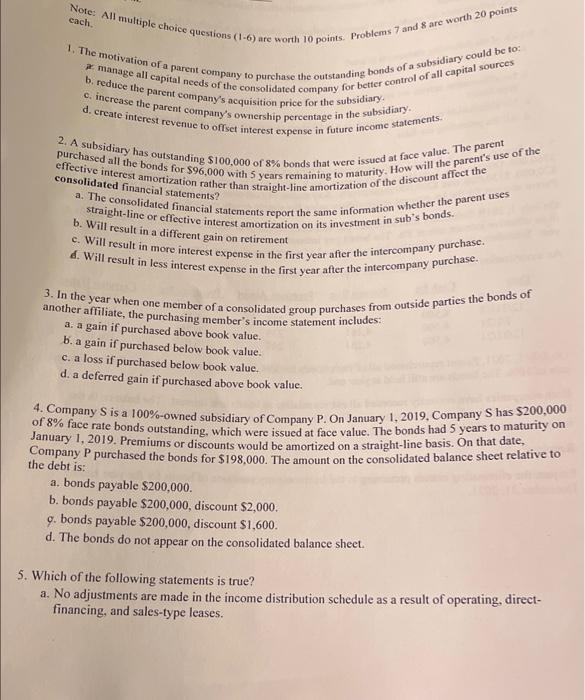

Question: cach Note: All multiple choice questions (1-6) are worth 10 points. Problems 7 and 8 are worth 20 points 1. The motivation of a parent

cach Note: All multiple choice questions (1-6) are worth 10 points. Problems 7 and 8 are worth 20 points 1. The motivation of a parent company to purchase the outstanding bonds of a subsidiary could be to: b. reduce the parent company's acquisition price for the subsidiary. manage all capital needs of the consolidated company for better control of all capital sources d. create interest revenue to offset interest expense in future income statements c. increase the parent company's ownership percentage in the subsidiary. purchased all the bonds for $96,000 with 5 years remaining to maturity. How will the parent's use of the effective interest amortization rather than straight-line amortization of the discount affect the 2. A subsidiary has outstanding $100,000 of 8% bonds that were issued at face value. The parent a. The consolidated financial statements report the same information whether the parent uses straight-line or effective interest amortization on its investment in sub's bonds. 6. Will result in less interest expense in the first year after the intercompany purchase. c. Will result in more interest expense in the first year after the intercompany purchase. 3. In the year when one member of a consolidated group purchases from outside parties the bonds of consolidated financial statements? b. Will result in a different gain on retirement another affiliate, the purchasing members income statement includes: a. again if purchased above book value. b. a gain if purchased below book value. c. a loss if purchased below book value. d. a deferred gain if purchased above book value. of company is a 100%-owned subsidiary of Company P. On January 1, 2019. Company S has $200,000 Dafts% face rate bonds outstanding, which were firsued a face value. The bonds had 5 years to maturity on January 1, 2019. Premiums or discounts would be amortized on a straight-line basis. On that date, hempany P purchased the bonds for $198,000. The amount on the consolidated balance sheet relative to a. bonds payable $200,000. b. bonds payable $200,000, discount $2,000. 9. bonds payable $200,000, discount $1,600 d. The bonds do not appear on the consolidated balance sheet. debt is: 5. Which of the following statements is true? a. No adjustments are made in the income distribution schedule as a result of operating, direct- financing, and sales-type leases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts