Question: Calculate each employee's payroll but using data information below. SHOW ALL CALCULATIONS CPP 5.45% EI 1.58% Facts: Employee 1 - Sakura Tanaka (Sales and Marketing)

Calculate each employee's payroll but using data information below. SHOW ALL CALCULATIONS

CPP 5.45% EI 1.58%

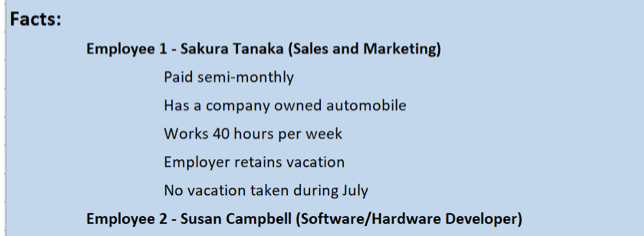

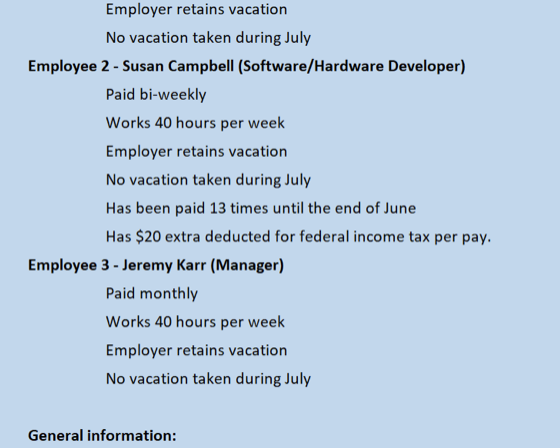

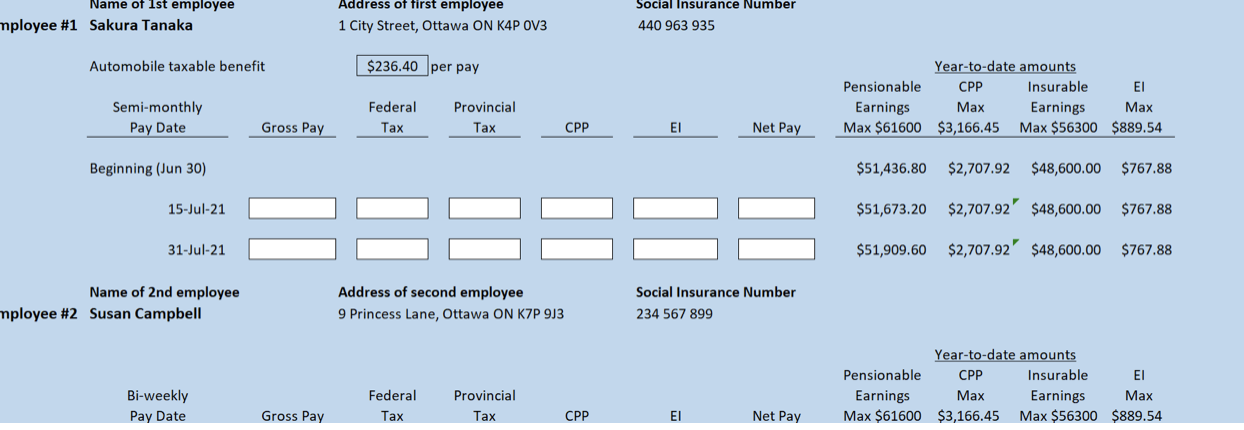

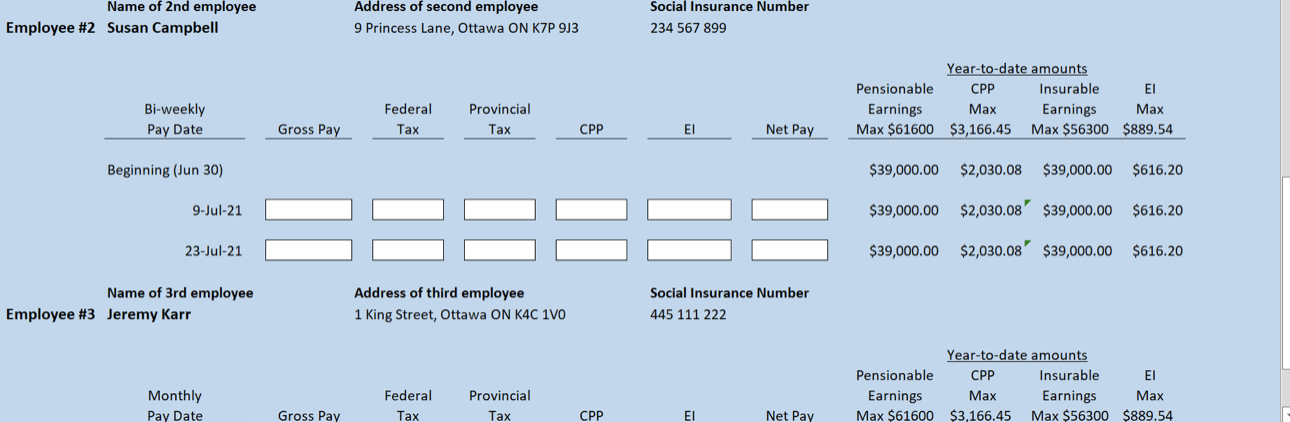

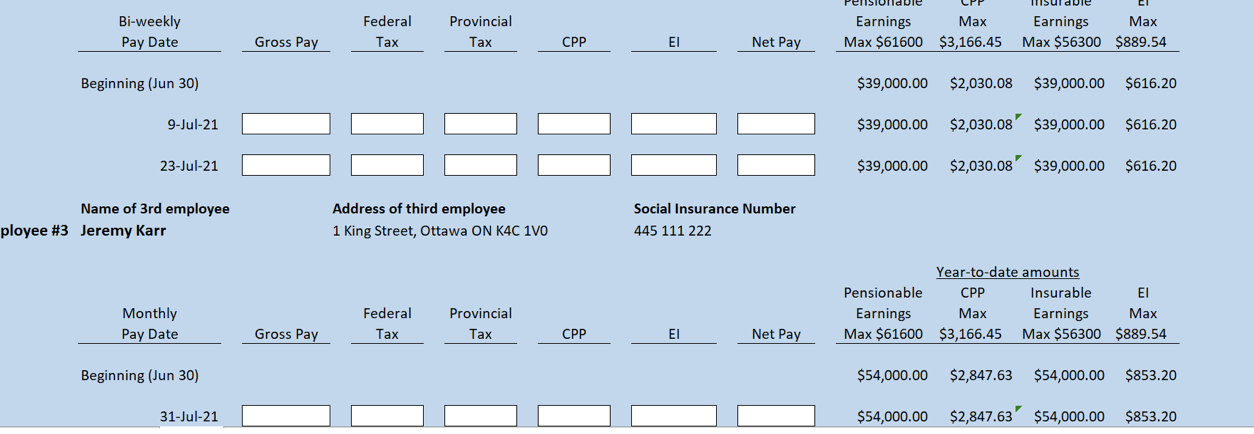

Facts: Employee 1 - Sakura Tanaka (Sales and Marketing) Paid semi-monthly Has a company owned automobile Works 40 hours per week Employer retains vacation No vacation taken during July Employee 2 - Susan Campbell (Software/Hardware Developer) Employer retains vacation No vacation taken during July Employee 2 - Susan Campbell (Software/Hardware Developer) Paid bi-weekly Works 40 hours per week Employer retains vacation No vacation taken during July Has been paid 13 times until the end of June Has $20 extra deducted for federal income tax per pay. Employee 3 - Jeremy Karr (Manager) Paid monthly Works 40 hours per week Employer retains vacation No vacation taken during July General information: Name of Ist employee mployee #1 Sakura Tanaka Address of first employee 1 City Street, Ottawa ON K4P OV3 Social Insurance Number 440 963 935 Automobile taxable benefit $236.40 per pay Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Semi-monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Beginning (Jun 30) $51,436.80 $2,707.92 $48,600.00 $767.88 15-Jul-21 $51,673.20 $2,707.92' $48,600.00 $767.88 31-Jul-21 $51,909.60 $2,707.92' $48,600.00 $767.88 Name of 2nd employee mployee #2 Susan Campbell Address of second employee 9 Princess Lane, Ottawa ON K7P 933 Social Insurance Number 234 567 899 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Bi-weekly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Name of 2nd employee Employee #2 Susan Campbell Address of second employee 9 Princess Lane, Ottawa ON KZP 933 Social Insurance Number 234 567 899 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Bi-weekly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Beginning (Jun 30) $39,000.00 $2,030.08 $39,000.00 $616.20 9-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 BE 23-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 Name of 3rd employee Employee #3 Jeremy Karr Address of third employee 1 King Street, Ottawa ON K4C 1V0 Social Insurance Number 445 111 222 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Bi-weekly Pay Date Federal Tax Provincial Tax Earnings Max Max $61600 $3,166.45 Earnings Max Max $56300 $889.54 Gross Pay CPP Net Pay Beginning (Jun 30) $39,000.00 $2,030.08 $39,000.00 $616.20 9-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 23-Jul-21 $39,000.00 $2,030.08 $39,000.00 $616.20 Name of 3rd employee ployee #3 Jeremy Karr Address of third employee 1 King Street, Ottawa ON K4C 1VO Social Insurance Number 445 111 222 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max $61600 $3,166.45 Max $56300 $889.54 Max Monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP EI Net Pay Beginning (Jun 30) $54,000.00 $2,847.63 $54,000.00 $853.20 31-Jul-21 $54,000.00 $2,847.63' $54,000.00 $853.20 Facts: Employee 1 - Sakura Tanaka (Sales and Marketing) Paid semi-monthly Has a company owned automobile Works 40 hours per week Employer retains vacation No vacation taken during July Employee 2 - Susan Campbell (Software/Hardware Developer) Employer retains vacation No vacation taken during July Employee 2 - Susan Campbell (Software/Hardware Developer) Paid bi-weekly Works 40 hours per week Employer retains vacation No vacation taken during July Has been paid 13 times until the end of June Has $20 extra deducted for federal income tax per pay. Employee 3 - Jeremy Karr (Manager) Paid monthly Works 40 hours per week Employer retains vacation No vacation taken during July General information: Name of Ist employee mployee #1 Sakura Tanaka Address of first employee 1 City Street, Ottawa ON K4P OV3 Social Insurance Number 440 963 935 Automobile taxable benefit $236.40 per pay Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Semi-monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Beginning (Jun 30) $51,436.80 $2,707.92 $48,600.00 $767.88 15-Jul-21 $51,673.20 $2,707.92' $48,600.00 $767.88 31-Jul-21 $51,909.60 $2,707.92' $48,600.00 $767.88 Name of 2nd employee mployee #2 Susan Campbell Address of second employee 9 Princess Lane, Ottawa ON K7P 933 Social Insurance Number 234 567 899 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Bi-weekly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Name of 2nd employee Employee #2 Susan Campbell Address of second employee 9 Princess Lane, Ottawa ON KZP 933 Social Insurance Number 234 567 899 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Bi-weekly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Beginning (Jun 30) $39,000.00 $2,030.08 $39,000.00 $616.20 9-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 BE 23-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 Name of 3rd employee Employee #3 Jeremy Karr Address of third employee 1 King Street, Ottawa ON K4C 1V0 Social Insurance Number 445 111 222 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max Max $61600 $3,166.45 Max $56300 $889.54 Monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP Net Pay Bi-weekly Pay Date Federal Tax Provincial Tax Earnings Max Max $61600 $3,166.45 Earnings Max Max $56300 $889.54 Gross Pay CPP Net Pay Beginning (Jun 30) $39,000.00 $2,030.08 $39,000.00 $616.20 9-Jul-21 $39,000.00 $2,030.08' $39,000.00 $616.20 23-Jul-21 $39,000.00 $2,030.08 $39,000.00 $616.20 Name of 3rd employee ployee #3 Jeremy Karr Address of third employee 1 King Street, Ottawa ON K4C 1VO Social Insurance Number 445 111 222 Year-to-date amounts Pensionable CPP Insurable Earnings Max Earnings Max $61600 $3,166.45 Max $56300 $889.54 Max Monthly Pay Date Federal Tax Provincial Tax Gross Pay CPP EI Net Pay Beginning (Jun 30) $54,000.00 $2,847.63 $54,000.00 $853.20 31-Jul-21 $54,000.00 $2,847.63' $54,000.00 $853.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts