Question: Cain, Inc. signed a 120-day, 10% note payable on November 1, 2020 with a face value of $33,000. Cain made the appropriate year-end accrual on

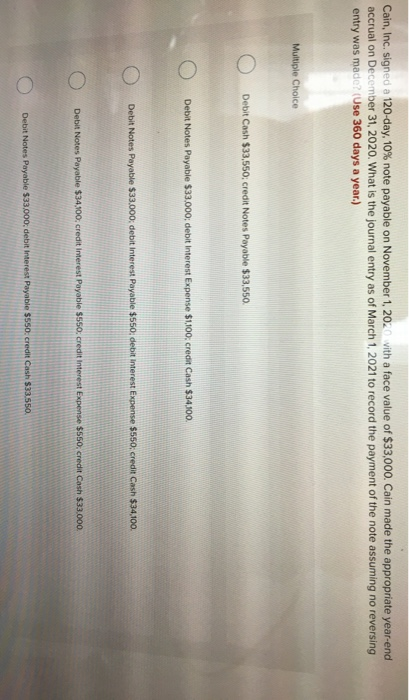

Cain, Inc. signed a 120-day, 10% note payable on November 1, 2020 with a face value of $33,000. Cain made the appropriate year-end accrual on December 31, 2020. What is the journal entry as of March 1, 2021 to record the payment of the note assuming no reversing entry was made? (Use 360 days a year.) Multiple Choice Debit Cash $33,550: credit Notes Payable $33,550. ) Debit Notes Payable $33.000; debit Interest Expense $1100, credit Cash $34,100. Debit Notes Payable $33.000, debit Interest Payable $550. debit Interest Expense $550.credit Cash $34,100 Debil Notes Payable $34,100 credit Interest Payable S550, credit Interest Expense 3560, credit Cash $33.000 OO Debit Notes Payable $33.000, debit interest Payable $550. credit Cash $33.550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts