Question: Calculate Expected NPV for minimum ROR 10% on buying and drilling an oil lease with these estimated costs: The lease costs 150,000 dollars at time

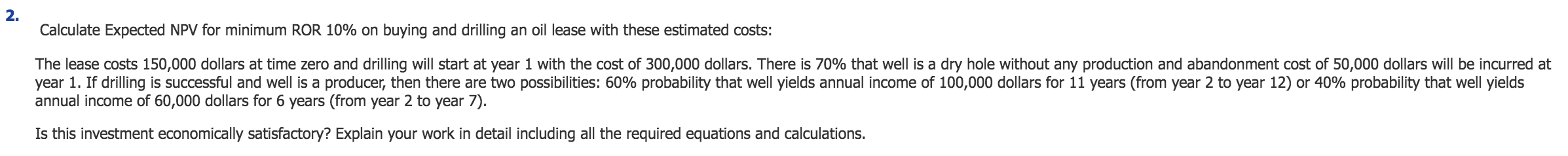

Calculate Expected NPV for minimum ROR 10% on buying and drilling an oil lease with these estimated costs: The lease costs 150,000 dollars at time zero and drilling will start at year 1 with the cost of 300,000 dollars. There is 70% that well is a dry hole without any production and abandonment cost of 50,000 dollars will be incurred at year 1. If drilling is successful and well is a producer, then there are two possibilities: 60% probability that well yields annual income of 100,000 dollars for 11 years (from year 2 to year 12) or 40% probability that well yields annual income of 60,000 dollars for 6 years (from year 2 to year 7). Is this investment economically satisfactory? Explain your work in detail including all the required equations and calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts