Question: calculate Ratio Analysis for the given data below Profitability Ratios Net Sales - CGS / Net Sales Net Profit / Net Sales Operating Income /

calculate Ratio Analysis for the given data below

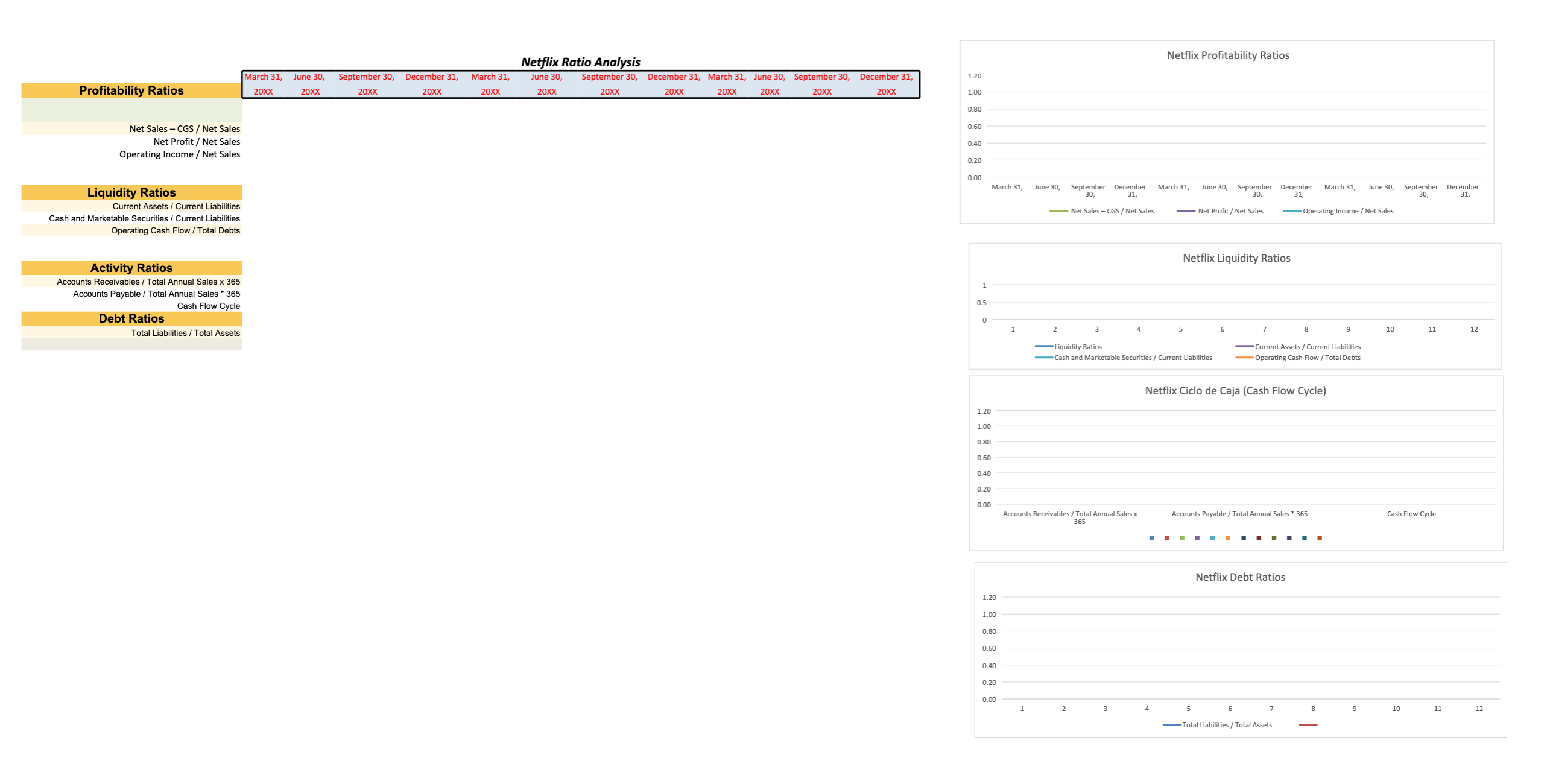

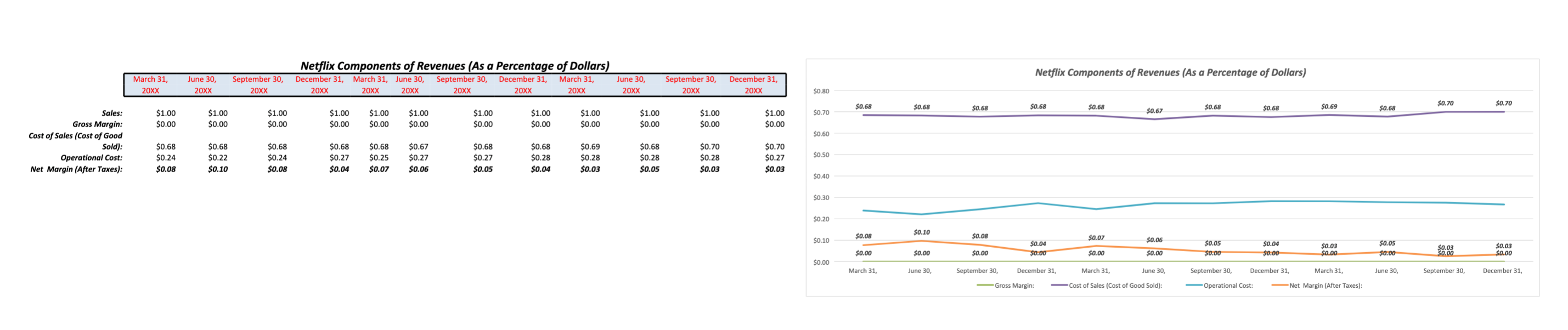

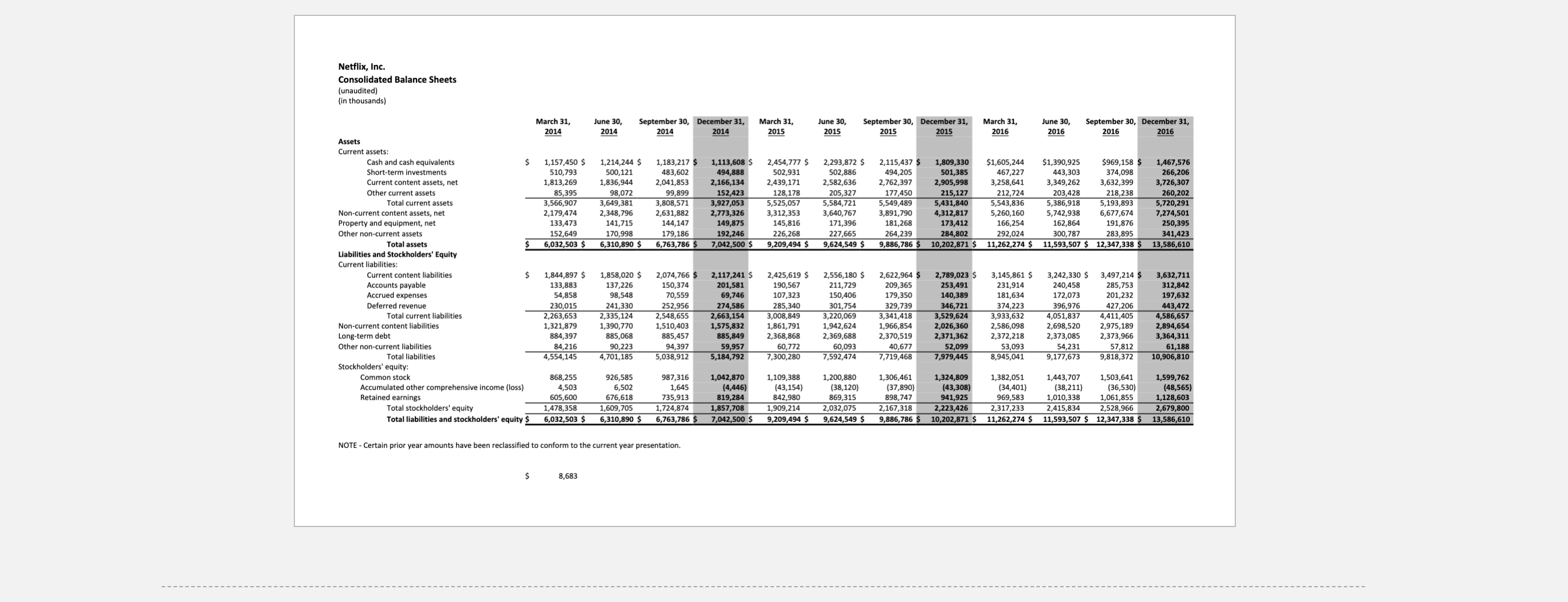

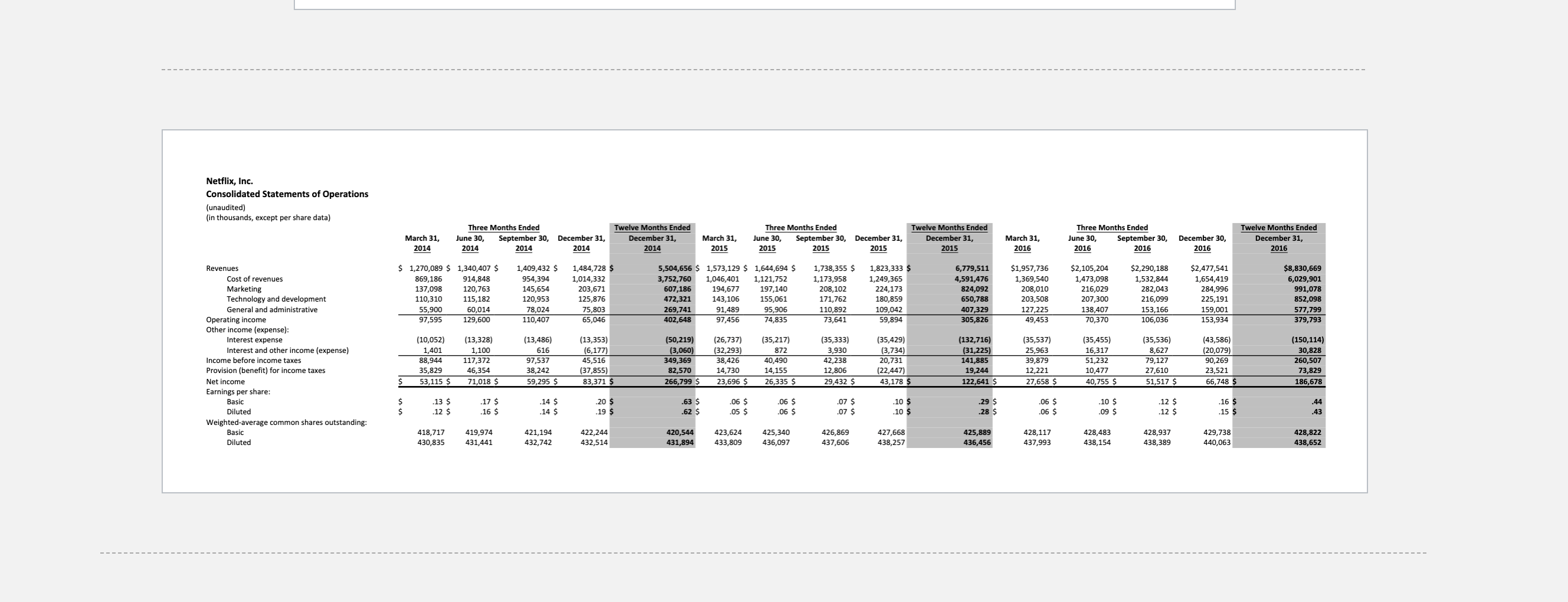

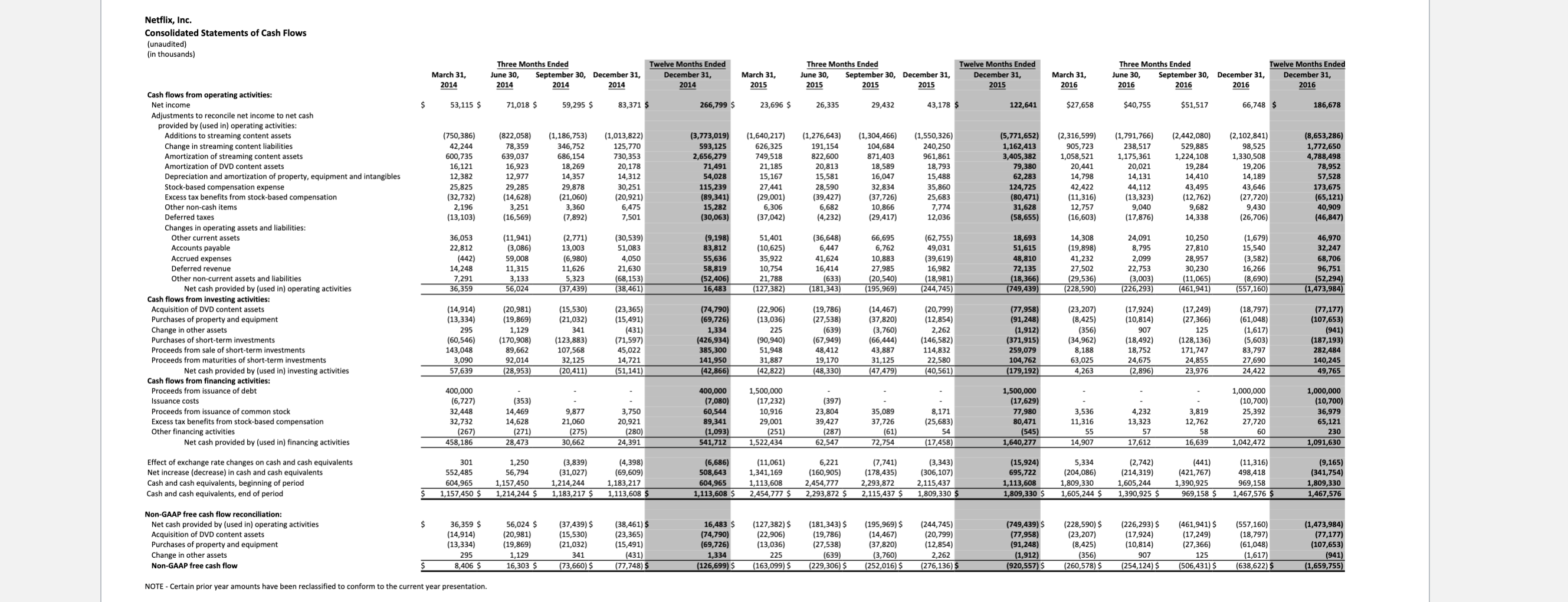

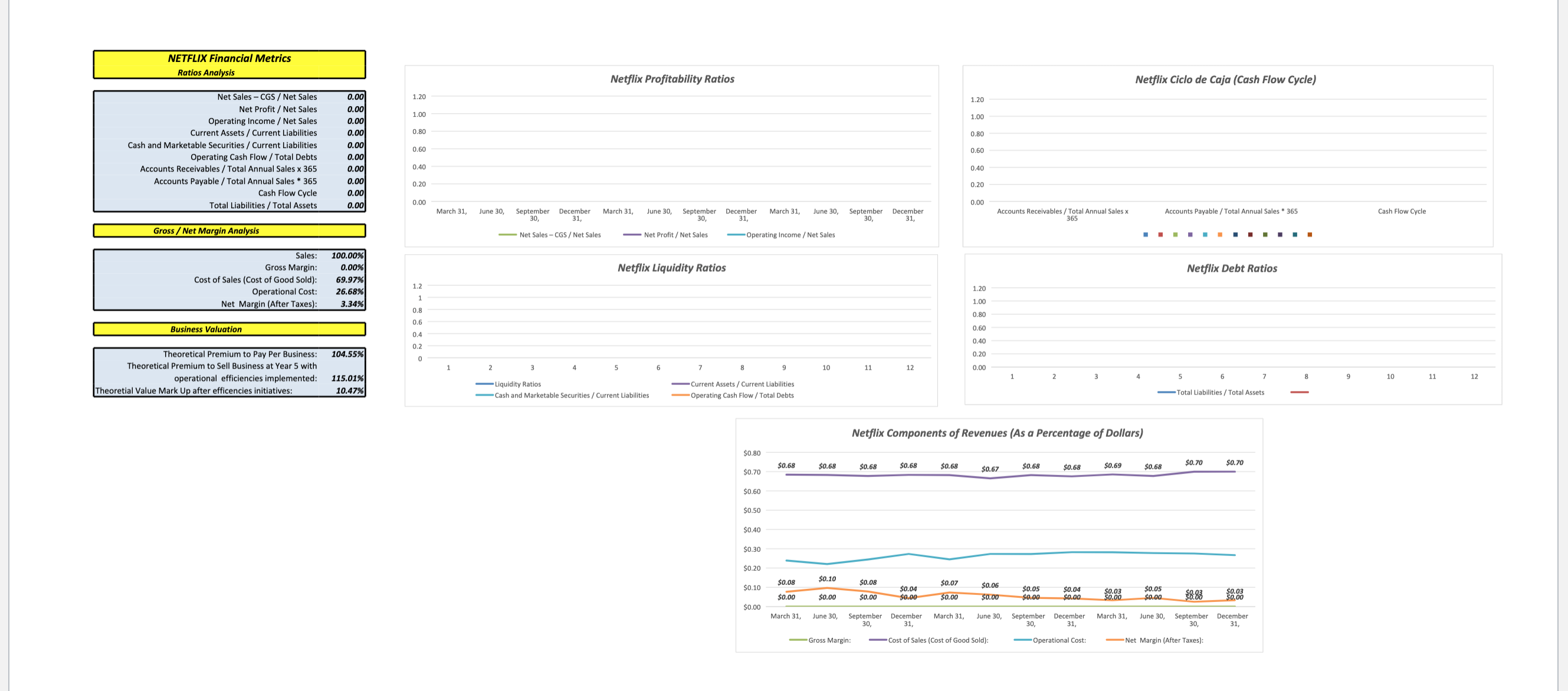

Profitability Ratios Net Sales - CGS / Net Sales Net Profit / Net Sales Operating Income / Net Sales Liquidity Ratios Current Assets / Current Liabilities Cash and Marketable Securities / Current Liabilities Operating Cash Flow / Total Debts Activity Ratios Accounts Receivables / Total Annual Sales x 365 Accounts Payable / Total Annual Sales * 365 Debt Ratios Cash Flow Cycle Total Liabilities / Total Assets Netflix Profitability Ratios Netflix Ratio Analysis September 30, 20XX 20XX 20XX December 31, March 31, June 30, September 30, 20XX 20XX December 31, 20XX 1.20 1.00 March 31, June 30, 20XX 20XX September 30, 20XX December 31, 20XX March 31, 20XX June 30, 20XX 0.80 0.60 0.40 0.20 0.00 March 31, June 30, September 30, December 31, March 31, June 30, September 30, December 31, March 31, June 30, September 30, December 31, - Net Sales - CGS/Net Sales -Net Profit / Net Sales -Operating Income / Net Sales 1 0.5 Netflix Liquidity Ratios 0 1 2 3 4 5 6 8 9 10 11 12 Liquidity Ratios Cash and Marketable Securities/Current Liabilities Current Assets / Current Liabilities Operating Cash Flow/Total Debts Netflix Ciclo de Caja (Cash Flow Cycle) 1.20 1.00 0.80 0.60 0.40 0.20 0.00 Accounts Receivables/Total Annual Sales x Accounts Payable/Total Annual Sales * 365 Cash Flow Cycle 365 Netflix Debt Ratios 1.20 1.00 0.80 0.60 0.40 0.20 0.00 1 2 3 4 5 6 7 8 9 10 11 12 -Total Liabilities/Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts