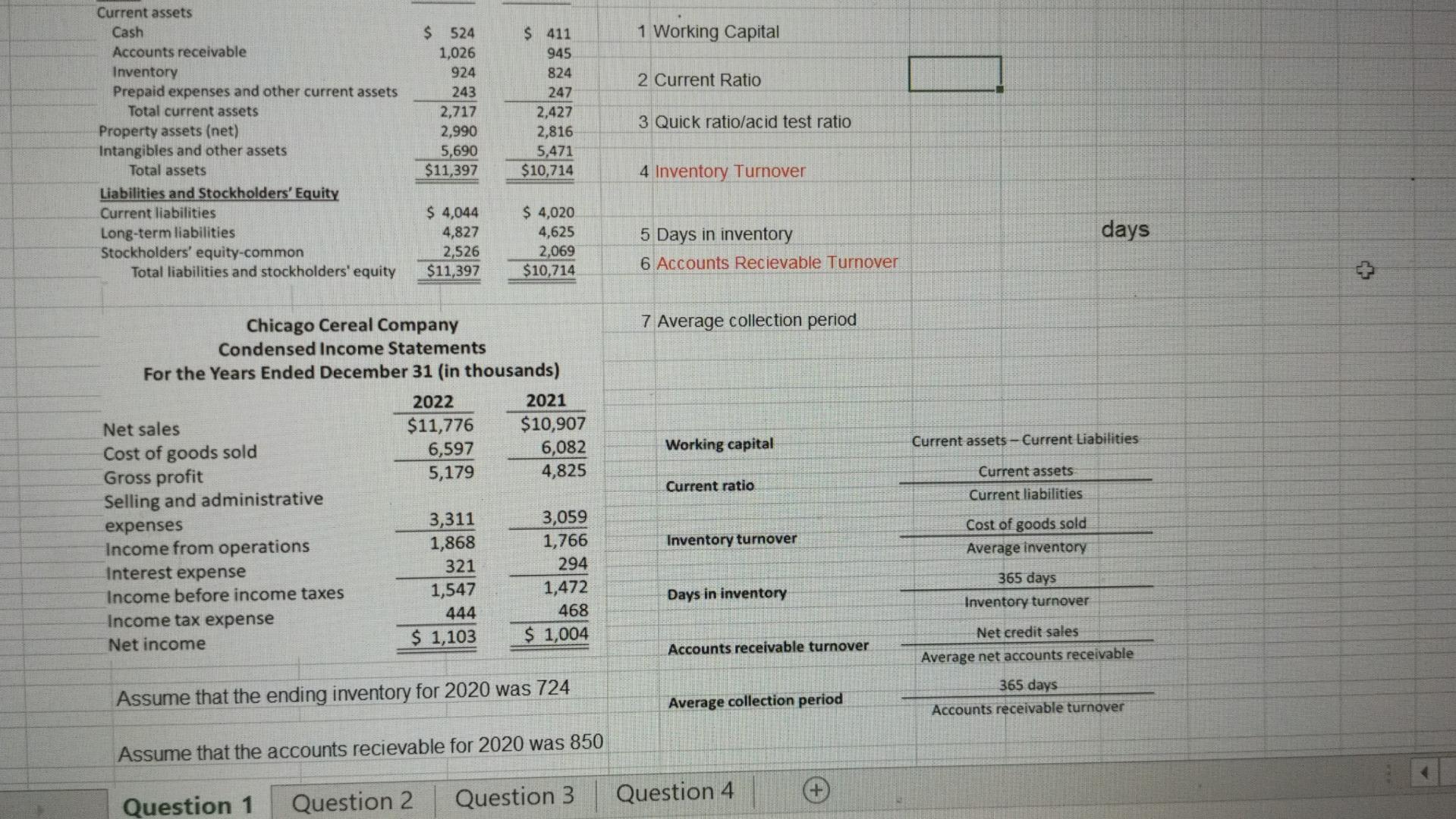

Question: Calculate 1 working capital 2 current ratio 3 quick ratio/ acid test ratio 4 inventory turnover 5 days in inventory 6 accounts receivable turnover 7

Calculate

1 working capital 2 current ratio 3 quick ratio/ acid test ratio 4 inventory turnover 5 days in inventory 6 accounts receivable turnover 7 average collection period

1 Working Capital 2 Current Ratio Current assets Cash Accounts receivable Inventory Prepaid expenses and other current assets Total current assets Property assets (net) Intangibles and other assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Stockholders' equity-common Total liabilities and stockholders' equity $ 524 1,026 924 243 2,717 2,990 5,690 $11,397 $ 411 945 824 247 2,427 2,816 5,471 $10,714 3 Quick ratio/acid test ratio 4 Inventory Turnover $ 4,044 4,827 2,526 $11,397 $ 4,020 4,625 2,069 $10,714 days 5 Days in inventory 6 Accounts Recievable Turnover 5 7 Average collection period Working capital Current assets - Current Liabilities Chicago Cereal Company Condensed Income Statements For the Years Ended December 31 (in thousands) 2022 2021 Net sales $11,776 $10,907 Cost of goods sold 6,597 6,082 Gross profit 5,179 4,825 Selling and administrative expenses 3,311 3,059 Income from operations 1,868 1,766 Interest expense 321 294 Income before income taxes 1,547 1,472 Income tax expense 444 468 Net income $ 1,103 $ 1,004 Current ratio Current assets Current liabilities Inventory turnover Cost of goods sold Average inventory Days in inventory 365 days Inventory turnover Accounts receivable turnover Net credit sales Average net accounts receivable Assume that the ending inventory for 2020 was 724 Average collection period 365 days Accounts receivable turnover Assume that the accounts recievable for 2020 was 850 Question 1 Question 2 Question 3 Question 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts