Question: Calculate 1) Amount Change and % change from Year 2000 to Year 2001 2) Current ratio, Acid Test Ratio, A/R turn-over, Avg collection period,

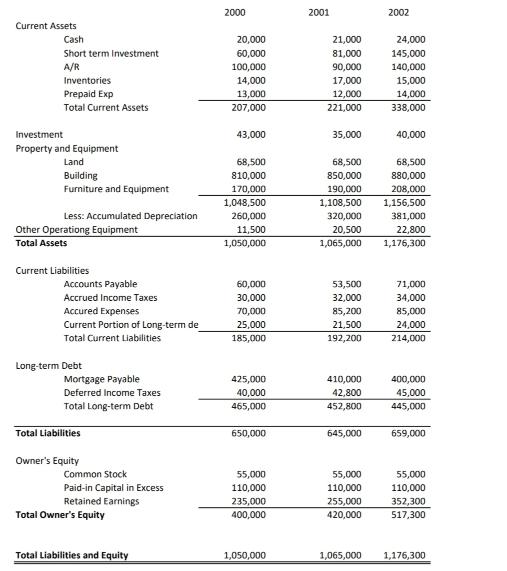

Calculate 1) Amount Change and % change from Year 2000 to Year 2001 2) Current ratio, Acid Test Ratio, A/R turn-over, Avg collection period, Solvency Ratio, profit ratio for Year2001) (Assume the 2002 Revenue 1,300,000, profit is 65,000) Operating Cash flow is 201,000. Current Assets Cash Short term Investment A/R Inventories Prepaid Exp Total Current Assets Investment Property and Equipment Land Building Furniture and Equipment Less: Accumulated Depreciation Other Operationg Equipment Total Assets Current Liabilities Accounts Payable Accrued Income Taxes Accured Expenses Current Portion of Long-term de Total Current Liabilities Long-term Debt Mortgage Payable Deferred Income Taxes Total Long-term Debt Total Liabilities Owner's Equity Common Stock Paid-in Capital in Excess Retained Earnings Total Owner's Equity Total Liabilities and Equity 2000 20,000 60,000 100,000 14,000 13,000 207,000 43,000 68,500 810,000 170,000 1,048,500 260,000 11,500 1,050,000 60,000 30,000 70,000 25,000 185,000 425,000 40,000 465,000 650,000 55,000 110,000 235,000 400,000 1,050,000 2001 21,000 81,000 90,000 17,000 12,000 221,000 35,000 68,500 850,000 190,000 1,108,500 320,000 20,500 1,065,000 53,500 32,000 85,200 21,500 192,200 410,000 42,800 452,800 645,000 55,000 110,000 255,000 420,000 2002 24,000 145,000 140,000 15,000 14,000 338,000 40,000 68,500 880,000 208,000 1,156,500 381,000 22,800 1,176,300 71,000 34,000 85,000 24,000 214,000 400,000 45,000 445,000 659,000 55,000 110,000 352,300 517,300 1,065,000 1,176,300

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Solution Here are the calculations for the description 1 Amount Change and change from Year ... View full answer

Get step-by-step solutions from verified subject matter experts