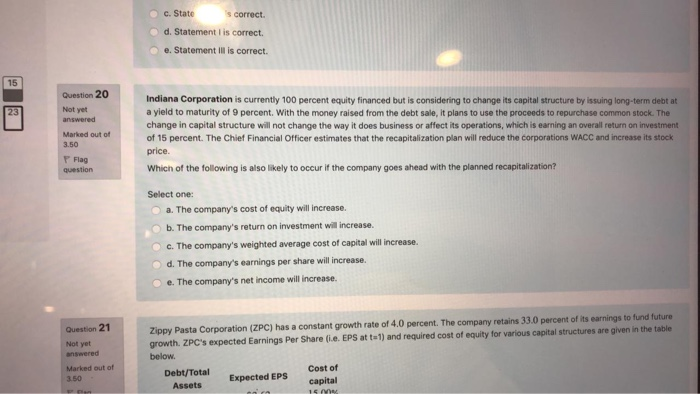

Question: c. State s correct. d. Statement is correct. e. Statement it is correct. 15 Question 20 Not yet answered 23 Marked out of 3.50 Indiana

c. State s correct. d. Statement is correct. e. Statement it is correct. 15 Question 20 Not yet answered 23 Marked out of 3.50 Indiana Corporation is currently 100 percent equity financed but is considering to change its capital structure by issuing long-term det at a yield to maturity of 9 percent. With the money raised from the debt sale, it plans to use the proceeds to repurchase common stock. The change in capital structure will not change the way it does business or affect its operations, which is earning an overall return on investment of 15 percent. The Chief Financial Officer estimates that the recapitalization plan will reduce the corporations WACC and increase its stock price. Which of the following is also likely to occur if the company goes ahead with the planned recapitalization? F Flag Question Select one: a. The company's cost of equity will increase. b. The company's return on investment will increase. c. The company's weighted average cost of capital will increase. d. The company's earnings per share will increase. e. The company's net income will increase. Question 21 Not yet answered Marked out of 3.50 Zippy Pasta Corporation (ZPC) has a constant growth rate of 4.0 percent. The company retains 33.0 percent of its earnings to fund future growth. ZPC's expected Earnings Per Share (ie. EPS at t-1) and required cost of equity for various capital structures are given in the table below. Debt/Total Cost of Expected EPS Assets capital ara 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts