Question: Calculate a suitable overhead absorption rate for each department, using a basis that is deemed suitable. The following information relates to Zimbos Cc a manufacturing

Calculate a suitable overhead absorption rate for each department, using a basis that is deemed suitable.

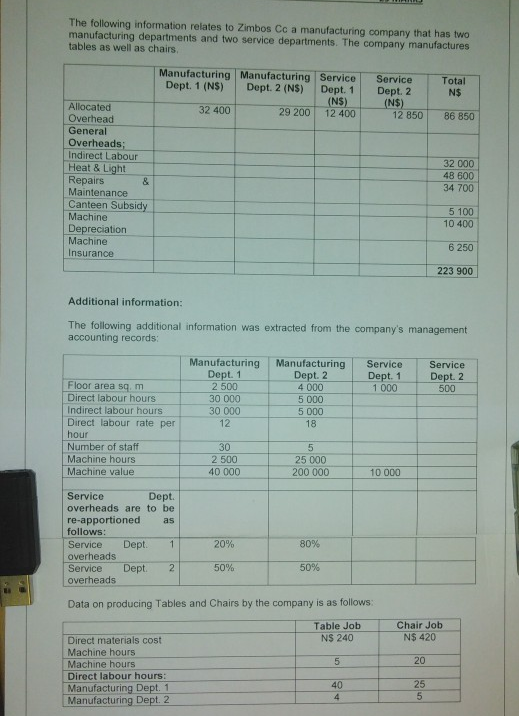

The following information relates to Zimbos Cc a manufacturing company that has two manufacturing departments and two service departments. The company manufactures tables as well as chairs Manufacturing Manufacturing Service Dept. 1 (NS) Dept. 2 (NS) Dept. 1 (NS) 32 400 29 200 12 400 Total N$ Service Dept. 2 (N$) 12 850 86 850 Allocated Overhead General Overheads; Indirect Labour Heat & Light Repairs & Maintenance Canteen Subsidy Machine Depreciation Machine Insurance 32 000 48 600 34 700 5 100 10 400 6 250 223 900 Additional information: The following additional information was extracted from the company's management accounting records Manufacturing Dept. 2 4 000 5 000 5 000 18 Manufacturing Dept. 1 2 500 30 000 30 000 12 Service Dept. 1 1 000 Service Dept. 2 500 Floor area sqm Direct labour hours Indirect labour hours Direct labour rate per hour Number of staff Machine hours Machine value 30 2 500 40 000 5 25 000 200 000 10 000 Service Dept. overheads are to be re-apportioned as follows: Service Dept. 1 overheads Service Dept 2 overheads 20% 80% 50% 50% Data on producing Tables and Chairs by the company is as follows: Table Job NS 240 Chair Job N$ 420 5 20 Direct materials cost Machine hours Machine hours Direct labour hours: Manufacturing Dept. 1 Manufacturing Dept. 2 40 4 25 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts