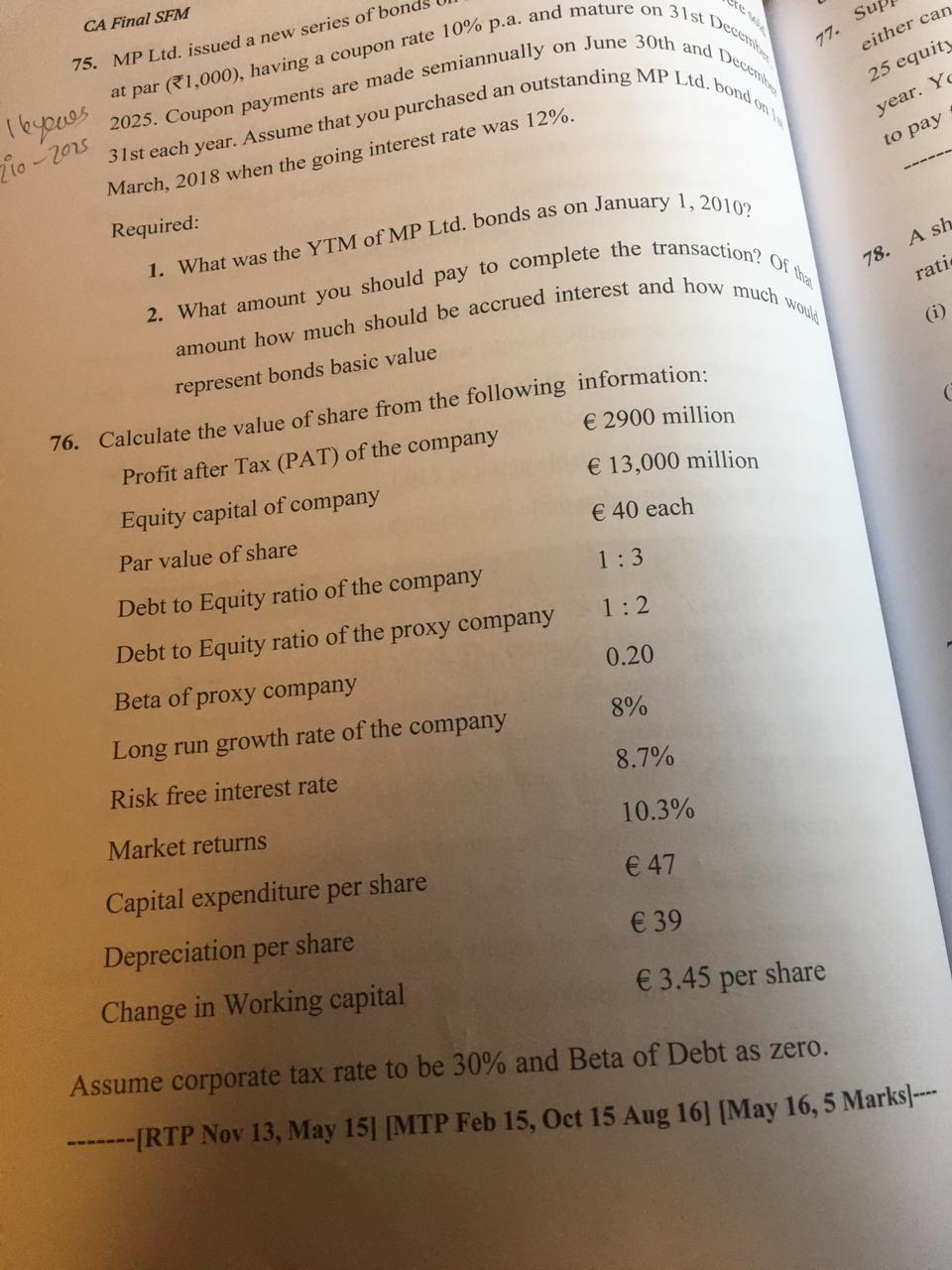

Question: CA Final SEM 77. Su either can 25 equity 75. MP Ltd. issued a new series of bond 2025. Coupon payments are made semiannually on

CA Final SEM 77. Su either can 25 equity 75. MP Ltd. issued a new series of bond 2025. Coupon payments are made semiannually on June 30th and Decensito at par R1,000), having a coupon rate 10% p.a. and mature on 31st Decenti outstanding MP Ltd. bondon year. Y to pay 210-2015 Ibyowes 31st each year. Assume that you purchased an March, 2018 when the going interest rate was 12%. Required: 78. Ash rati 1. What was the YTM of MP Ltd. bonds as on January 1, 2010? 2. What amount you should pay to complete the transaction? amount how much should be accrued interest and how much (i) represent bonds basic value 76. Calculate the value of share from the following information: 2900 million Profit after Tax (PAT) of the company 13,000 million Equity capital of company 40 each Par value of share 1:3 Debt to Equity ratio of the company 1:2 Debt to Equity ratio of the proxy company Beta of proxy company 0.20 Long run growth rate of the company 8% Risk free interest rate 8.7% 10.3% Market returns 47 39 Capital expenditure per share Depreciation per share Change in Working capital 3.45 per share Assume corporate tax rate to be 30% and Beta of Debt as zero. [RTP Nov 13, May 15] MTP Feb 15, Oct 15 Aug 16] [May 16, 5 Marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts