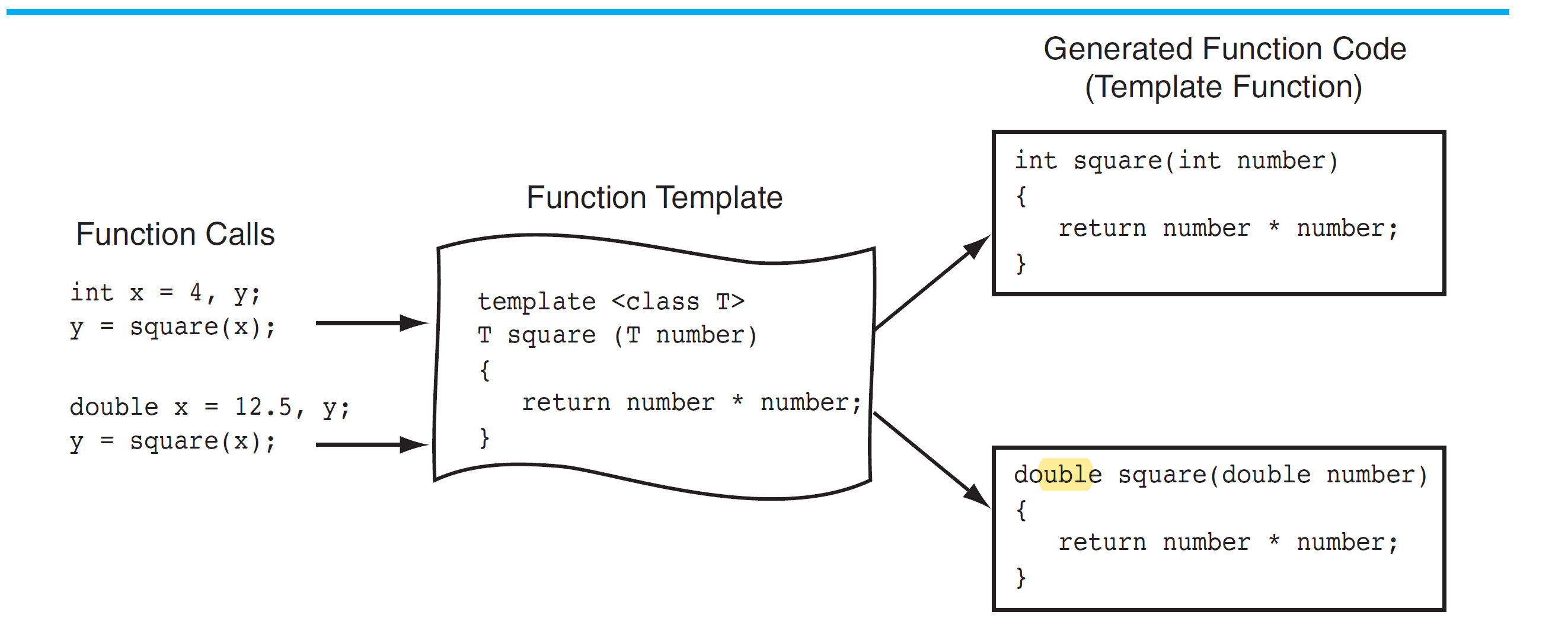

- Program a function template as described in section 16.2 and use the template to create methods that calculates the taxes.

- Display the tax rate found for the reported taxable income (from Column 1)

- Display the taxes owed for each of the 3 variable types entered. The resulting taxes need to be the same datatype from the given income.

Be sure to include the upper and lower range values in the calculations. I.E - Be sure that $9875 can be calculated and not bypassed.

Generated Function Code (Template Function) int square ( int number) Function Template { Function Calls return number * number; } intx=4, y; template

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts