Question: (c) The Fast Track Co. has thus far only used equity to finance its operations and currently has 1,000,000 shares outstanding with an EBIT of

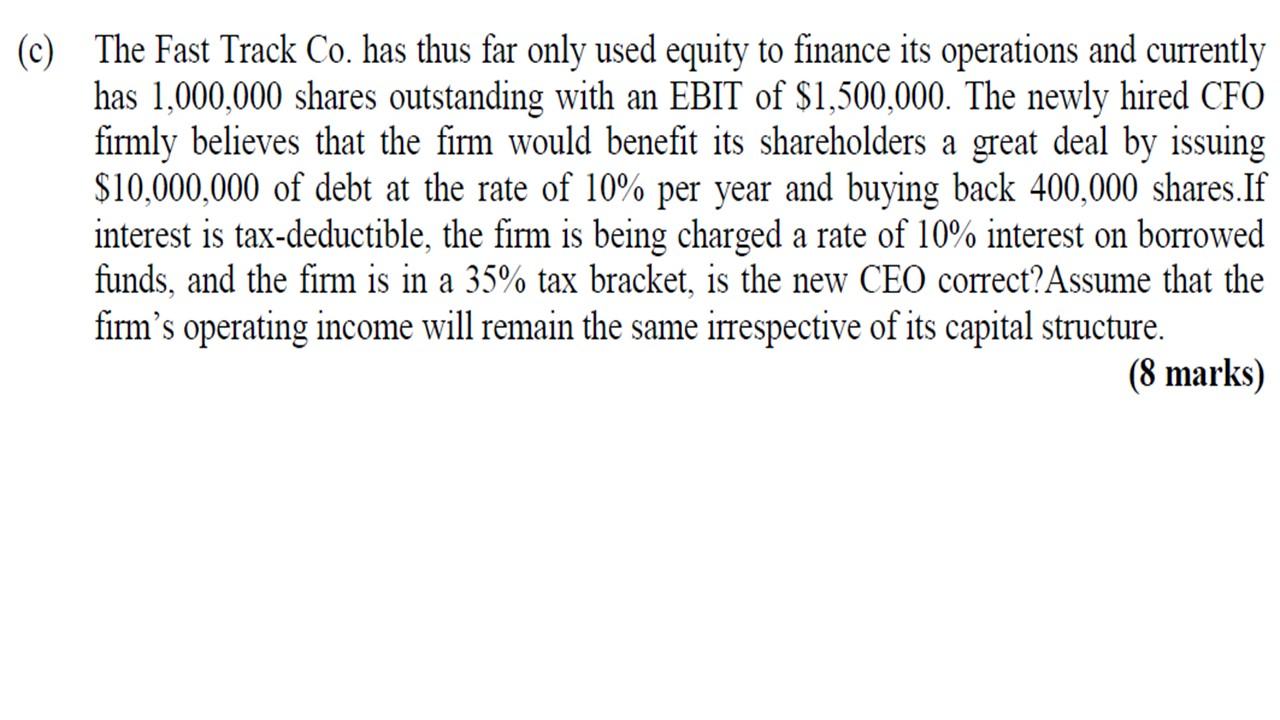

(c) The Fast Track Co. has thus far only used equity to finance its operations and currently has 1,000,000 shares outstanding with an EBIT of $1,500,000. The newly hired CFO firmly believes that the firm would benefit its shareholders a great deal by issuing $10,000,000 of debt at the rate of 10% per year and buying back 400,000 shares. If interest is tax-deductible, the firm is being charged a rate of 10% interest on borrowed funds, and the firm is in a 35% tax bracket, is the new CEO correct?Assume that the firm's operating income will remain the same irrespective of its capital structure. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock