Question: c. Should the company go ahead with either project? multiple choice 1 Yes No d. If it must choose between them, which should it take?

c. Should the company go ahead with either project?

multiple choice 1

-

Yes

-

No

d. If it must choose between them, which should it take?

multiple choice 2

-

Swiss plant

-

German plant

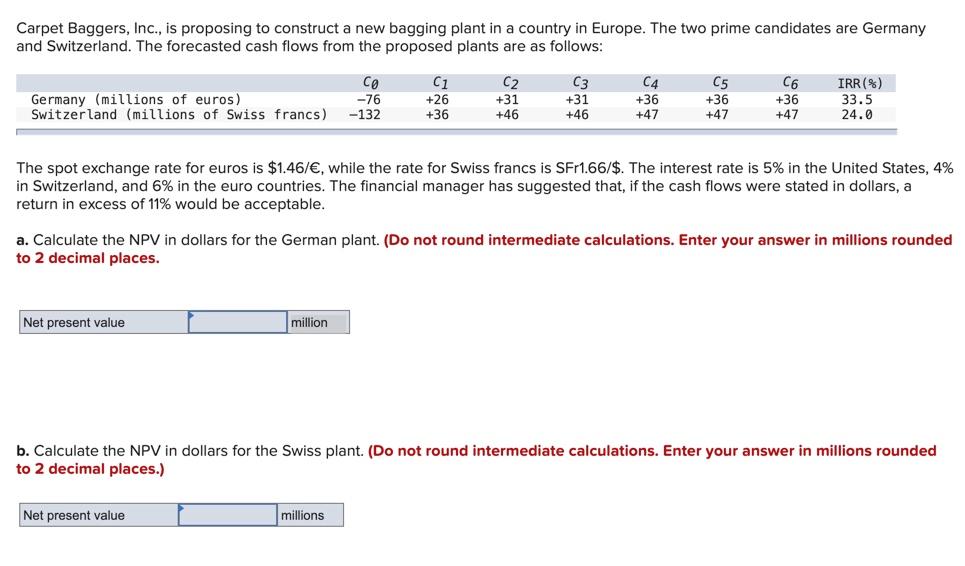

Carpet Baggers, Inc., is proposing to construct a new bagging plant in a country in Europe. The two prime candidates are Germany and Switzerland. The forecasted cash flows from the proposed plants are as follows: Germany (millions of euros) Switzerland (millions of Swiss francs) -76 -132 C1 +26 +36 C2 +31 +46 C3 +31 +46 C4 +36 +47 C5 +36 +47 +36 +47 IRR(%) 33.5 24.0 The spot exchange rate for euros is $1.46/, while the rate for Swiss francs is SFr1.66/$. The interest rate is 5% in the United States, 4% in Switzerland, and 6% in the euro countries. The financial manager has suggested that, if the cash flows were stated in dollars, a return in excess of 11% would be acceptable. a. Calculate the NPV in dollars for the German plant. (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. Net present value million b. Calculate the NPV in dollars for the Swiss plant. (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Net present value millions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts