Question: (C) UpBeat Berhad needs to raise RM 75 million for its future expansion in Iskandar Puteri, Johor. It plans to issue 10-year annual coupon bonds

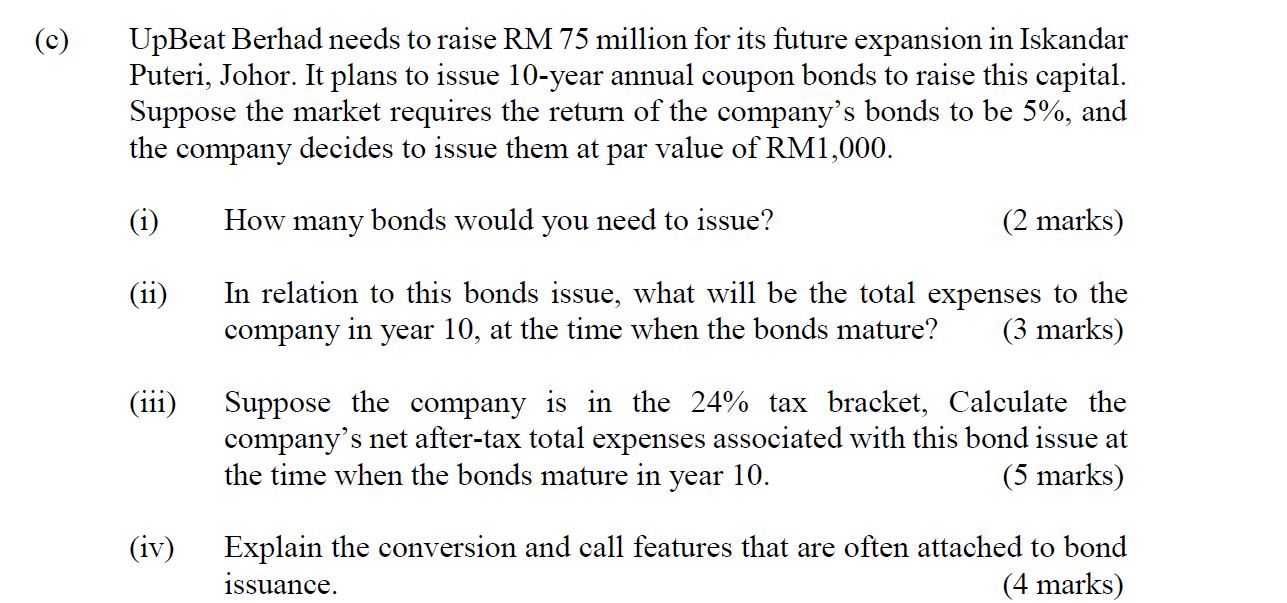

(C) UpBeat Berhad needs to raise RM 75 million for its future expansion in Iskandar Puteri, Johor. It plans to issue 10-year annual coupon bonds to raise this capital. Suppose the market requires the return of the company's bonds to be 5%, and the company decides to issue them at par value of RM1,000. (i) How many bonds would you need to issue? (2 marks) 11) In relation to this bonds issue, what will be the total expenses to the company in year 10, at the time when the bonds mature? (3 marks) (iii) Suppose the company is in the 24% tax bracket, Calculate the company's net after-tax total expenses associated with this bond issue at the time when the bonds mature in year 10. (5 marks) (iv) Explain the conversion and call features that are often attached to bond (4 marks) issuance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts