Question: C2.J. Changes in shareholders' equity are determined by total earnings minus net payout to shareholders, but the change in shareholders' equity is not equal to

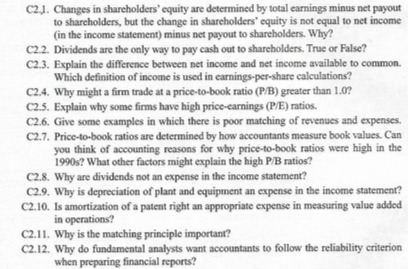

C2.J. Changes in shareholders' equity are determined by total earnings minus net payout to shareholders, but the change in shareholders' equity is not equal to net income (in the income statement) minus net payout to shareholders. Why? C2.2. Dividends are the only way to pay cash out to shareholders. True or False? C2.3. Explain the difference between net income and net income available to common. Which definition of income is used in earnings-per-share calculations? C2.4. Why might a firm trade at a price-to-book ratio (P/B) greater than 1.0? C2.5. Explain why some firms have high price-earnings (P/E) ratios. C2.6. Give some examples in which there is poor matching of revenues and expenses. C2.7. Price-to-book ratios are determined by how accountants measure book values. Can you think of accounting reasons for why price-to-book ratios were high in the 1990s? What other factors might explain the high P/B ratios? C2.8. Why are dividends not an expense in the income statement? C2.9. Why is depreciation of plant and equipment an expense in the income statement? C2.10. Is amortization of a patent right an appropriate expense in measuring value added in operations? C2.11. Why is the matching principle important? C2.12. Why do fundamental analysts want accountants to follow the reliability criterion when preparing financial reports

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts