Question: (c) The minimum amount you would suggest as the elected proceeds (d) The benefit of making the election 3. Based on GI's objective to amalgamate

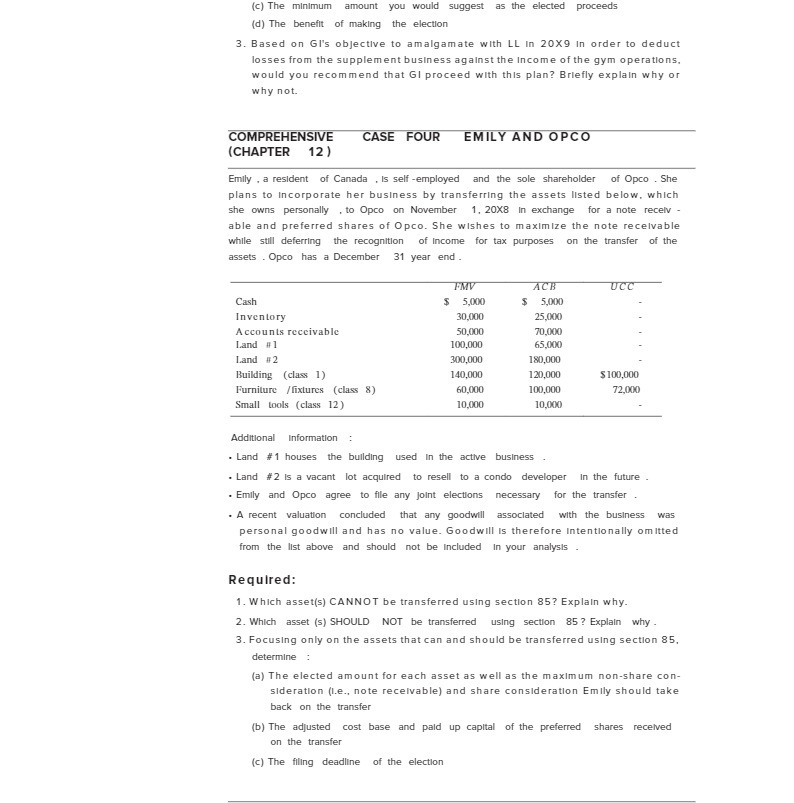

(c) The minimum amount you would suggest as the elected proceeds (d) The benefit of making the election 3. Based on GI's objective to amalgamate with LL in 20X9 In order to deduct losses from the supplement business against the Income of the gym operations. would you recommend that GI proceed with this plan? Briefly explain why or why not. COMPREHENSIVE CASE FOUR EMILY AND OPCO (CHAPTER 12 ) Emily , a resident of Canada , Is self -employed and the sole shareholder of Opco . She plans to Incorporate her business by transferring the assets listed below, which she owns personally . to Opco on November 1, 20X8 In exchange for a note receiv able and preferred shares of Opco. She wishes to maximize the note receivable while still deferring the recognition of Income for tax purposes on the transfer of the assets . Opco has a December 31 year end F.MV ACH UCC Cash $ 5,000 5,000 Inventory 30,000 25,000 Accounts receivable 50,000 70.000 Land #1 100,000 65,000 Land #2 300,000 180,000 Building (class 1) 140,000 120,000 $ 100,000 Furniture /fixtures (class 8) 60,000 100,000 72,010 Small tools (class 12) 10,000 10.000 Additional Information . Land #1 houses the building used In the active business . Land #2 is a vacant lot acquired to resell to a condo developer In the future . Emily and Opco agree to file any joint elections necessary for the transfer A recent valuation concluded that any goodwill associated with the business was personal goodwill and has no value. Goodwill Is therefore Intentionally omitted from the list above and should not be Included In your analysis Required: 1. Which asset(s) CANNOT be transferred using section 85? Explain why. 2. Which asset (s) SHOULD NOT be transferred using section 85 ? Explain why . 3. Focusing only on the assets that can and should be transferred using section 85, determine : (a) The elected amount for each asset as well as the maximum non-share con- sideration (1.e., note receivable) and share consideration Emily should take back on the transfer (b) The adjusted cost base and pald up capital of the preferred shares received on the transfer (c) The filing deadline of the election