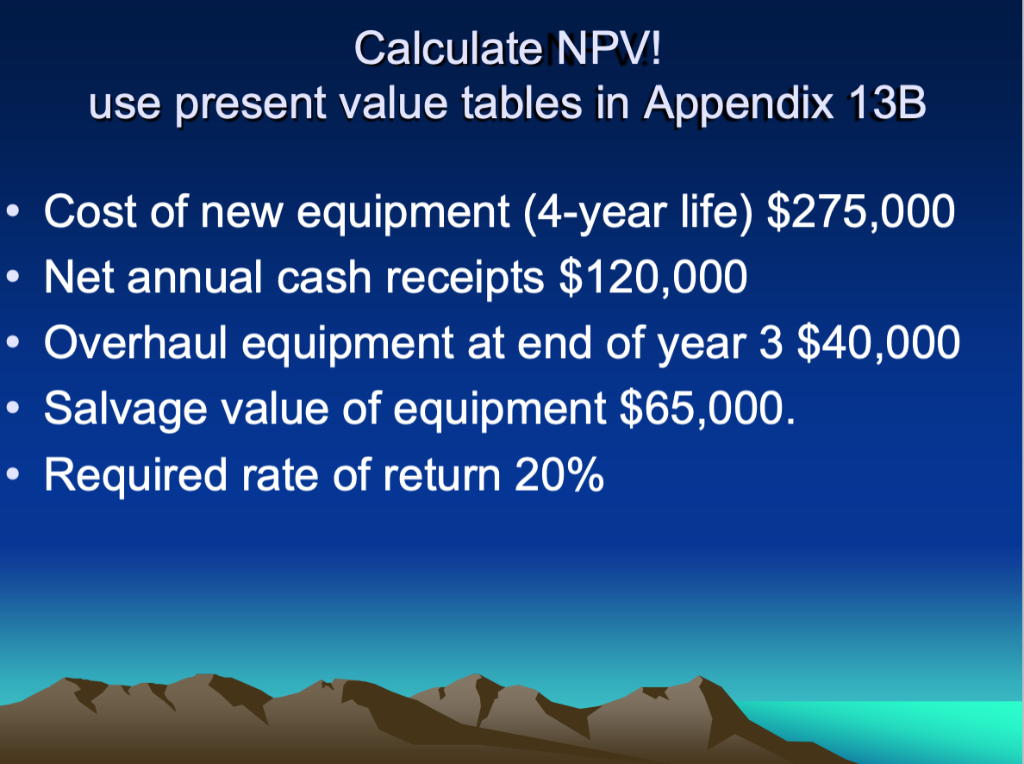

Question: Calculate NPV! use present value tables in Appendix 13B Cost of new equipment (4-year life) $275,000 Net annual cash receipts $120,000 Overhaul equipment at end

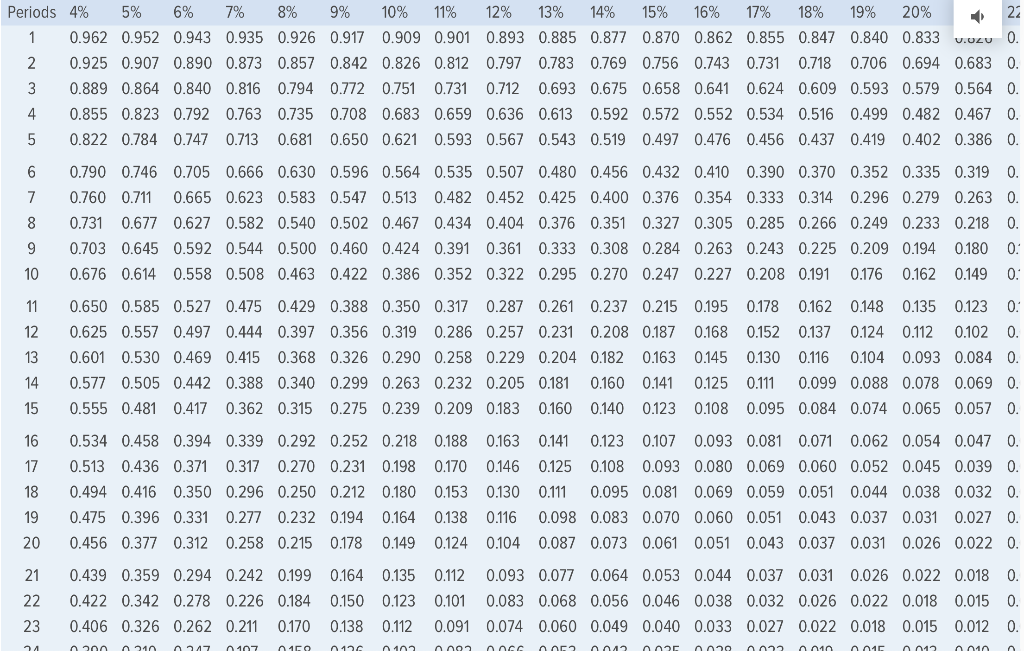

Calculate NPV! use present value tables in Appendix 13B Cost of new equipment (4-year life) $275,000 Net annual cash receipts $120,000 Overhaul equipment at end of year 3 $40,000 Salvage value of equipment $65,000. Required rate of return 20% 1 9 | Periods 4% 5% 6% 7% 8% 9% 10% 1% 12% 13% 14% 5% 16% 7% 18% 19% 20% | 22 10.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 v.dzy 0. 2 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.31 0.718 0.706 0.694 0.683 0. 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0. 10.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0. 10.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0. 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0. 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.263 0. 8 10.31 0.67 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0. | 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0. 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0. 10.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0. 2 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.28 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0. 10.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0. 10.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0160 0.141 0.125 011 0.099 0.088 0.078 0.069 0. | 0.555 0.481 0.47 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0. | 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0. 10.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0. 18 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.11 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0. 10.475 0.396 0.331 0.277 0.232 0194 0.164 0.138 016 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0. 0.456 0.377 0.312 0.258 0.25 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0. 0.439 0.359 0.294 0.242 0.199 0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0. | 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0. 23 0.406 0.326 0.262 0.211 0.170 0.138 0.112 0.091 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0. nnnnnnnnnnnnnnnnnnnnce nnnnnnnnnnnnnnnnnnnnnnnn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts