Question: c) repeat a) for the case where normal , variable costing is used. Please provide a full answer wirh explanations and interpretations. Ralphs Job deals

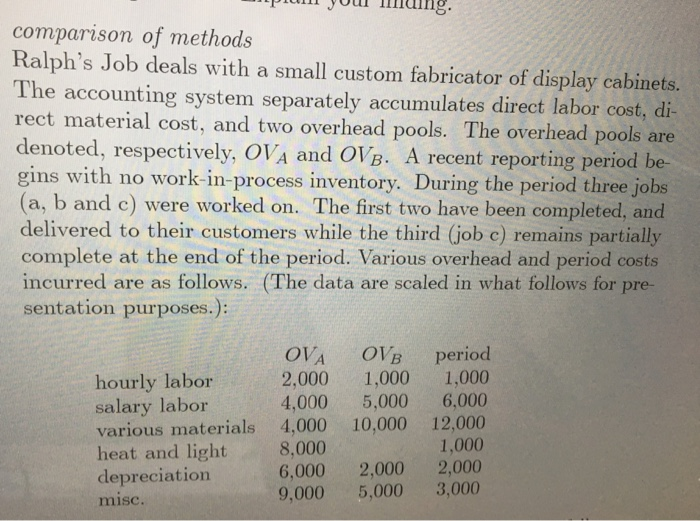

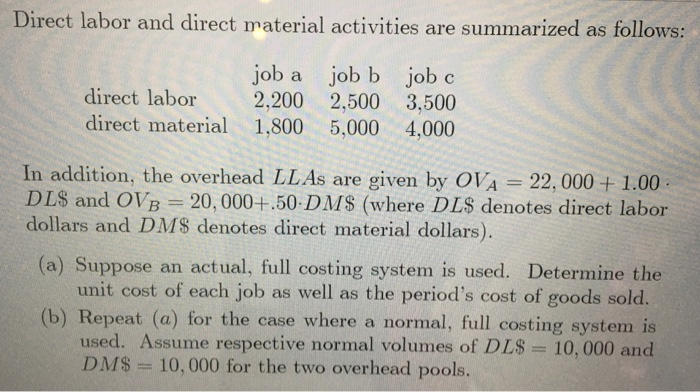

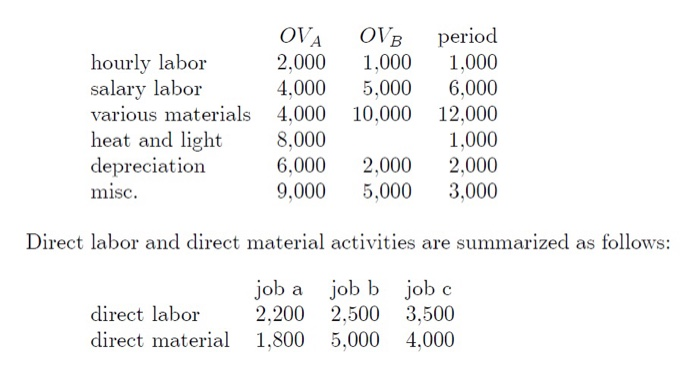

comparison of methods Ralph's Job deals with a small custom fabricator of display cabinets. The accounting system separately accumulates direct labor cost, di- rect material cost, and two overhead pools. The overhead pools are denoted, respectively, OVA and OVB. A recent reporting period be- gins with no work-in-process inventory. During the period three jobs (a, b and c) were worked on. The first two have been completed, and delivered to their customers while the third (job c) remains partially complete at the end of the period. Various overhead and period costs incurred are as follows. (The data are scaled in what follows for pre- sentation purposes.): OVB 1,000 period 1,000 6,000 OVA 2,000 4,000 4,000 8,000 6,000 9,000 hourly labor salary labor various materials heat and light depreciation misc. 5,000 10,000 12,000 1,000 2,000 3,000 2,000 5,000 Direct labor and direct material activities are summarized as follows: job a job b job c 2,200 2,500 3,500 direct labor direct material 1,800 5,000 4,000 In addition, the overhead LLAS are given by OVA = 22, 000 + 1.00 DL$ and OVB= 20, 000+.50 DM$ (where DL$ denotes direct labor dollars and DM$ denotes direct material dollars). (a) Suppose an actual, full costing system is used. Determine the unit cost of each job as well as the period's cost of goods sold. (b) Repeat (a) for the case where a normal, full costing system is used. Assume respective normal volumes of DL$ = 10,000 and DM$ = 10,000 for the two overhead pools. OVB period 1,000 OVA hourly labor salary labor 1,000 5,000 2,000 4,000 6,000 various materials 4,000 10,000 12,000 heat and light depreciation misc. 8,000 1,000 6,000 9,000 2,000 2,000 5,000 3,000 Direct labor and direct material activities are summarized as follows: job a job b job c 2,200 2,500 3,500 direct labor direct material 1,800 5,000 4,000 comparison of methods Ralph's Job deals with a small custom fabricator of display cabinets. The accounting system separately accumulates direct labor cost, di- rect material cost, and two overhead pools. The overhead pools are denoted, respectively, OVA and OVB. A recent reporting period be- gins with no work-in-process inventory. During the period three jobs (a, b and c) were worked on. The first two have been completed, and delivered to their customers while the third (job c) remains partially complete at the end of the period. Various overhead and period costs incurred are as follows. (The data are scaled in what follows for pre- sentation purposes.): OVB 1,000 period 1,000 6,000 OVA 2,000 4,000 4,000 8,000 6,000 9,000 hourly labor salary labor various materials heat and light depreciation misc. 5,000 10,000 12,000 1,000 2,000 3,000 2,000 5,000 Direct labor and direct material activities are summarized as follows: job a job b job c 2,200 2,500 3,500 direct labor direct material 1,800 5,000 4,000 In addition, the overhead LLAS are given by OVA = 22, 000 + 1.00 DL$ and OVB= 20, 000+.50 DM$ (where DL$ denotes direct labor dollars and DM$ denotes direct material dollars). (a) Suppose an actual, full costing system is used. Determine the unit cost of each job as well as the period's cost of goods sold. (b) Repeat (a) for the case where a normal, full costing system is used. Assume respective normal volumes of DL$ = 10,000 and DM$ = 10,000 for the two overhead pools. OVB period 1,000 OVA hourly labor salary labor 1,000 5,000 2,000 4,000 6,000 various materials 4,000 10,000 12,000 heat and light depreciation misc. 8,000 1,000 6,000 9,000 2,000 2,000 5,000 3,000 Direct labor and direct material activities are summarized as follows: job a job b job c 2,200 2,500 3,500 direct labor direct material 1,800 5,000 4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts