Question: Caitlyn is considering making a large charitable deduction this year (2019). Her filing status is MFJ and their AGI is $60,000. She is deciding between

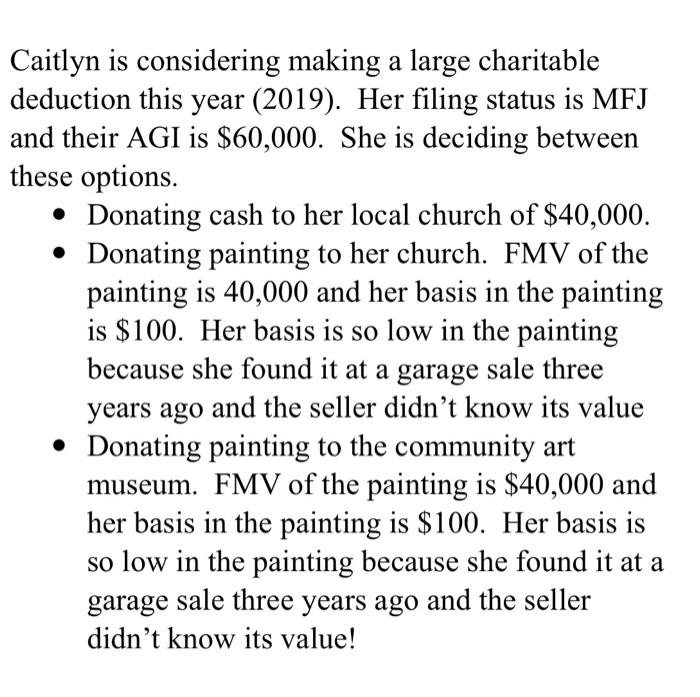

Caitlyn is considering making a large charitable deduction this year (2019). Her filing status is MFJ and their AGI is $60,000. She is deciding between these options. Donating cash to her local church of $40,000. Donating painting to her church. FMV of the painting is 40,000 and her basis in the painting is $100. Her basis is so low in the painting because she found it at a garage sale three years ago and the seller didn't know its value Donating painting to the community art museum. FMV of the painting is $40,000 and her basis in the painting is $100. Her basis is so low in the painting because she found it at a garage sale three years ago and the seller didn't know its value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts