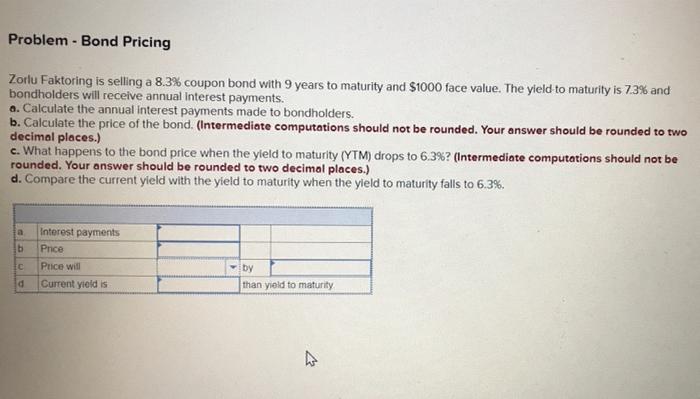

Question: c.) Price will (rise/fall) d.) current yield is (more/less) Problem - Bond Pricing Zorlu Faktoring is selling a 8.3% coupon bond with 9 years to

Problem - Bond Pricing Zorlu Faktoring is selling a 8.3% coupon bond with 9 years to maturity and $1000 face value. The yield to maturity is 7.3% and bondholders will receive annual Interest payments. a. Calculate the annual interest payments made to bondholders. b. Calculate the price of the bond. (Intermediate computations should not be rounded. Your answer should be rounded to two decimal places.) c. What happens to the bond price when the yield to maturity (YTM) drops to 6.3%? (Intermediate computations should not be rounded. Your answer should be rounded to two decimal places.) d. Compare the current yield with the yield to maturity when the yield to maturity falls to 6.3%. a b Interest payments Price Puice will Current yield is by than yold to maturity d 42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts