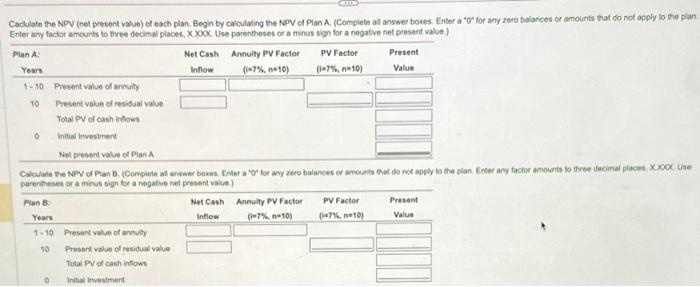

Question: Caclulate the NPV (nel present value) each plan. Begin by calculating the NPV of Plan A. (Complete all anwer boves. Enter a O for any

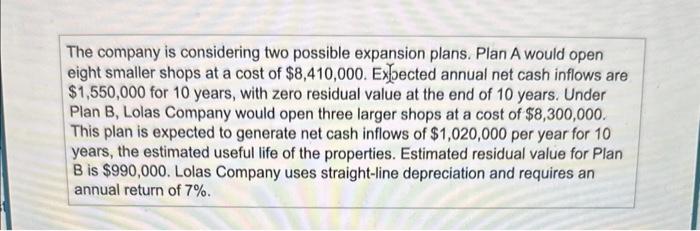

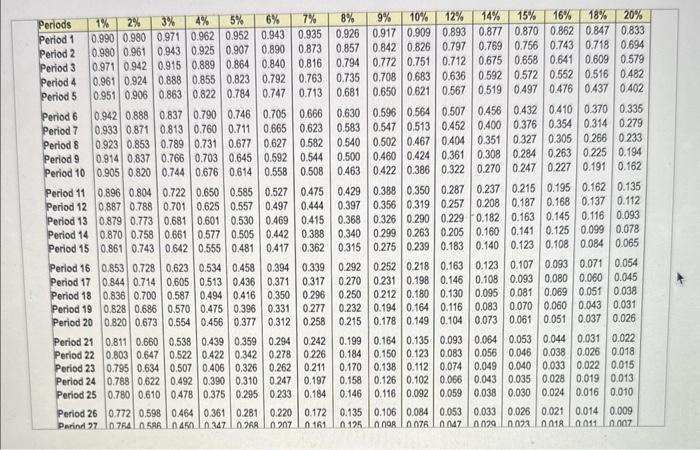

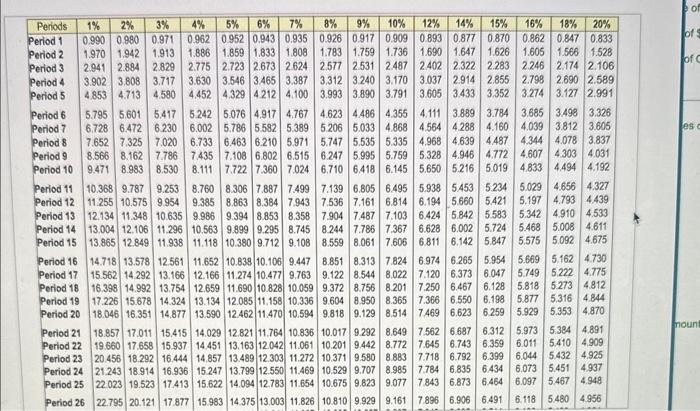

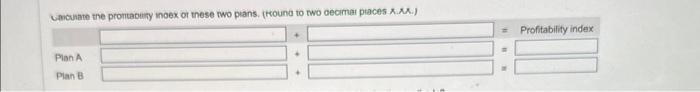

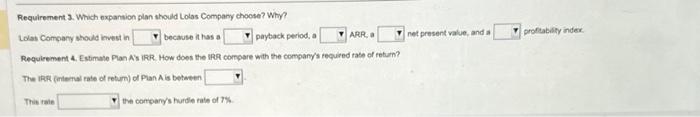

Caclulate the NPV (nel present value) each plan. Begin by calculating the NPV of Plan A. (Complete all anwer boves. Enter a "O" for any zero balances or anounts that do not apply to the plan Enter ary factor amounts to three decimal places, x0x. Use parentheses or a minus sign for a negaive net present valoe.) The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,410,000. Exlected annual net cash inflows are $1,550,000 for 10 years, with zero residual value at the end of 10 years. Under Plan B, Lolas Company would open three larger shops at a cost of $8,300,000. This plan is expected to generate net cash inflows of $1,020,000 per year for 10 years, the estimated useful life of the properties. Estimated residual value for Plan B is $990,000. Lolas Company uses straight-line depreciation and requires an annual return of 7%. Gacuate the promtabiny inoex or these two plans. (rrouna to two oecrmar ptaces ..) Requirement 3. Which expansion plan should Lolos Company choose? Why? Lolat Comcany thould inest in becave it has a payback period, a ARP. a net present value, and a proftabify inder Requirement 4. Estimale Plan A's IRR. How does the IRP compare with the company's required rase of fetum? The IRR (entertal rate of retum) of Plan A is between This rale the concany's hurdle rate of 7%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts