Question: Cake Mart understated its ending inventory in the current year by $ 5 , 0 0 0 . The company incorrectly reported net income of

Cake Mart understated its ending inventory in the current year by $ The company incorrectly reported net income of $ Determine the effect this error had on the financial statements.

Cost of goods sold will be too high by $ and this caused net income to be understated by $

Cost of goods sold will be too high by $ and this caused net income to be overstated by $

Total assets on the balance sheet will be too high by $

Cost of goods sold was too low by $ which caused net income to be overstated.

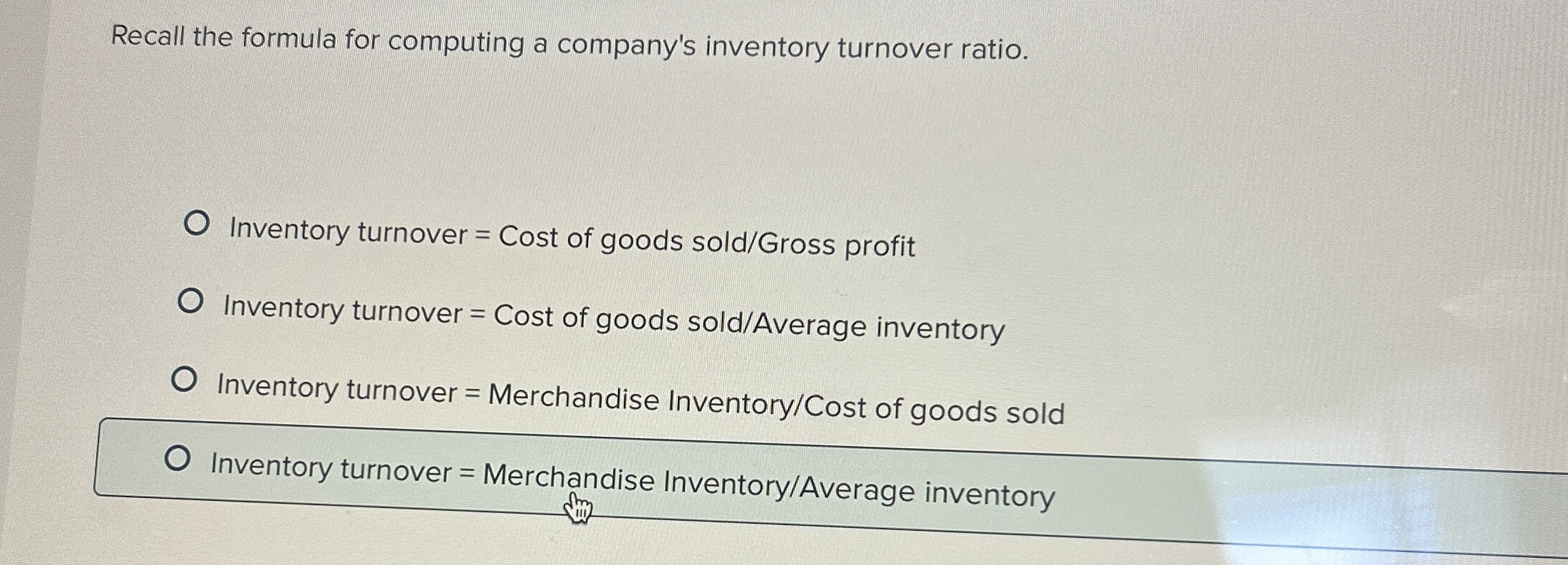

Recall the formula for computing a company's inventory turnover ratio.

Inventory turnover Cost of goods soldGross profit

Inventory turnover Cost of goods soldAverage inventory

Inventory turnover Merchandise InventoryCost of goods sold

Inventory turnover Merchandise InventoryAverage inventory

Recall the formula for computing a company's inventory turnover ratio.

Inventory turnover Cost of goods soldGross profit

Inventory turnover Cost of goods soldAverage inventory

Inventory turnover Merchandise InventoryCost of goods sold

Inventory turnover Merchandise InventoryAverage inventory

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock