Question: Calculate cash flow from assets using operating cash flow, net capital spending, additions to net working capital (NWC), and the dividend payment in 2019. As

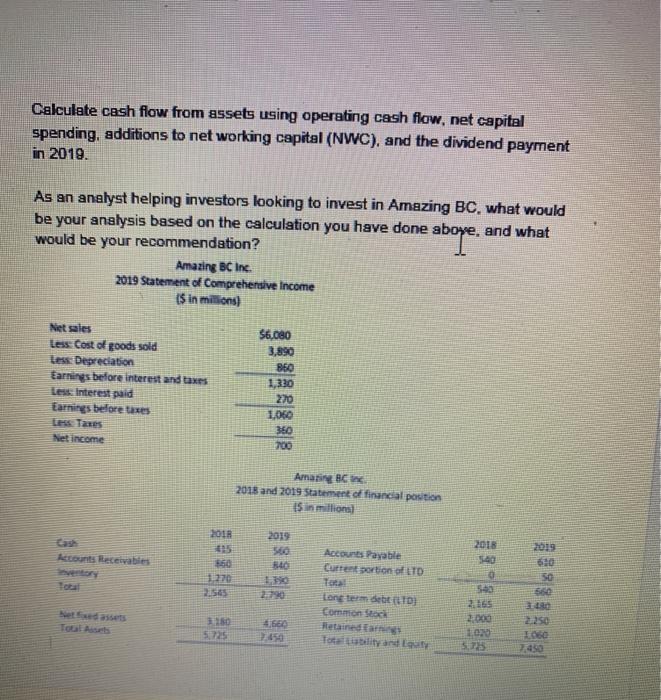

Calculate cash flow from assets using operating cash flow, net capital spending, additions to net working capital (NWC), and the dividend payment in 2019. As an analyst helping investors looking to invest in Amazing BC. what would be your analysis based on the calculation you have done above, and what would be your recommendation? Amazing BC Inc. 2019 Statement of Comprehensive Income $ in millions) aboye 56,080 3.890 360 Net sales Less Cost of goods sold Less Depreciation Earnings before interest and taxes Lesse Interest paid Earnings before taxes Less Taxes Set income 20 1.060 380 700 Amating Bing 2015 and 2019 Statement of financial position in millions 2018 2018 Accounts Receivables 50 1270 4 Accounts Payable Current portion of LTD Total Long term detto) Common Stock 610 50 550 560 2790 2250 5725 4.660 450 Tot Libility and at 2.000 10 5.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts