Question: C. Using the offering price found in step 3 and assuming the FV =100 what is the YTM of your bond on offering (This means

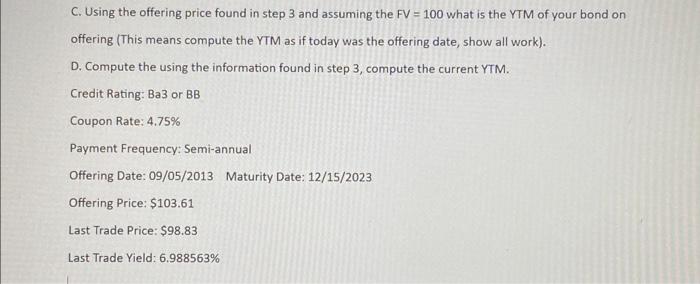

C. Using the offering price found in step 3 and assuming the FV =100 what is the YTM of your bond on offering (This means compute the YTM as if today was the offering date, show all work). D. Compute the using the information found in step 3 , compute the current YTM. Credit Rating: Ba3 or BB Coupon Rate: 4.75% Payment Frequency: Semi-annual Offering Date: 09/05/2013 Maturity Date: 12/15/2023 Offering Price: $103.61 Last Trade Price: $98.83 Last Trade Yield: 6.988563%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts