Question: c++ Programming Exercise #6 Write a program that calculates and prints the monthly paycheck for an employee. The net pay is calculated after taking the

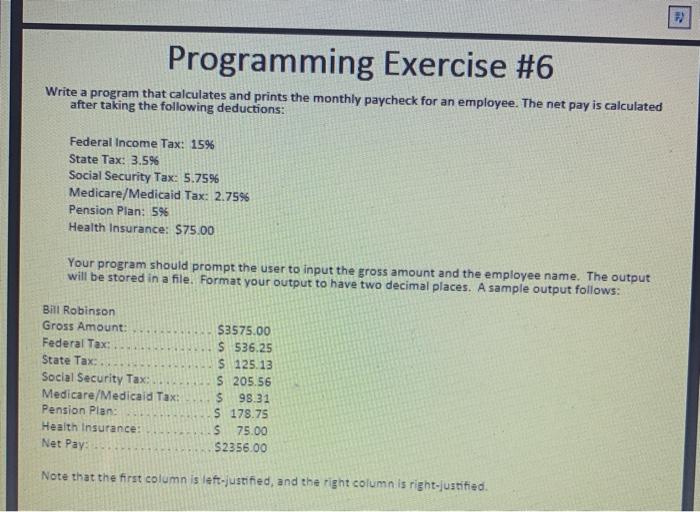

Programming Exercise #6 Write a program that calculates and prints the monthly paycheck for an employee. The net pay is calculated after taking the following deductions: Federal Income Tax: 15% State Tax: 3.5% Social Security Tax: 5.7596 Medicare/Medicaid Tax: 2.7596 Pension Plan: 596 Health Insurance: $75.00 Your program should prompt the user to input the gross amount and the employee name. The output will be stored in a file. Format your output to have two decimal places. A sample output follows: . Bill Robinson Gross Amount: Federal Tax State Tax Social Security Tax Medicare/Medicaid Tax: Pension Plan: Health Insurance: Net Pay $3575.00 $ 536.25 $ 125.13 S 205.56 $ 98.31 S 178.75 s 75.00 $2356.00 Note that the first column is left-justified, and the right column is right-justified

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts