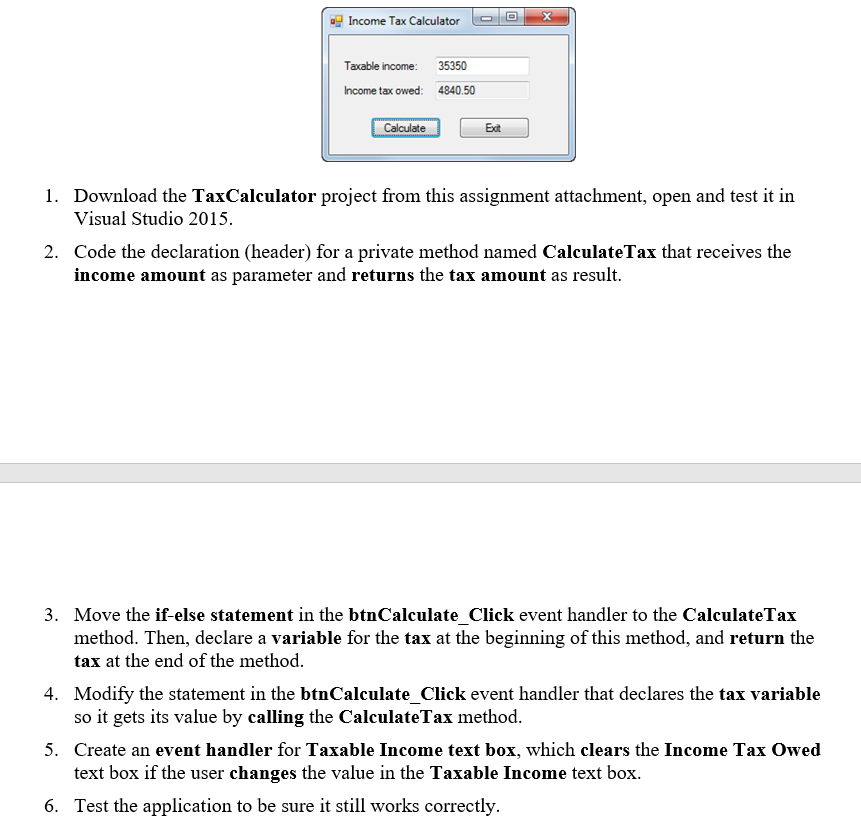

Question: C# using microsoft visual studio Taxable income: 35350 Calculate 8 hit Download the TaxCalculator project from this assignment attachment, open and test it in Visual

C# using microsoft visual studio

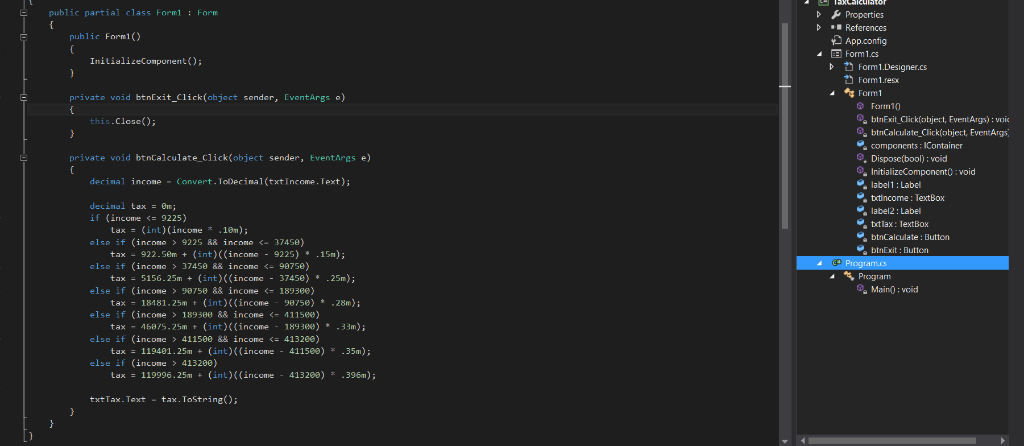

Taxable income: 35350 Calculate 8 hit Download the TaxCalculator project from this assignment attachment, open and test it in Visual Studio 2015. 1. 2. Code the declaration (header) for a private method named CalculateTax that receives the income amount as parameter and returns the tax amount as result. Move the if-else statement in the btnCalculate_Click event handler to the CalculateTax method. Then, declare a variable for the tax at the beginning of this method, and return the tax at the end of the method 3. Modify the statement in the btnCalculate_Click event handler that declares the tax variable so it gets its value by calling the CalculateTax method. Create an event handler for Taxable Income text box, which clears the Income Tax Owed text box if the user changes the value in the Taxable Income text box Test the application to be sure it still works correctly. 4. 5. 6. public partial class Form1: Form References App.config Form1.cs puhlic Form) InitializeComporient; pForm1.Designer.cs Form1.resx Form1 privato void btnExit Click(objoct sonder, EvontArgs a) Form10 this.Close) btnExit Click(object, FventArgs):voi components: Container Disposc(bool) void private void btnCalculate Click(object sender, EventArgs e) decinal income -Convert.ToDecimal(txtIncome. Text); label1:Label totincome: TextBox decinal taxm; a label2: Label ttlax: TextBox a btnCalculate: Button if (incom e 98758 && income 1893ee) else if (incone 18938e && income4115e0) else if (incone 411580 && income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts