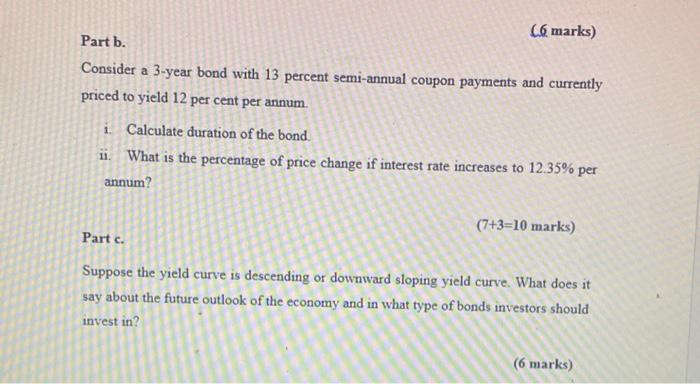

Question: C6 marks) Part b. Consider a 3-year bond with 13 percent semi-annual coupon payments and currently priced to yield 12 per cent per annum. i

C6 marks) Part b. Consider a 3-year bond with 13 percent semi-annual coupon payments and currently priced to yield 12 per cent per annum. i Calculate duration of the bond, ii. What is the percentage of price change if interest rate increases to 12.35% per annum? (7+3=10 marks) Part c. Suppose the yield curve is descending or downward sloping yield curve. What does it say about the future outlook of the economy and in what type of bonds investors should invest in? (6 marks) C6 marks) Part b. Consider a 3-year bond with 13 percent semi-annual coupon payments and currently priced to yield 12 per cent per annum. i Calculate duration of the bond, ii. What is the percentage of price change if interest rate increases to 12.35% per annum? (7+3=10 marks) Part c. Suppose the yield curve is descending or downward sloping yield curve. What does it say about the future outlook of the economy and in what type of bonds investors should invest in? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts