Question: Calculate bad debt expense for 2017 under the direct write-off method and the allowance method. Compute net income under both methods (assume a tax bracket

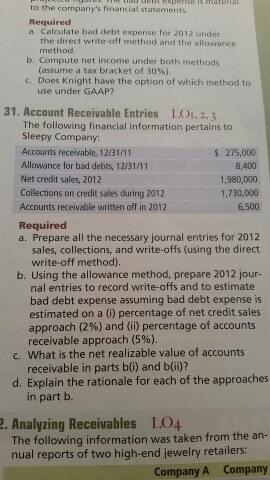

Calculate bad debt expense for 2017 under the direct write-off method and the allowance method. Compute net income under both methods (assume a tax bracket of 30%). Does Knight have the option of which method to use under GAAP? The following financial information pertains to Sleepy Company: Required Prepare all the necessary journal entries for 2012 sales, collections, and write-offs (using the direct write-off method). Using the allowance method, prepare 2012 journal entries to record write-offs and to estimate bad debt expense assuming bad debt expense is estimated on a percentage of net credit sales approach (2%) and percentage of accounts receivable approach (5%). What is the net realizable value of accounts receivable in parts b(i) and b(ii)? Explain the rationale for each of the approaches in part b. The following information was taken from the annual reports of two high-end jewelry retailers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts