Question: CA - Decision Analysis The strategic decisions considered in this context, such as those involving the cost of capital and commercialization options for a new

CADecision Analysis

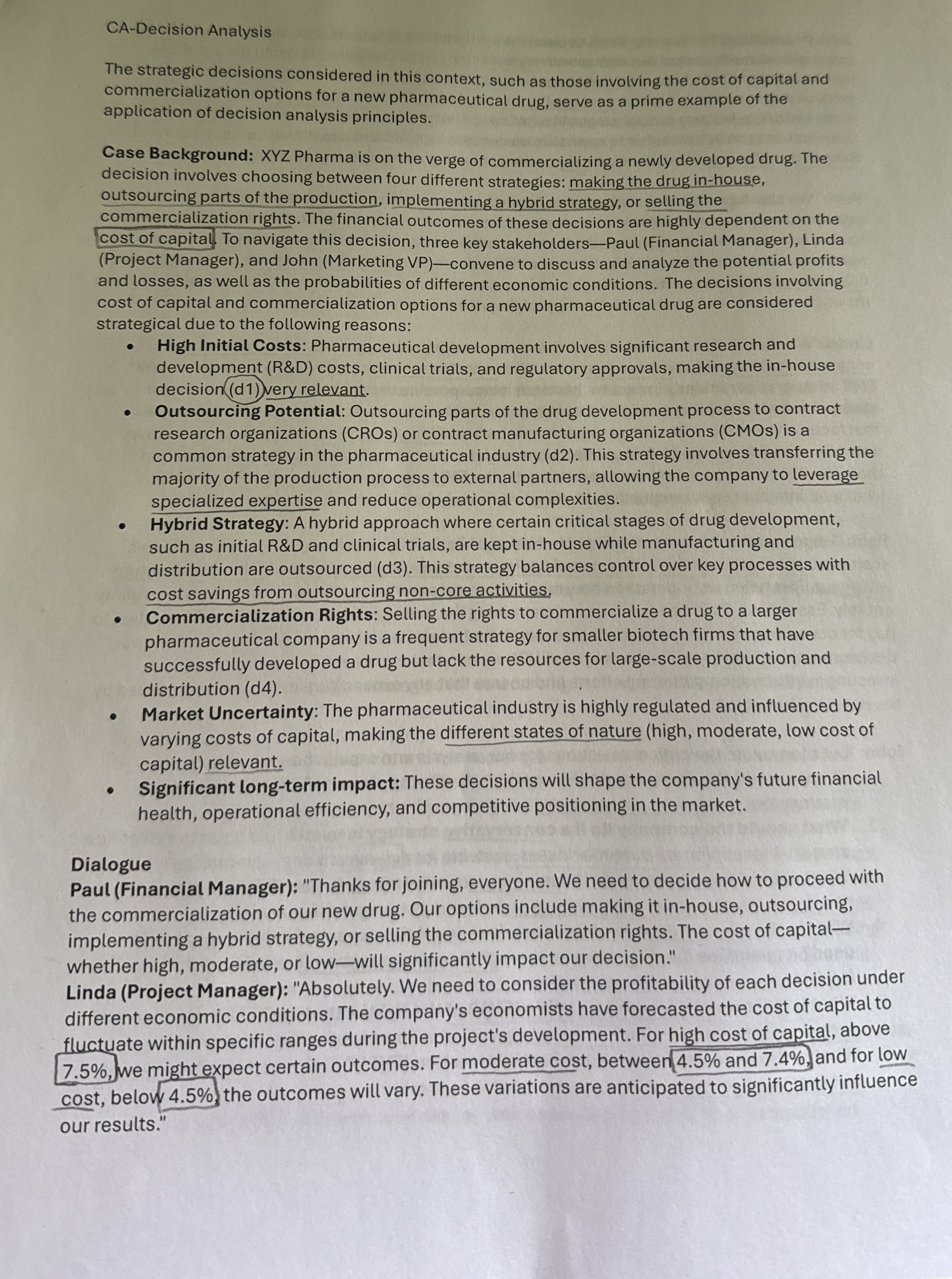

The strategic decisions considered in this context, such as those involving the cost of capital and commercialization options for a new pharmaceutical drug, serve as a prime example of the application of decision analysis principles.

Case Background: XYZ Pharma is on the verge of commercializing a newly developed drug. The decision involves choosing between four different strategies: making the drug inhouse, outsourcing parts of the production, implementing a hybrid strategy, or selling the commercialization rights. The financial outcomes of these decisions are highly dependent on the cost of capital. To navigate this decision, three key stakeholdersPaul Financial Manager Linda Project Manager and John Marketing VPconvene to discuss and analyze the potential profits and losses, as well as the probabilities of different economic conditions. The decisions involving cost of capital and commercialization options for a new pharmaceutical drug are considered strategical due to the following reasons:

High Initial Costs: Pharmaceutical development involves significant research and development R&D costs, clinical trials, and regulatory approvals, making the inhouse decisiond very relevant.

Outsourcing Potential: Outsourcing parts of the drug development process to contract research organizations CROs or contract manufacturing organizations CMOs is a common strategy in the pharmaceutical industry d This strategy involves transferring the majority of the production process to external partners, allowing the company to leverage specialized expertise and reduce operational complexities.

Hybrid Strategy: A hybrid approach where certain critical stages of drug development, such as initial R&D and clinical trials, are kept inhouse while manufacturing and distribution are outsourced d This strategy balances control over key processes with cost savings from outsourcing noncore activities.

Commercialization Rights: Selling the rights to commercialize a drug to a larger pharmaceutical company is a frequent strategy for smaller biotech firms that have successfully developed a drug but lack the resources for largescale production and distribution d

Market Uncertainty: The pharmaceutical industry is highly regulated and influenced by varying costs of capital, making the different states of nature high moderate, low cost of capital relevant.

Significant longterm impact: These decisions will shape the company's future financial health, operational efficiency, and competitive positioning in the market.

Dialogue

Paul Financial Manager: "Thanks for joining, everyone. We need to decide how to proceed with the commercialization of our new drug. Our options include making it inhouse, outsourcing, implementing a hybrid strategy, or selling the commercialization rights. The cost of capitalwhether high, moderate, or lowwill significantly impact our decision."

Linda Project Manager: "Absolutely. We need to consider the profitability of each decision under different economic conditions. The company's economists have forecasted the cost of capital to fluctuate within specific ranges during the project's development. For high cost of capital, above we might expect certain outcomes. For moderate cost, between and and for low cost, below the outcomes will vary. These variations are anticipated to significantly influence our results."

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock