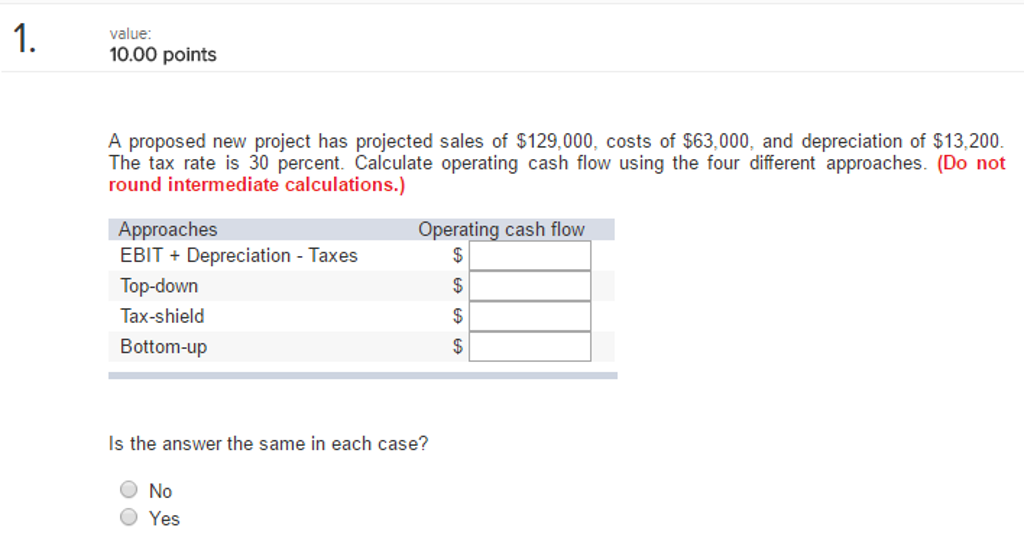

Question: Calculate operating Cash flow using the four different approaches... A) EBIT + Depr. - Taxes... B) Top Down Approach: Revenues - Expenses - Taxes or

Calculate operating Cash flow using the four different approaches...

A) EBIT + Depr. - Taxes...

B) Top Down Approach: Revenues - Expenses - Taxes or Cash inflows - cash outflows...

C) Tax Shield: (S - C) x (1 - T) + D x T or Net income wihtout depreciation + (Depr.)(Tax Rate)...

D) Bottom Up: Net income + Depreciation...

E) Is the answers the same in each case?...

If you could make it easy to identify how you worked out each method, and where final answer is, I would appreciate it.

value 10.00 points A proposed new project has projected sales of $129,000, costs of $63,000, and depreciation of $13,200. The tax rate is 30 percent. Calculate operating cash flow using the four different approaches. (Do not round intermediate calculations.) Approaches Operating cash flow EBIT Depreciation - Taxes Tax-shield Bottom-up Is the answer the same in each case? O No O Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts