Question: CALCRATOR MESSAGE MY INSTRUCTOR STANDARD VIEW BACK PRINTER VERSION NEXT Question 33 Rachel Sells is unable to reconcile the bank balance at January 31. Rachel's

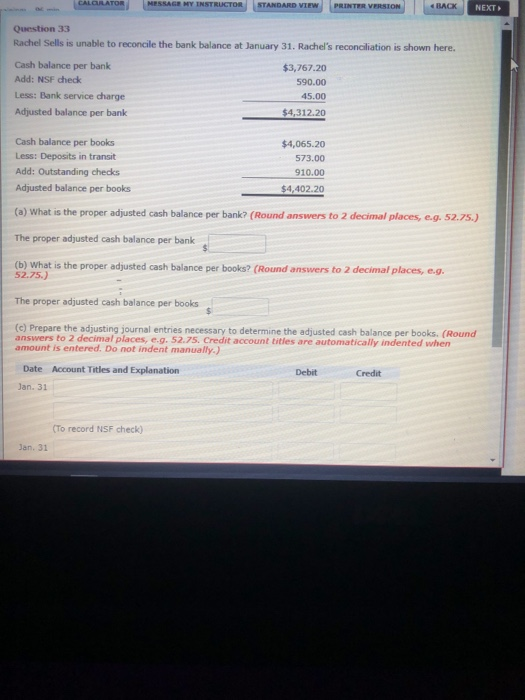

CALCRATOR MESSAGE MY INSTRUCTOR STANDARD VIEW BACK PRINTER VERSION NEXT Question 33 Rachel Sells is unable to reconcile the bank balance at January 31. Rachel's reconciliation is shown here. Cash balance per bank $3,767.20 Add: NSF check 590.00 Less: Bank service charge 45.00 Adjusted balance per bank $4,312.20 Cash balance per books $4,065.20 Less: Deposits in transit 573.00 Add: Outstanding checks 910.00 Adjusted balance per books $4,402.20 (a) What is the proper adjusted cash balance per bank? (Round answers to 2 decimal places, e.g. 52.75.) The proper adjusted cash balance per bank (b) What is the proper adjusted cash balance per books? (Round answers 52.75.) to 2 decimal places, e.g. The proper adjusted cash balance per books (c) Prepare the adjusting journal entries necessary to determine the adjusted cash balance per books. (Round answers to 2 decimal places, e.g. 52.75. Creditaccount titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Date Debit Credit Jan. 31 (To record NSF check) Jan. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts