Question: Calculate A. Modify EBIT for cash flow purposes to equal pretax income + interest expense. Then set operating cash flow equal to modified EBIT

Calculate

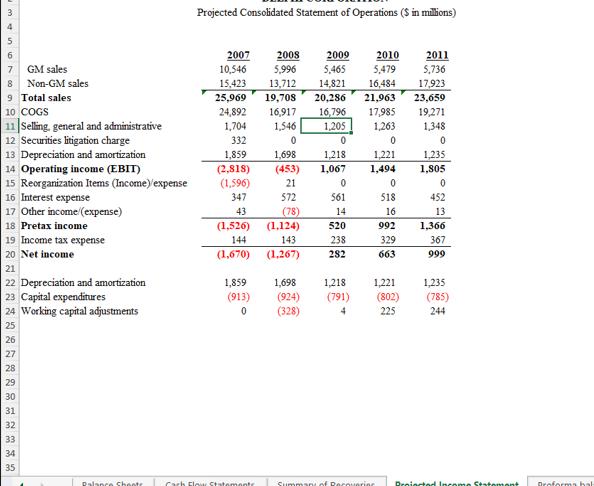

A. Modify EBIT for cash flow purposes to equal pretax income + interest expense. Then set operating cash flow equal to modified EBIT – unlevered taxes + depreciation & amortization.

a. Set unlevered taxes at income tax expense + corporate tax rate * interest expense.

b. Assume a 38% corporate tax rate.

B. Notice that the “working capital adjustments” are the opposite of the change in NWC and that “capital expenditures” are the opposite of capital expenditures—the signs on those numbers indicate the impact they should have on free cash flows.

C. For years after 2011, assume a 2% terminal growth rate in interest expense, pretax income, and depreciation

& amortization.

a. Set income tax expense for 2012 and beyond, however, at pretax income * corporate tax rate

b. Assume that for 2012 and onward, capital expenditure is 2% higher than the same year’s

depreciation and amortization.

c. Set the 2012 working capital adjustment at -10 with subsequent adjustments rising at 2%.

8 9 Total sales 10 COGS 11 Selling, general and administrative 12 Securities litigation charge 13 Depreciation and amortization 14 Operating income (EBIT) 15 Reorganization Items (Income)/expense 16 Interest expense 17 Other income/(expense) 18 Pretax income 19 20 22222222 21 23 22 Depreciation and amortization Capital expenditures 24 Working capital adjustments 25 26 27 28 GM sales Non-GM sales 29 30 31 32 Income tax expense Net income 33 34 35 Palance Sheets Projected Consolidated Statement of Operations ($ in millions) 2007 1,859 2008 10,546 5,996 5,465 15,423 13,712 14,821 25,969 24,892 1,704 332 1,859 (2,818) (1,596) 347 43 572 (78) (1.526) (1,124) 144 143 (1,670) (1,267) (913) 0 Cach Flow Statementr 2011 5,479 5,736 16,484 17,923 19,708 20,286 21,963 23,659 16,917 16,796 17,985 19,271 1,546 1,205 1,263 1,348 0 0 0 0 1,698 (453) 21 2009 1,698 (924) (328) 1,218 1,067 0 561 14 520 238 282 2010 1,221 1,494 Summary of Recovering 0 518 16 992 329 663 1,235 1,805 (802) 225 0 452 13 1,218 1,221 1,235 (791) (785) 4 244 1,366 367 999 Proiected Income Statement Broforma hab

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Answer Lets address each part of the question A Modify EBIT for Cash Flow Purposes Modified EBIT Pretax Income Interest Expense Calculate Unlevered Ta... View full answer

Get step-by-step solutions from verified subject matter experts