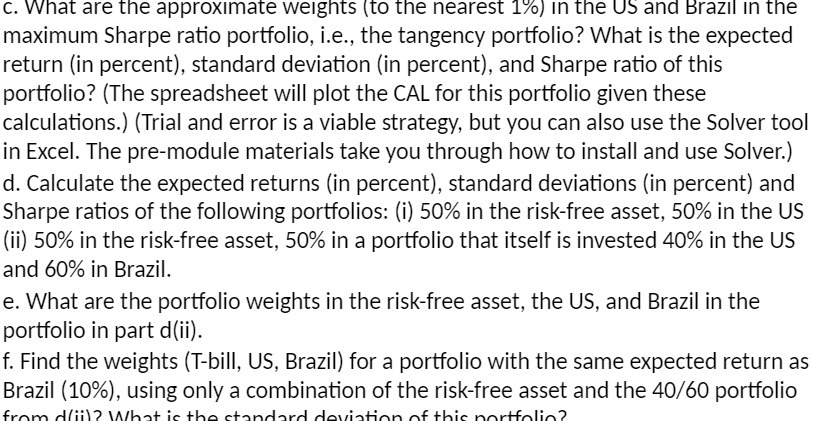

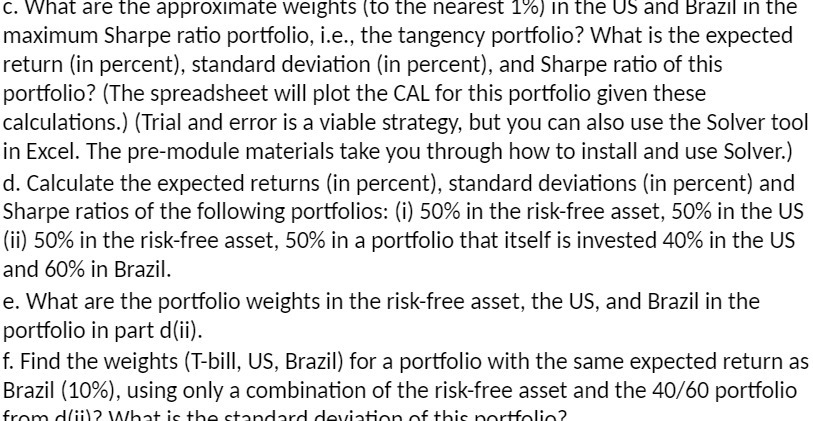

Question: c. What are the approximate weights (to the nearest 1%%) in the US and Brazil in the maximum Sharpe ratio portfolio, i.e., the tangency portfolio?

c. What are the approximate weights (to the nearest 1%%) in the US and Brazil in the maximum Sharpe ratio portfolio, i.e., the tangency portfolio? What is the expected return (in percent), standard deviation (in percent), and Sharpe ratio of this portfolio? (The spreadsheet will plot the CAL for this portfolio given these calculations.) (Trial and error is a viable strategy, but you can also use the Solver tool in Excel. The pre-module materials take you through how to install and use Solver.) d. Calculate the expected returns (in percent), standard deviations (in percent) and Sharpe ratios of the following portfolios: (i) 50% in the risk-free asset, 50% in the US (ii) 50% in the risk-free asset, 50% in a portfolio that itself is invested 40% in the US and 60% in Brazil. e. What are the portfolio weights in the risk-free asset, the US, and Brazil in the portfolio in part d(ii). f. Find the weights (T-bill, US, Brazil) for a portfolio with the same expected return as Brazil (10%), using only a combination of the risk-free asset and the 40/60 portfolio from dijl? What is the dard leviation of this na folia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts