Question: Fredo plc is preparing its consolidated statement of cash flows for the year ended 31 December 2020. The following summarised information is taken from

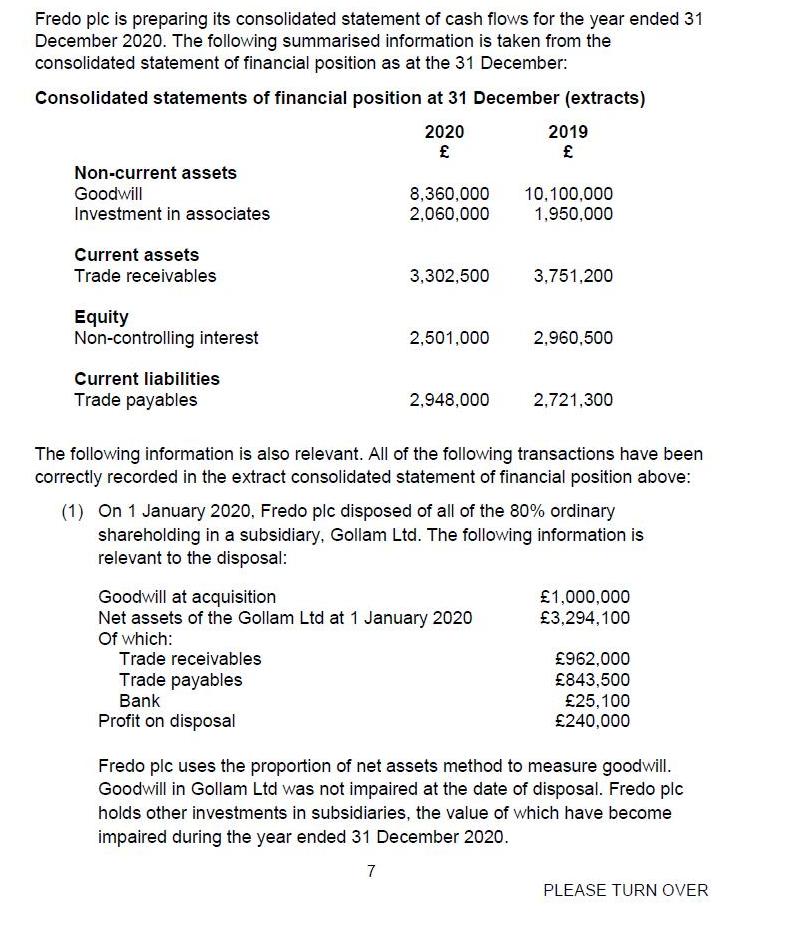

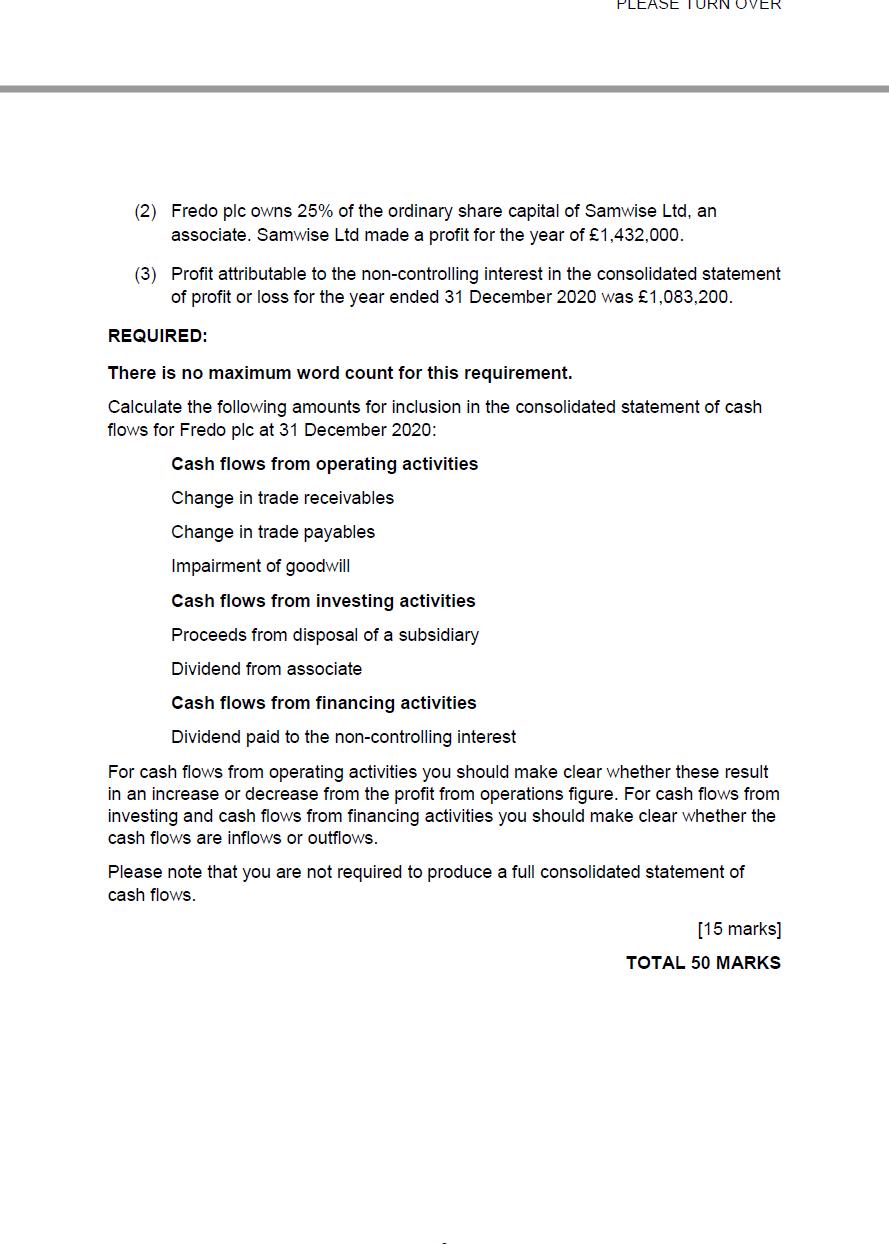

Fredo plc is preparing its consolidated statement of cash flows for the year ended 31 December 2020. The following summarised information is taken from the consolidated statement of financial position as at the 31 December: Consolidated statements of financial position at 31 December (extracts) 2020 Non-current assets Goodwill Investment in associates Current assets Trade receivables Equity Non-controlling interest Current liabilities Trade payables 8,360,000 2,060,000 3,302,500 2,501,000 Trade payables Bank Profit on disposal 2,948,000 2019 Goodwill at acquisition Net assets of the Gollam Ltd at 1 January 2020 Of which: Trade receivables 10,100,000 1,950,000 3,751,200 2,960,500 The following information is also relevant. All of the following transactions have been correctly recorded in the extract consolidated statement of financial position above: 2,721,300 (1) On 1 January 2020, Fredo plc disposed of all of the 80% ordinary shareholding in a subsidiary, Gollam Ltd. The following information is relevant to the disposal: 1,000,000 3,294,100 962,000 843,500 25,100 240,000 Fredo plc uses the proportion of net assets method to measure goodwill. Goodwill in Gollam Ltd was not impaired at the date of disposal. Fredo plc holds other investments in subsidiaries, the value of which have become impaired during the year ended 31 December 2020. 7 PLEASE TURN OVER

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

We will breakdown each component so as to calculate the amounts for inclusion in the consolidated statement of cash flows for Fredo plc at 31 December ... View full answer

Get step-by-step solutions from verified subject matter experts