Question: calculate payback period, profitability index and net present value. write a short memo explaining whether the company should invest in this project or choose the

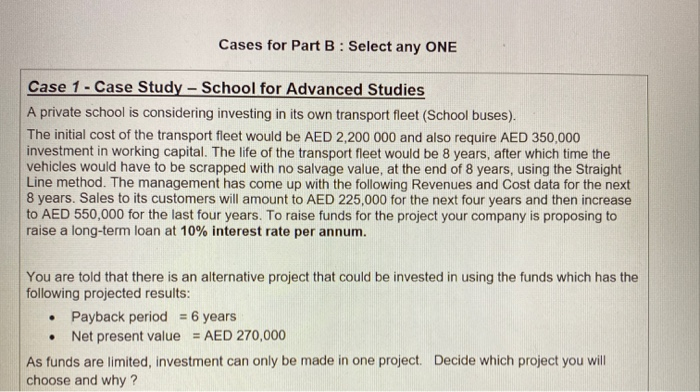

Cases for Part B : Select any ONE Case 1 - Case Study - School for Advanced Studies A private school is considering investing in its own transport fleet (School buses). The initial cost of the transport fleet would be AED 2,200 000 and also require AED 350,000 investment in working capital. The life of the transport fleet would be 8 years, after which time the vehicles would have to be scrapped with no salvage value, at the end of 8 years, using the Straight Line method. The management has come up with the following Revenues and Cost data for the next 8 years. Sales to its customers will amount to AED 225,000 for the next four years and then increase to AED 550,000 for the last four years. To raise funds for the project your company is proposing to raise a long-term loan at 10% interest rate per annum. You are told that there is an alternative project that could be invested in using the funds which has the following projected results: Payback period = 6 years Net present value = AED 270,000 As funds are limited, investment can only be made in one project. Decide which project you will choose and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts