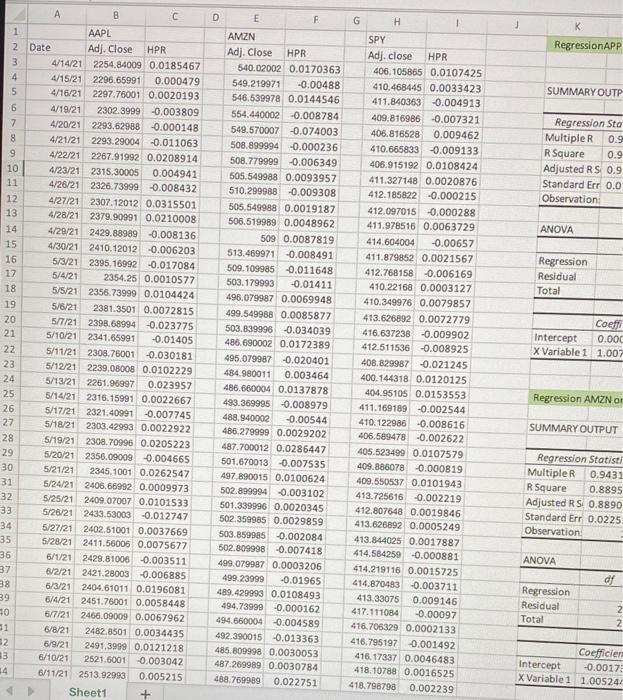

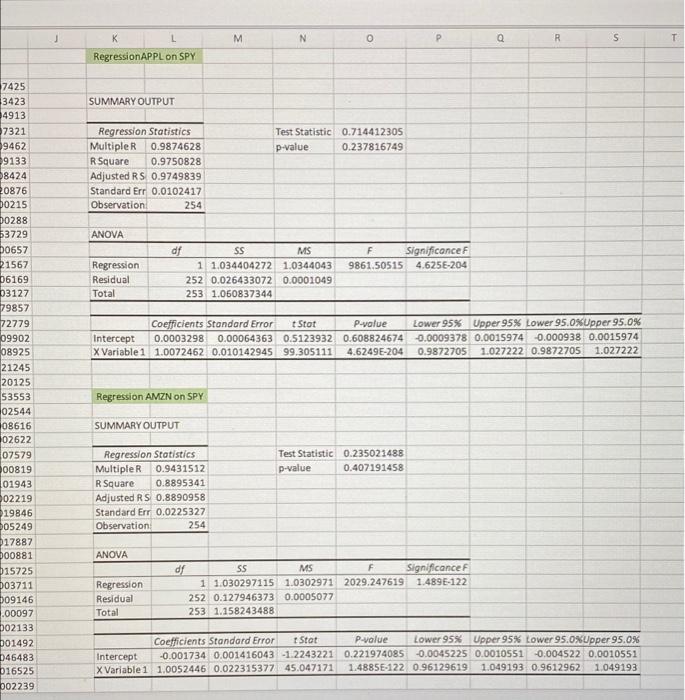

Question: Calculate downside beta for each stock a. What does the downside beta mean? b. Is the downside beta significantly less than one (or significantly greater

G RegressionAPP HPR Nm 00 SUMMARY OUTP Regression Sta Multiple R 0.9 R Square 0.9 Adjusted RS 0.9 Standard Err 0.0 Observation ANOVA 00 at Regression Residual Total A B 1 AAPL 2 Date Adj. Close HPR 4/14/21 2254.84009 0.0185467 4/15/21 2296.65991 0.000479 4/16/21 2297.76001 0.0020193 4/19/21 2302.3999 0.003809 7 4/20/21 2293.62988 -0.000148 8 4/21/21 2293 29004 -0.011063 9 4/22/21 2267.91992 0.0208914 10 4/23/21 2315.30005 0.004941 11 4/26/21 2326.73999 -0.008432 12 4/27/21 2307.12012 0.0315501 13 4/28/21 2379.90991 0.0210008 14 4/29/21 2429.88989 -0.008136 15 4/30/21 2410.12012 -0.006203 16 5/3/21 2395.16992 -0.017084 17 5/4/21 2354.25 0.0010577 18 5/5/21 2356.73999 0.0104424 19 5/6/21 2381.3501 0.0072815 20 5/7/21 2398.68994 -0.023775 21 5/10/21 2341.65991 -0.01405 22 5/11/21 2308.76001 -0.030181 23 5/12/21 2239.08008 0.0102229 24 5/13/21 2261.96997 0.023957 25 5/14/21 2316.15991 0.0022667 26 5/17/21 2321.40991 0.007745 27 5/18/21 2303.42993 0.0022922 28 5/19/21 2308.70996 0.0205223 29 5/20/21 2356.09009 0.004665 30 5/21/21 2345. 1001 0.0262547 31 5/24/21 2406.66992 0.0009973 32 5/25/21 2409.07007 0.0101533 33 5/26/21 2433.53003 -0.012747 34 5/27/21 2402.51001 0.0037669 35 5/28/21 2411.56006 0.0075677 36 6/1/21 2429,81006 -0.003511 37 6/2/21 2421.28003 -0.006885 88 6/3/21 2404.61011 0.0196081 39 6/4/21 2451.76001 0.0058448 90 6/7/21 2466.09009 0.0067962 11 6/8/21 2482.8501 0.0034435 2 6/9/21 2491,3999 0.0121218 3 6/10/21 2521.6001 -0.003042 14 6/11/21 2513.92993 0.005215 Sheet1 D E F AMZN Adj. Close HPR 540.02002 0.0170363 549.219971 -0.00488 546.539978 0.0144546 554.440002 -0.008784 549.570007 -0.074003 508.899994 -0.000236 508.779999 -0.006349 505.549988 0.0093957 510,299988 -0.009308 505.549988 0.0019187 506.519989 0.0048962 509 0.0087819 513.469971 -0.008491 509. 109985 -0.011648 503.179993 -0.01411 496.079987 0.0069948 499.549968 0.0085877 503.839996 -0.034039 486.690002 0.0172389 495.079987 -0.020401 484.980011 0.003464 486.660004 0.0137878 493.369995 -0.008979 488.940002 -0.00544 486.279999 0.0029202 487.700012 0.0286447 501.670013 -0.007535 497.890015 0.0100624 502.899994 -0.003102 501.339996 0.0020345 502.359985 0.0029859 503.859985 -0.002084 502.809998 -0.007418 499.079987 0.0003206 499.23999 -0.01965 489.429993 0.0108493 494.73999 -0.000162 494.660004 0.004589 492.390015 -0.013363 485.809998 0.0030053 487.269989 0.0030784 488.769989 0.022751 H 1 SPY Adj. close 406.105865 0.0107425 410.468445 0.0033423 411.840363 -0.004913 409.816986 -0.007321 406.816528 0.009462 410.665833 -0.009133 406.915192 0.0108424 411.327148 0.0020876 412.185822 -0.000215 412.097015 -0.000288 411.978516 0.0063729 414.604004 -0.00657 411.879852 0.0021567 412.768158 -0.006169 410.22168 0.0003127 410.349976 0.0079857 413.626892 0.0072779 416.637238 -0.009902 412.511536 -0.008925 408.829987 -0.021245 400.144318 0.0120125 404.95105 0.0153553 411.169189 -0.002544 410.122986 -0.008616 406.589478 -0.002622 405.523499 0.0107579 409.886078 0.000819 409,550537 0.0101943 413.725616 -0.002219 412.807648 0.0019846 413.626892 0.0005249 413.844025 0.0017887 414.584259 -0.000881 414.219116 0.0015725 414.870483 -0.003711 413.33075 0.009146 417.111084 -0.00097 416.706329 0.0002133 416.795197 -0.001492 416.17337 0.0046483 418.10788 0.0016525 418.798798 0.002239 Coeffi Intercept 0.000 X Variable 1 1.007 Regression AMZN or SUMMARY OUTPUT Regression Statist/ Multiple R 0.9431 R Square 0.8895 Adjusted RS 0.8890 Standard Err 0.0225 Observation ANOVA Regression Residual Total 2 2 Coefficier Intercept -0.0017 X Variable 1 1.00524 K L M N o Q R S Regression APPLON SPY SUMMARY OUTPUT Test Statistic 0.714412305 p-value 0.237816749 Regression Statistics Multiple 0.9874628 R Square 0.9750828 Adjusted RS 0.9749839 Standard Err 0.0102417 Observation 254 ANOVA F Significance 9861.50515 4.6256-204 Regression Residual Total df SS MS 1 1.034404272 1.0344043 252 0.026433072 0.0001049 253 1.060837344 Coefficients Standard Error t Stot P-value Lower 95% Upper 95% Lower 95.0%Upper 95.0% Intercept 0.0003298 0.00064363 0.5123932 0.608824674 -0.0009378 0.0015974 -0.000938 0.0015974 X Variable 1 1.0072462 0.010142945 99.305111 4.6249E-204 0.9872705 1.027222 0.9872705 1.027222 7425 3423 4913 7321 09462 9133 8424 20876 00215 00288 53729 00657 21567 06169 03127 79857 72779 09902 08925 21245 20125 53553 02544 08616 02622 07579 00819 01943 02219 19846 D05249 017887 000881 b15725 D03711 09146 .00097 D02133 001492 046483 016525 002239 Regression AMZN ON SPY SUMMARY OUTPUT Test Statistic 0.235021488 p-value 0.407191458 Regression Statistics MultipleR0.9431512 R Square 0.8895341 Adjusted RS 0.8890958 Standard Err 0.0225327 Observation 254 ANOVA Regression Residual Total df SS MS F Significance 1 1.030297115 1.0302971 2029.247619 1.489E-122 252 0.127946373 0.0005077 253 1.158243488 Coefficients Standard Error Stot P-value Lower 95% Upper 95% Lower 95.0%Upper 95.0% Intercept -0.001734 0.001416043 -1.2243221 0.221974085 -0.0045225 0.0010551 0.004522 0.0010551 X Variable 1 1.0052446 0.022315377 45.047171 1.4885E-122 0.96129619 1.049193 0.9612962 1.049193 G RegressionAPP HPR Nm 00 SUMMARY OUTP Regression Sta Multiple R 0.9 R Square 0.9 Adjusted RS 0.9 Standard Err 0.0 Observation ANOVA 00 at Regression Residual Total A B 1 AAPL 2 Date Adj. Close HPR 4/14/21 2254.84009 0.0185467 4/15/21 2296.65991 0.000479 4/16/21 2297.76001 0.0020193 4/19/21 2302.3999 0.003809 7 4/20/21 2293.62988 -0.000148 8 4/21/21 2293 29004 -0.011063 9 4/22/21 2267.91992 0.0208914 10 4/23/21 2315.30005 0.004941 11 4/26/21 2326.73999 -0.008432 12 4/27/21 2307.12012 0.0315501 13 4/28/21 2379.90991 0.0210008 14 4/29/21 2429.88989 -0.008136 15 4/30/21 2410.12012 -0.006203 16 5/3/21 2395.16992 -0.017084 17 5/4/21 2354.25 0.0010577 18 5/5/21 2356.73999 0.0104424 19 5/6/21 2381.3501 0.0072815 20 5/7/21 2398.68994 -0.023775 21 5/10/21 2341.65991 -0.01405 22 5/11/21 2308.76001 -0.030181 23 5/12/21 2239.08008 0.0102229 24 5/13/21 2261.96997 0.023957 25 5/14/21 2316.15991 0.0022667 26 5/17/21 2321.40991 0.007745 27 5/18/21 2303.42993 0.0022922 28 5/19/21 2308.70996 0.0205223 29 5/20/21 2356.09009 0.004665 30 5/21/21 2345. 1001 0.0262547 31 5/24/21 2406.66992 0.0009973 32 5/25/21 2409.07007 0.0101533 33 5/26/21 2433.53003 -0.012747 34 5/27/21 2402.51001 0.0037669 35 5/28/21 2411.56006 0.0075677 36 6/1/21 2429,81006 -0.003511 37 6/2/21 2421.28003 -0.006885 88 6/3/21 2404.61011 0.0196081 39 6/4/21 2451.76001 0.0058448 90 6/7/21 2466.09009 0.0067962 11 6/8/21 2482.8501 0.0034435 2 6/9/21 2491,3999 0.0121218 3 6/10/21 2521.6001 -0.003042 14 6/11/21 2513.92993 0.005215 Sheet1 D E F AMZN Adj. Close HPR 540.02002 0.0170363 549.219971 -0.00488 546.539978 0.0144546 554.440002 -0.008784 549.570007 -0.074003 508.899994 -0.000236 508.779999 -0.006349 505.549988 0.0093957 510,299988 -0.009308 505.549988 0.0019187 506.519989 0.0048962 509 0.0087819 513.469971 -0.008491 509. 109985 -0.011648 503.179993 -0.01411 496.079987 0.0069948 499.549968 0.0085877 503.839996 -0.034039 486.690002 0.0172389 495.079987 -0.020401 484.980011 0.003464 486.660004 0.0137878 493.369995 -0.008979 488.940002 -0.00544 486.279999 0.0029202 487.700012 0.0286447 501.670013 -0.007535 497.890015 0.0100624 502.899994 -0.003102 501.339996 0.0020345 502.359985 0.0029859 503.859985 -0.002084 502.809998 -0.007418 499.079987 0.0003206 499.23999 -0.01965 489.429993 0.0108493 494.73999 -0.000162 494.660004 0.004589 492.390015 -0.013363 485.809998 0.0030053 487.269989 0.0030784 488.769989 0.022751 H 1 SPY Adj. close 406.105865 0.0107425 410.468445 0.0033423 411.840363 -0.004913 409.816986 -0.007321 406.816528 0.009462 410.665833 -0.009133 406.915192 0.0108424 411.327148 0.0020876 412.185822 -0.000215 412.097015 -0.000288 411.978516 0.0063729 414.604004 -0.00657 411.879852 0.0021567 412.768158 -0.006169 410.22168 0.0003127 410.349976 0.0079857 413.626892 0.0072779 416.637238 -0.009902 412.511536 -0.008925 408.829987 -0.021245 400.144318 0.0120125 404.95105 0.0153553 411.169189 -0.002544 410.122986 -0.008616 406.589478 -0.002622 405.523499 0.0107579 409.886078 0.000819 409,550537 0.0101943 413.725616 -0.002219 412.807648 0.0019846 413.626892 0.0005249 413.844025 0.0017887 414.584259 -0.000881 414.219116 0.0015725 414.870483 -0.003711 413.33075 0.009146 417.111084 -0.00097 416.706329 0.0002133 416.795197 -0.001492 416.17337 0.0046483 418.10788 0.0016525 418.798798 0.002239 Coeffi Intercept 0.000 X Variable 1 1.007 Regression AMZN or SUMMARY OUTPUT Regression Statist/ Multiple R 0.9431 R Square 0.8895 Adjusted RS 0.8890 Standard Err 0.0225 Observation ANOVA Regression Residual Total 2 2 Coefficier Intercept -0.0017 X Variable 1 1.00524 K L M N o Q R S Regression APPLON SPY SUMMARY OUTPUT Test Statistic 0.714412305 p-value 0.237816749 Regression Statistics Multiple 0.9874628 R Square 0.9750828 Adjusted RS 0.9749839 Standard Err 0.0102417 Observation 254 ANOVA F Significance 9861.50515 4.6256-204 Regression Residual Total df SS MS 1 1.034404272 1.0344043 252 0.026433072 0.0001049 253 1.060837344 Coefficients Standard Error t Stot P-value Lower 95% Upper 95% Lower 95.0%Upper 95.0% Intercept 0.0003298 0.00064363 0.5123932 0.608824674 -0.0009378 0.0015974 -0.000938 0.0015974 X Variable 1 1.0072462 0.010142945 99.305111 4.6249E-204 0.9872705 1.027222 0.9872705 1.027222 7425 3423 4913 7321 09462 9133 8424 20876 00215 00288 53729 00657 21567 06169 03127 79857 72779 09902 08925 21245 20125 53553 02544 08616 02622 07579 00819 01943 02219 19846 D05249 017887 000881 b15725 D03711 09146 .00097 D02133 001492 046483 016525 002239 Regression AMZN ON SPY SUMMARY OUTPUT Test Statistic 0.235021488 p-value 0.407191458 Regression Statistics MultipleR0.9431512 R Square 0.8895341 Adjusted RS 0.8890958 Standard Err 0.0225327 Observation 254 ANOVA Regression Residual Total df SS MS F Significance 1 1.030297115 1.0302971 2029.247619 1.489E-122 252 0.127946373 0.0005077 253 1.158243488 Coefficients Standard Error Stot P-value Lower 95% Upper 95% Lower 95.0%Upper 95.0% Intercept -0.001734 0.001416043 -1.2243221 0.221974085 -0.0045225 0.0010551 0.004522 0.0010551 X Variable 1 1.0052446 0.022315377 45.047171 1.4885E-122 0.96129619 1.049193 0.9612962 1.049193

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts