Question: C3-55 i need the answer mainly B,D C3-55. Preparing Adjusting Entries, Financial Statements, and Closing Entries LO2,3, 4,5 Seaside Surf Shop began operations on July

C3-55 i need the answer mainly B,D

C3-55 i need the answer mainly B,D

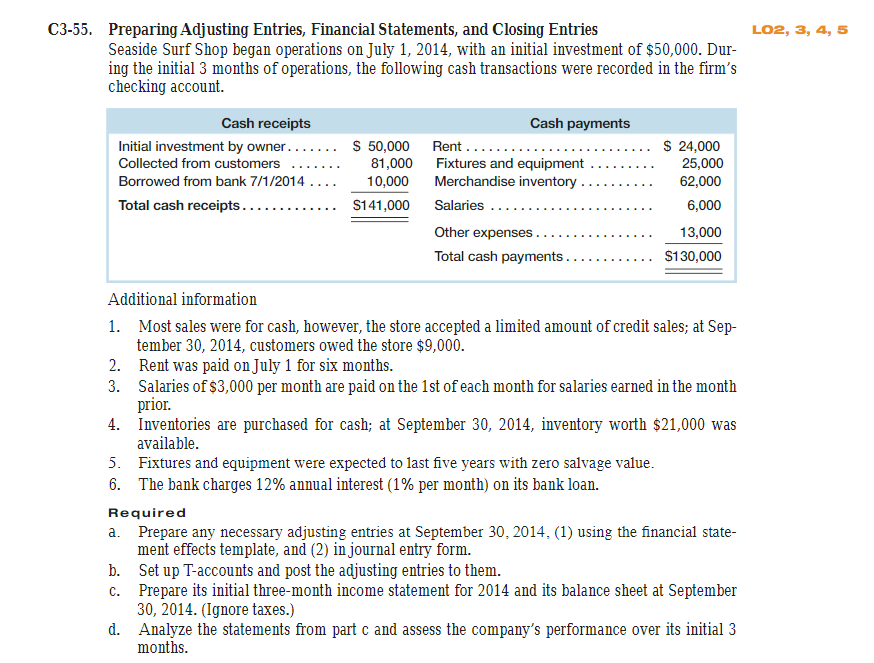

C3-55. Preparing Adjusting Entries, Financial Statements, and Closing Entries LO2,3, 4,5 Seaside Surf Shop began operations on July 1, 2014, with an initial investment of $50,000. Dur ing the initial 3 months of operations, the following cash transactions were recorded in the firm's checking account. Cash receipts Cash payments Collected from customers . ..81,000 Borrowed from bank 7/1/2014.... 10,000 Fixtures and equipment... . . . . .. Merchandise inventory . . . . . . . 25,000 62,000 Additional information 1. Most sales were for cash, however, the store accepted a limited amount of credit sales; at Sep- tember 30, 2014, customers owed the store $9,000 2. Rent was paid on July 1 for six months 3. Salaries of $3,000 per month are paid on the 1st of each month for salaries earned in the month prior. Inventories are purchased for cash; at September 30, 2014, inventory worth $21,000 was 4. available 5. Fixtures and equipment were expected to last five years with zero salvage value 6. The bank charges 12% annual interest (1% per month) on its bank loan. Required a. Prepare any necessary adjusting entries at September 30, 2014, (1) using the financial state- ment effects template, and (2) in journal entry form. b. Set up T-accounts and post the adjusting entries to them. c. Prepare its initial three-month income statement for 2014 and its balance sheet at September 30, 2014. (Ignore taxes.) Analyze the statements from part c and assess the company's performance over its initial 3 months d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts