Question: CALCLATOR FULL SCREEN PRINTER VERSIONBACK Problem 4-7 Your answer is partialy correct. Try again Wade Corp. has 150,000 shares of common stock outstanding. In 2017,

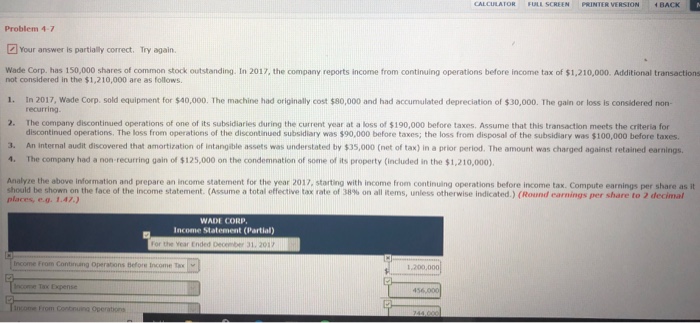

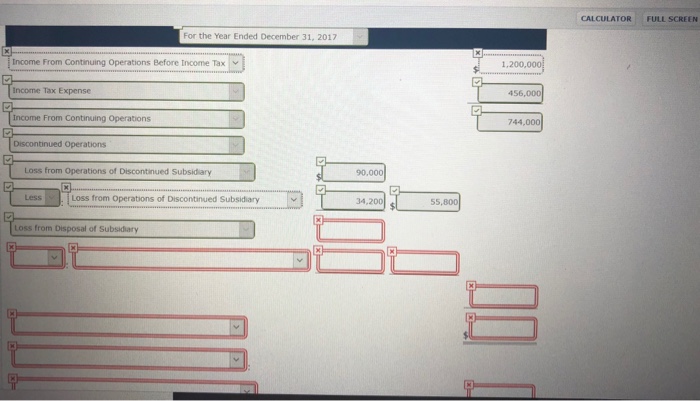

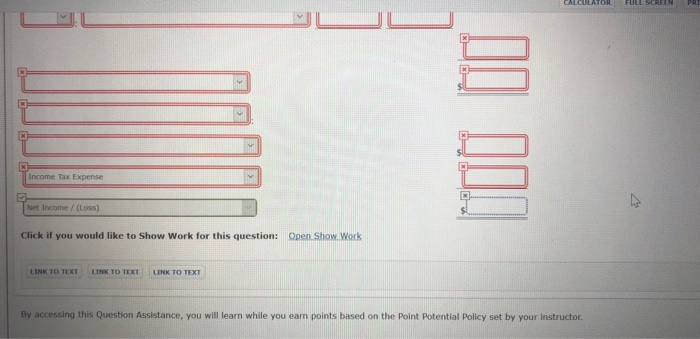

CALCLATOR FULL SCREEN PRINTER VERSIONBACK Problem 4-7 Your answer is partialy correct. Try again Wade Corp. has 150,000 shares of common stock outstanding. In 2017, the company reports income from continuing operations before income tax of $1,210,000. Additional transactions not considered in the $1,210,000 are as follows 1. In 2017, Wade Corp. sold equipment for $40,000. The machine had originally cost $80,000 and had accumulated depreciation of $30,000. The gain or loss is considered non- recurring 2. The company discontinued operations of one of its subsidiaries during the current year at a loss of $190,000 before taxes. Assume that this transaction meets the criteria for discontinued operations. The loss from operations of the discontinued subsidiary was $90,000 before taxes; the loss from disposal of the subsidiary was $100,000 before taxes 3. An internal audit discovered that amortization of intangible assets was understated by $35,000 (net of tax) in a prior period. The amount was charged against retained earnings. 4. The company had a non recurring gain of $125,000 on the condemnation of some of its property (included in the $1,210,000) Analyze the a ove information and prepare an income statement for the year 2017 starting with income rom continuing operations before income taCompute earnin s per share as i should be shown on the face of the income statement Assume a total effective tax rate of 38% on all Rems, unless otherwise indicated Round earnings per share to 2 dec mal places, e.g. 1.47.) WADE CORP Income Statement (Partial) Income From Conting Operabions Before Income Tax Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts