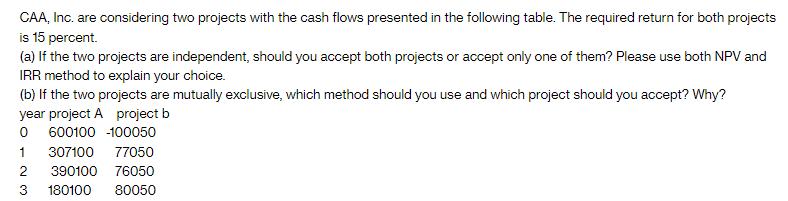

Question: CAA, Inc. are considering two projects with the cash flows presented in the following table. The required return for both projects is 15 percent.

CAA, Inc. are considering two projects with the cash flows presented in the following table. The required return for both projects is 15 percent. (a) If the two projects are independent, should you accept both projects or accept only one of them? Please use both NPV and IRR method to explain your choice. (b) If the two projects are mutually exclusive, which method should you use and which project should you accept? Why? year project A project b 0 600100 -100050 1 307100 77050 2 390100 76050 3 180100 80050

Step by Step Solution

3.46 Rating (179 Votes )

There are 3 Steps involved in it

To decide whether to accept these projects we can evaluate them using both the Net Present Value NPV ... View full answer

Get step-by-step solutions from verified subject matter experts