Question: Calculate Equivalent Units, Unit Costs, and Transferred CostsWeighted Average Method Godfrey Manufacturing, Inc., operates a plant that produces its own regionally-marketed Spicy Steak Sauce. The

Calculate Equivalent Units, Unit Costs, and Transferred CostsWeighted Average Method

Godfrey Manufacturing, Inc., operates a plant that produces its own regionally-marketed Spicy Steak Sauce. The sauce is produced in two processes, blending and bottling. In the Blending Department, all materials are added at the start of the process, and labor and overhead are incurred evenly throughout the process. Godfrey uses the weighted average method. The following data from the Work in ProcessBlending Department account for January 2016 is missing a few items:

Work in Process-Blending DepartmentJanuary 1 inventory (5,000 gallons, 60% processed)

Direct material$24,000

Conversion costs11,800

Transferred to Bottling Department (60,000 gallons)

January charges:

Direct material (61,000 gallons) 305,000

Direct labor 147,200

Manufacturing overhead 97,600

January 31 inventory [ ? gallons, 70% processed]

Required

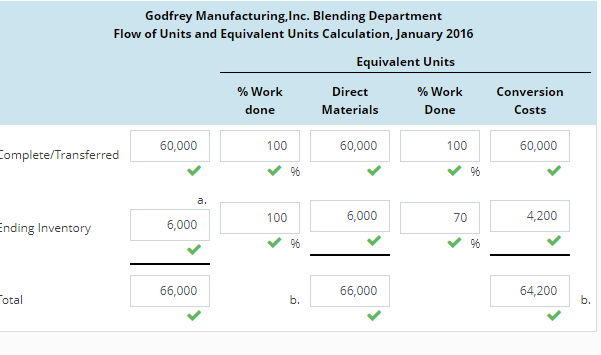

Assuming Godfrey uses the weighted average method in process costing, calculate the following amounts for the Blending Department:

- Number of units in the January 31 inventory.

- Equivalent units for materials and conversion costs.

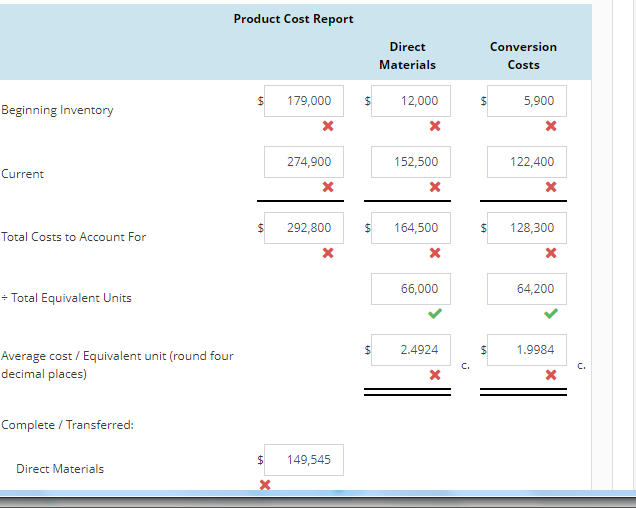

- January cost per equivalent unit for materials and conversion costs.

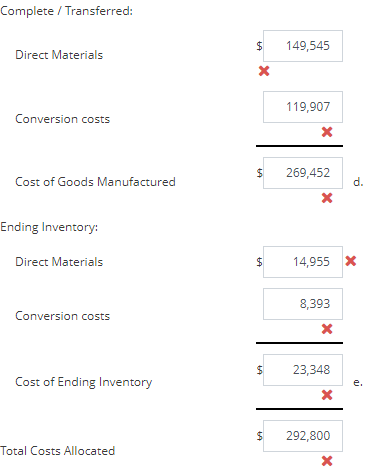

- Cost of the units transferred to the Bottling Department.

- Cost of the incomplete units in the January 31 inventory.

Round average cost per equivalent unit to four decimal places. Use rounded answers for subsequent calculations. Round other answers to the nearest whole number.

Godfrey Manufacturing,Inc. Blending Department Flow of Units and Equivalent Units Calculation, January 2016 Equivalent Units % Work % Work Direct Materials Conversion cone Done Costs 60,000 100 60,000 100 60,000 omplete/Transferred 100 6,000 70 4,200 nding Inventory 6,000 66,000 66,000 64,200 otal b. b. Product Cost Report Direct Materials Conversion Costs $179,000 12,000 5,900 eginning nventory 274,900 152,500 122,400 Current $292,800 164,500 128,300 Total Costs to Account For 66,000 64,200 Total Equivalent Units 2.4924 1.9984 Average cost/Equivalent unit (round four decimal places) C. C. Complete /Transferred 149,545 Direct Materials Complete Transferred: 149,545 Direct Materials 19,907 Lonversion costS 269,452 Cost of Goods Manufactured d. Ending Inventory: Direct Materials 14,955 x 8,393 Lonversion costS 23 Cost of Ending Inventory e. 292,800 Total Costs Allocated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts