Question: c. Using the real term structure, price the 2% Coupon TIPS with maturity 4/14/2012 and index ratio 1.07817 d. On December 12, 2008, the TIPS

c. Using the real term structure, price the 2% Coupon TIPS with maturity 4/14/2012 and index ratio 1.07817

d. On December 12, 2008, the TIPS priced in Part (c) was actually trading at 95

15/16. Is your price close to trading price?

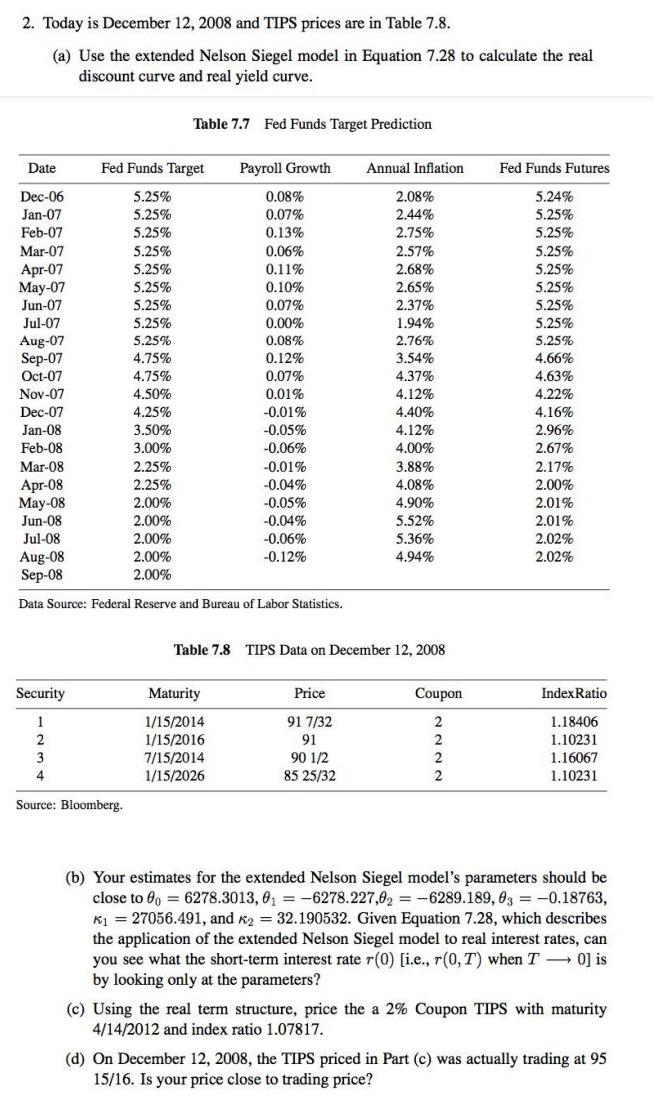

2. Today is December 12,2008 and TIPS prices are in Table 7.8 . (a) Use the extended Nelson Siegel model in Equation 7.28 to calculate the real discount curve and real yield curve. Table 7.7 Fed Funds Target Prediction Data Source: Federal Reserve and Bureau of Labor Statistics. Table 7.8 TIPS Data on December 12, 2008 source: Bloomberg. (b) Your estimates for the extended Nelson Siegel model's parameters should be close to 0=6278.3013,1=6278.227,2=6289.189,3=0.18763, 1=27056.491, and 2=32.190532. Given Equation 7.28, which describes the application of the extended Nelson Siegel model to real interest rates, can you see what the short-term interest rate r(0) [i.e., r(0,T) when T0 ] is by looking only at the parameters? (c) Using the real term structure, price the a 2% Coupon TIPS with maturity 4/14/2012 and index ratio 1.07817 . (d) On December 12, 2008, the TIPS priced in Part (c) was actually trading at 95 15/16. Is your price close to trading price? 2. Today is December 12,2008 and TIPS prices are in Table 7.8 . (a) Use the extended Nelson Siegel model in Equation 7.28 to calculate the real discount curve and real yield curve. Table 7.7 Fed Funds Target Prediction Data Source: Federal Reserve and Bureau of Labor Statistics. Table 7.8 TIPS Data on December 12, 2008 source: Bloomberg. (b) Your estimates for the extended Nelson Siegel model's parameters should be close to 0=6278.3013,1=6278.227,2=6289.189,3=0.18763, 1=27056.491, and 2=32.190532. Given Equation 7.28, which describes the application of the extended Nelson Siegel model to real interest rates, can you see what the short-term interest rate r(0) [i.e., r(0,T) when T0 ] is by looking only at the parameters? (c) Using the real term structure, price the a 2% Coupon TIPS with maturity 4/14/2012 and index ratio 1.07817 . (d) On December 12, 2008, the TIPS priced in Part (c) was actually trading at 95 15/16. Is your price close to trading price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts