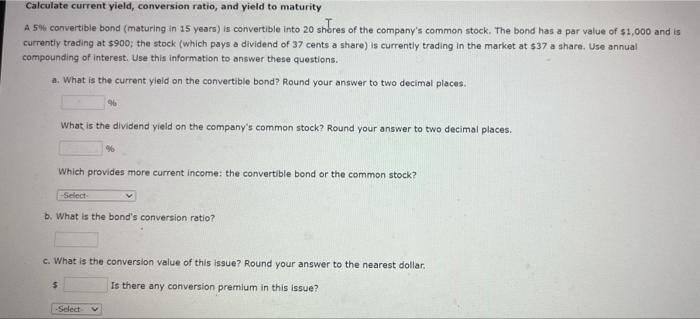

Question: Calculate current yield, conversion ratio, and yield to maturity A5% convertible bond (maturing in 15 years) in convertible into 20 shores of the company's common

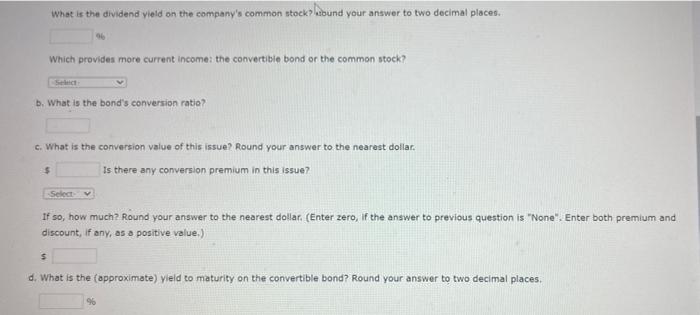

Calculate current yield, conversion ratio, and yield to maturity A5% convertible bond (maturing in 15 years) in convertible into 20 shores of the company's common stock. The bond has a par value of $1,000 and is currently trading at $900; the stock (which pays a dividend of 37 cents a share) is currently trading in the market at $37 a share. Use annual compounding of interest. Use this information to answer these questions. a. What is the current yield on the convertible bond? Round your answer to two decimal places. 96 What is the dividend yield on the company's common stock? Round your answer to two decimal places. 96 Which provides more current income the convertible bond or the common stock? Select b. What is the band's conversion ratio? c. What is the conversion value of this issue? Round your answer to the nearest dollar 5 Is there any conversion premium in this issue? Select V What is the dividend yield on the company's common stock bund your answer to two decimal places. which provides more current income the convertible bond or the common stock? b. What is the bond's conversion ratio? c. What is the conversion value of this issue? Round your answer to the nearest dollar. Is there any conversion premium in this issue? $ Select v If so, how much? Round your answer to the nearest dollar. (Enter zero, if the answer to previous question is "None Enter both premium and discount, if any, as a positive value.) $ d. What is the approximate) yleld to maturity on the convertible bond? Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts