Question: (C1) Now suppose you have another factor. This factor is also a portfo- lio like the market portfolio with an expected return of 7% (so

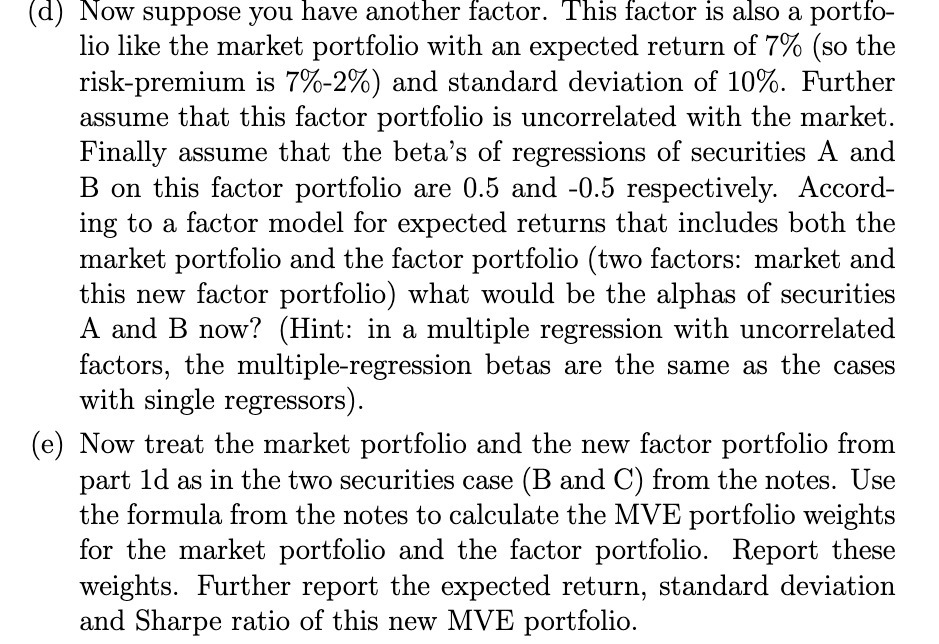

(C1) Now suppose you have another factor. This factor is also a portfo- lio like the market portfolio with an expected return of 7% (so the risk-premium is 7%-2%) and standard deviation of 10%. Further assume that this factor portfolio is uncorrelated with the market. Finally assume that the beta's of regressions of securities A and B on this factor portfolio are 0.5 and -0.5 reSpectively. Accord- ing to a factor model for expected returns that includes both the market portfolio and the factor portfolio (two factors: market and this new factor portfolio) what would be the alphas of securities A and B now? (Hint: in a multiple regressiOn with uncorrelated factors, the multiple-regression betas are the same as the cases with single regressors). Now treat the market portfolio and the new factor portfolio from part 1d as in the two securities case (B and C) from the notes. Use the formula from the notes to calculate the MVE portfolio weights for the market portfolio and the factor portfolio. Report these weights. Further report the expected return, standard deviation and Sharpe ratio of this new MVE portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts