Question: c) You have $100,000 to invest in a share portfolio. Your choices are shares in A.G. Ltd, with an expected return of 13.25%, and shares

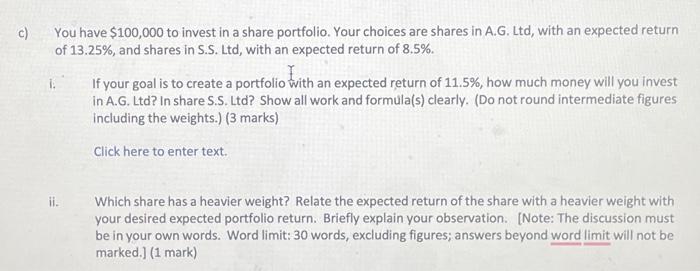

c) You have $100,000 to invest in a share portfolio. Your choices are shares in A.G. Ltd, with an expected return of 13.25%, and shares in S.S. Ltd, with an expected return of 8.5%. If your goal is to create a portfolio with an expected return of 11.5%, how much money will you invest in A.G. Ltd? In share S.S. Ltd? Show all work and formula(s) clearly. (Do not round intermediate figures including the weights.) (3 marks) Click here to enter text. ii. Which share has a heavier weight? Relate the expected return of the share with a heavier weight with your desired expected portfolio return. Briefly explain your observation. [Note: The discussion must be in your own words. Word limit: 30 words, excluding figures; answers beyond word limit will not be marked.] (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts